Digital Platforms For Patient Engagement In Clinical Trials — Trends & Outlook

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

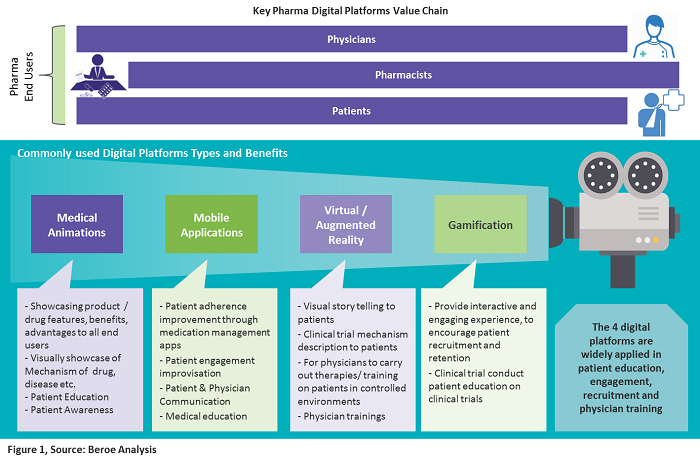

Pharmaceutical companies have three targeted users: physicians, pharmacists, and patients. Various digital platforms are used to create a good customer experience for educating these end users. The core focus is on patients driving patient care, education, and adherence. Figure 1 below provides a snapshot of the key digital platforms that are widely applied in patient education, engagement, recruitment, and physician training.

Digital Platforms Used In Clinical Trials

Medical Animations

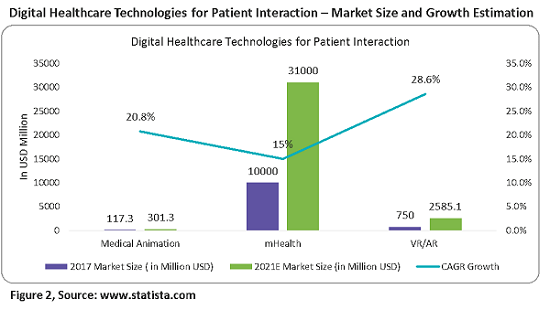

Pharma companies use animated videos to get consent from patients for participation in clinical trials. These provide clarity on the effects and results of the drugs in trials, hence improving patient adherence in the trials. The adoption of medical animation by pharma companies for showcasing the mechanisms of action of drugs and real medical procedures is driving growth in this market. As of 2017, the estimated market value was $117.3 million, growing at a CAGR of 20.8 percent to reach over $300 million in 2021. North America has the largest share at greater than 40 percent, driven by the presence of major pharmaceutical companies, increased healthcare spending, etc.

Among therapeutic areas, the oncology segment accounts for the largest share, attributed to increasing awareness amongst patients on various diseases, side effects, and defects. There is a need for computer-aided diagnostics in the geriatric population, and medical animation is being used here to highlight details of diseases and investigational drugs in trials.

mHealth Apps

Connected medical devices and healthcare apps comprise the mHealth market, with devices dominating the market and generating 80 percent of its revenue. The potential of mHealth apps to enhance patient adherence and engagement in clinical trials is being progressively recognized by sponsors, CROs, academic institutions, etc. As a patient-centric solution, CROs conduct home-based trials to improve patient adherence. Virtual trials such as these remove travel burdens, allowing trial participation from the comfort of a patient’s home. This model is driving the demand for apps used for cardiac monitoring, diabetes management, multi-parameter tracker, sleep apnea, etc.

As of 2017, the estimated market value was $10 billion, growing at a CAGR of 15 percent to reach over $30 billion in 2021. A pharma-branded app with customization and behavior modification tools would be valuable to all healthcare stakeholders and raise the profile of the sponsoring pharma company — adding patient engagement value.

Virtual Reality (VR) and Augmented Reality (AR)

Since 2012, there has been growth in head-mounted display product development (Oculus Rift, HTC Vive, Gear VR, and Google Cardboard). This has also penetrated the healthcare industry in recent years as a way to educate patients about treatment methods. Trials involving cognitive behavioral studies, pain management, dental treatment, body rehabilitation, and cancer pain using VR are in nascent stages according to data from clinicaltrials.gov.

