An Overview Of Offshoring HEOR

By Harsh Parikh, research analyst- clinical research, Beroe Inc.

Introduction To HEOR Services

Health Economics and Outcomes Research (HEOR) complements clinical development, helping decision makers and healthcare payers determine patient access to specific drugs, services, and reimbursement policies.1 The increasingly complex legislative environment and demand for HEOR data by global reimbursement agencies, is leading to rapid growth of the HEOR industry.2 For example, within European countries such as the Netherlands and U.K., etc., the success rate of new drugs is largely dependent on the reimbursement decision of government agencies.1 The role of HEOR services became an integral part of clinical R&D, impacting clinical trial design, trial simulation modelling, and the management of economic endpoints in trials. These studies are used during the initial phase of trials in order to assess the burden of disease as well as in comparator trials in order to demonstrate effectiveness of the new drug.

HEOR services procurement is managed across major pharma companies by the marketing services procurement or the R&D procurement department. Some pharma companies have even started integrating market access and R&D teams in their HEOR procurement.3 Within Big Pharma, these teams range between 80 to 200 employees, having two to three full-time employees (FTEs) dedicated to procuring HEOR services. HEOR procurement can be intricate due to the lack of standardized requirements and regulations. Pharma companies are facing various hurdles in HEOR procurement because of a highly fragmented supplier base, which is increasing HEOR FTE rates and making tail end management more complex. This has led pharma companies to explore a number of options, including bundling services, long term strategic relationships, and offshoring HEOR services in order to overcome the above hurdles.

Outsourcing HEOR Services

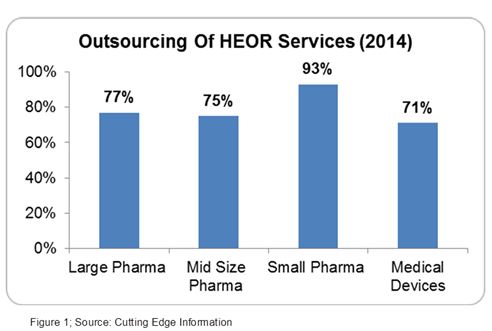

Outsourcing HEOR services is highly prevalent due to the lack of technical expertise, varying nature, and complexity of health economic studies, and the requirement of an expensive patient database.3 Both small and big pharma companies outsource at least 75 percent of their HEOR work (Figure 1).4 These studies are performed by a trained, experienced, and skilled workforce which studies the market, product life, patient needs, and reimbursement opportunities.3

The U.S. and European markets comprise more than 85 percent of the global HEOR market. Rapid growth of this market led to an increase in salaries of HEOR professionals (mainly in the U.S. & Europe), which quickly became a major pain point for the pharma industry.5 The major manpower cost in HEOR services can be minimized by offshoring HEOR services.

Offshoring HEOR Sub Services

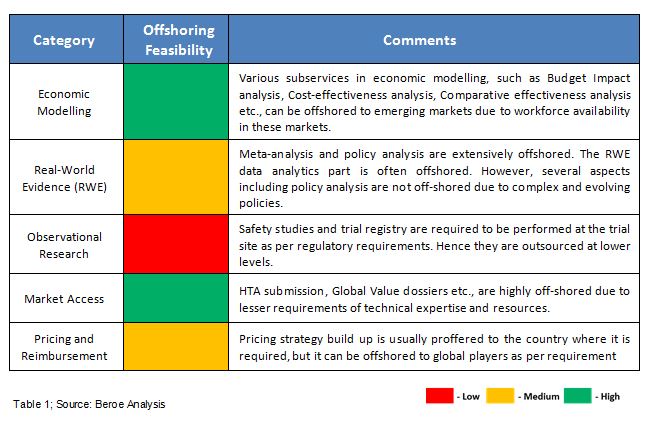

There are a number of sub services under the umbrella of HEOR services. The feasibility of offshoring these services depends on various factors like the complexity, amount of data required, and the criticality of services (Table 1).6-7 Among HEOR services, systematic literature review, economic modelling, meta-analysis, and HTA submissions are offshored with ease, whereas services like conjoint analysis and retrospective policy analysis are difficult to offshore due to high regulatory needs.7

Geographies For Offshoring HEOR services

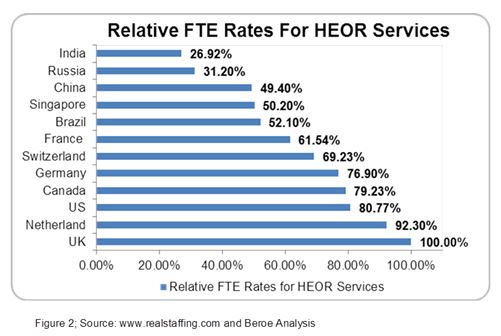

The HEOR market is primarily driven by mandatory HTA submission requirements and the growing impact of real-world evidence in pricing and reimbursement, with the U.S. and U.K. markets being mature for HEOR services due to high demand. HEOR studies for a drug molecule can cost around $1.1 million on average ranging from $0.1 to $6 million depending on the size of the pharma company.8 As pharma companies are under constant pressure to reduce costs, offshoring HEOR services to various emerging markets like India and Russia will leverage cost advantage.6 For instance, the relative FTE rates associated with offshoring HEOR services to emerging markets like India and Russia are particularly attractive.9 India, China, and Russia offer HEOR services like economic modelling, GVD, meta-analysis, etc. In the case of Western Europe, France has the lowest HEOR FTE rates, hence providing cost benefit as many companies recruit talent from overseas (Figure 2). Several critical offshored services from Western Europe include study design and observational research, etc.2