Patient-centric healthcare focused on retention and engagement programs is the main driver of this market. As of 2017, the estimated market value was $750 million, growing at a CAGR of 28.6 percent to reach over $2,585.1 billion in 2021. North America continues to lead the combined healthcare VR hardware and software market with a share of over 45 percent in 2017.

Figure 2 below provides the market size and growth of all of the above digital technologies.

Supply Market Trends

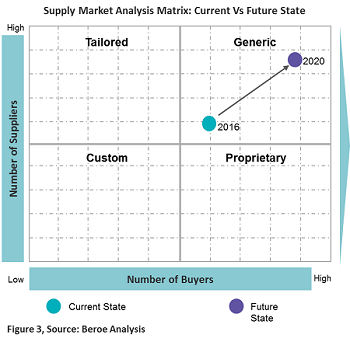

- Medical Animations: The supplier market consists mainly of specialists that cater only to the life sciences industry. The presence of multiple players gives pharma companies greater choice, and hence more buying power. Suppliers also consider pharma to be attractive as it brings in many purchase orders, higher payment terms, and greater brand visibility.

- mHealth Apps: The supplier market is highly fragmented with technology players that cater to multiple sectors and specialists. Again, pharma has greater choice and more buying power. Suppliers consider pharma attractive in terms of brand visibility. However, other industries are preferred because they lack regulatory stringency.

- VR and AR: The supplier market consists of multiple supplier types, both specialists and generalists. Pharma has a choice and the ability to switch between suppliers, resulting in medium to high buying power. Suppliers consider pharma to be attractive, although its value in revenue generation is relatively low due to its highly regulated environment.

Figure 3 below provides a perspective of the current supply market state with future trends for all of the above technologies.

Considering the current state of the supply market for the above technologies, the supplier’s mindset is to beat the competition. Hence, they focus on leveraging the market price through innovative technologies and specialization due to the presence of several service providers. Though the market is highly fragmented with a large number of technology providers, players with experience in the pharma industry are limited to 50+. There are certain key players pharma prefers to engage with due to their focus on the life sciences industry and experience with programs involving patient and physician engagement, e.g., Random42 Scientific Communication, Blausen Medical Communications, and CAST PHARMA. In the future, suppliers are expected to expand their scope from a pharma marketing perspective to assisting with patient engagement programs.

Strategy vs. Risk

Medical animations have a lower strategic impact and supply risk, whereas AR,VR, and mobile apps have medium supply risk, with high impact on patient retention. The adoption rate of AR, VR, and mHealth applications for patient retention is currently low, resulting in a lower strategic impact to pharma. Use of these technologies for patient retention and engagement problems would increase with a need for patient adherence, hence having a high strategic impact to pharma. This would result in improved patient retention and shorter timelines for trial completion. The supply market would see changes wherein greater numbers of technology providers would expand their scope to the life sciences industry as well, resulting in this service being seen as strategic, with innovation playing a crucial role and the presence of cost competition.

Conclusion

The attractiveness of pharma as a buyer among technology providers is still in the development stage in terms of relative business value due to the highly regulated environment. Providers are attracted by perceptions of future business potential. Consequently, they are ready to invest time and effort into developing a long-term relationship with the buying organization with the goal of increasing sales over time. Once suppliers have experience working with pharmaceutical companies, they are expected to expand their scope of business within the life sciences industry — biotechnology, medical devices, CROs, etc. This will increase the relative business value in terms of revenue generation, increasing the attractiveness of pharma buyers among suppliers.

About The Author:

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. Her analysis has enabled global fortune 500+ companies in their strategic decisions on service outsourcing contracts, category management and efficient sourcing. She has written for several publications related to R&D procurement opportunities. With her category knowledge, she has published 25+ articles in leading journals, co-authored with industry experts. She has a master's in management from University College London (UCL) and has worked as a consultant in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. Her analysis has enabled global fortune 500+ companies in their strategic decisions on service outsourcing contracts, category management and efficient sourcing. She has written for several publications related to R&D procurement opportunities. With her category knowledge, she has published 25+ articles in leading journals, co-authored with industry experts. She has a master's in management from University College London (UCL) and has worked as a consultant in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.