Central Eastern Europe, along with Russia, Hungary, and Poland, are also emerging as HEOR destinations because of the entry of global suppliers.10 India and Russia are expected to evolve as some of the major offshoring destinations for HEOR services where strong Healthcare IT and large volume catering capacity will act as a backbone for India and academic growth in Russia.2

Supplier Market For Offshoring HEOR Services

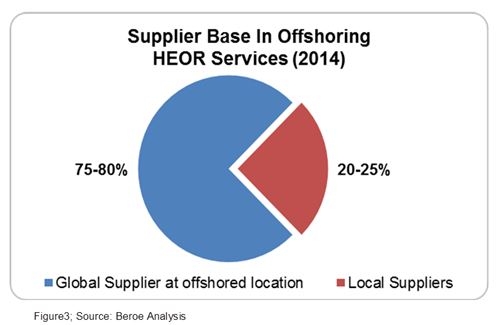

There are three types of service providers for HEOR services: Academia, Consultants, and CROs. The academic players are less preferred over CROs and consultants due to their lesser experience in the clinical trial space. The offshored HEOR services are mainly catered by two types of suppliers — local suppliers at the offshore location and global suppliers with a presence at the offshore location. The market share of global suppliers is the highest at 75 to 80 percent as large pharma companies prefer to offshore HEOR services along with clinical trial management or data analytics to global players like TCS, IMS, Heron (Parexel), etc. This acts as a negotiation lever for pharma due to the bundling of services. Local suppliers like Marksman Health and Capita India have a market share of about 20 percent (Figure 3).The local suppliers have contracts mainly with midsize pharma companies or global suppliers who are not present in that given geography. They provide advantages like niche specialty, ease of customization, and flexibility.6

The trend of consolidation is observed within the HEOR industry as global suppliers attempt to broaden their service portfolio. For instance, in September 2014, Kantar Health acquired Evidências, an industry leader in evidence-based, health management services in Brazil.11

Conclusion

Offshoring HEOR enables Big Pharma to leverage cost advantage, and it enables higher volume capacities, niche specialty, study customization, manpower flexibility, and the ability to execute more complex studies. As a result, offshoring HEOR services would be one important agenda for global pharma companies considering this market is expected to grow in the upcoming five years. Also, the HEOR industry is expected to witness M&A’s in emerging markets. Many late phase service providers (CROs) will be adding HEOR to their service portfolio to emerge as a one-stop-shop for pharma clients.

References

- http://www.ncbi.nlm.nih.gov/pmc/articles/PMC4031700/pdf/ahdb-05-428.pdf

- http://www.imshealth.com/deployedfiles/imshealth/Global/Content/Services/Pharma%20Commercial%20Effectiveness/Health%20Economics%20_%20Outcomes%20Research/AccessPoint-5-281012%20F.pdf

- http://www.cuttingedgeinfo.com/research/market-access/health-economics-and-outcomes-research/

- http://www.businesswire.com/news/home/20120911006024/en/Top-Drug-Companies-Outsource-75-Health-Economics#.VX2XJPmqqko

- http://www.imshealth.com/portal/site/imshealth/menuitem.3e17c48750a3d98f53c753c71ad8c22a/?vgnextoid=7d4a5f1f58e0e310VgnVCM10000076192ca2RCRD

- http://www.ephmra.org/user_uploads/imm%202013%20frankfurt%20final%20write%20up%2013%20february.pdf

- http://www.isrreports.com/product/benchmarking-pharma-industrys-heor-functions/

- http://www.pharmaceuticalcommerce.com/index.php?pg=latest_news&articleid=27190&keyword=HEOR%20economics-health-ISR-outcomes

- http://www.hays.com.sg/cs/groups/hays_common/@cn/@content/documents/digitalasset/hays_139198.pdf

- http://ipcm.de/wp-content/uploads/2012/09/Clinical-Research-in-Eastern-Europe-2013.pdf

- http://www.kantarhealth.com/news-room/2014/09/15/kantar-health-acquires-brazilian-healthcare-consulting-firm-evidencias

About The Author

Harsh is a research analyst in the Pharma R&D vertical at Beroe Inc. He specializes in understanding the global clinical research market and shifting industry trends. He completed his masters in Biotechnology and Pharmaceutical sciences from National Institute of Pharmaceutical Education and Research, Mohali India, where he was actively involved in scientific research in the field of Proteomics and Immunology.

Harsh is a research analyst in the Pharma R&D vertical at Beroe Inc. He specializes in understanding the global clinical research market and shifting industry trends. He completed his masters in Biotechnology and Pharmaceutical sciences from National Institute of Pharmaceutical Education and Research, Mohali India, where he was actively involved in scientific research in the field of Proteomics and Immunology.