GCC Price Harmonization Process: Implications And Outcomes

By Patricia Ladrón de Guevara, Consultant, Alliance Life Sciences Consulting Group

The Gulf Central Committee for Drug Registration (GCC-DR) was approved on May 15th, 1999 by the Executive Office for Health Ministers in Riyadh, Saudi Arabia. It was created to provide Gulf States with safe and effective medications at a reasonable price . The GCC-DR committee consists of two state nominated representatives from Bharain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE).

The Process and Plan

Aiming to harmonize prices by aligning the Cost, Insurance, and Freight (CIF) price of all marketed presentations in GCC countries, the GCC-DR implemented the planned price unification in phases depending on therapy group.

With the process still ongoing, the final implementation plan is still unknown. Phase one was expected to consist of cardiovascular agents, however, price harmonization was seen for non-cardiovascular agents in 2013. The exact size and scope remains unclear; reports suggest that it may initially focus on innovative products.

The Price Harmonization Process Implications

International reference price setting legislation found in Saudi Arabia creates the lowest Drug prices of 30 countries across the globe with countries such as Turkey, Greece, and Egypt contributing to the low prices.

Pharmaceutical companies must resubmit documents such as the Price Certificate which lists product prices in reference counties every five years after product registration due to Saudi Arabia’s review process. While reviewing, if a lower price is listed, the price in Saudi Arabia is consequently reduced to the same level.

While significant reductions in prices are anticipated across all GCC Markets (see figure 1 below), freely priced markets allows Qatar to possibly be the greatest with regards to the potential impact on product prices. Because prices are typically higher than in other GCC markets, the new price harmonization process, may force Qatar to see price reductions comparable with Saudi Arabia

The Effect on Actively Marketed Medications

During the Price Harmonization Process, if the current CIF price for a pharmaceutical product approved in Saudi Arabia is found to not be the lowest among all GCC counties, Saudi Arabia will reduce its price to the same level. This causes an impact on other non-GCC markets that reference Saudi Arabia pricing.

For example, four months after the price is reduced in Saudi Arabia, Jordan will reduce its CIF price and take the lowest price of the basket. Morocco reviews registered product prices every five years and takes the average of the basket.

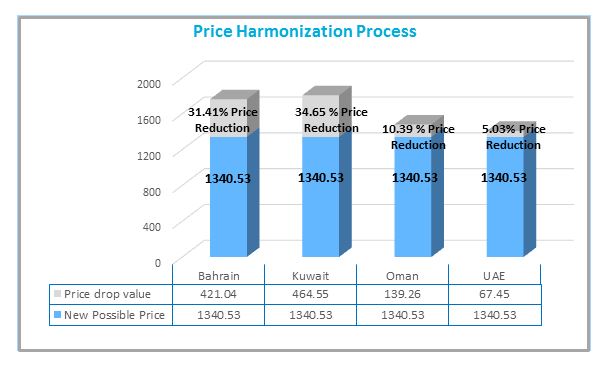

An example of the potential impact is depicted using Glivec® 100mg below:

Based on the prices approved as of 16th of April in 2014 for Glivec®100 mg 60 tablets in the GCC countries:

• Saudi Arabia: CIF price = 1,340.53 USD*

• Bahrain: CIF price = 1,761.57 USD*

• Kuwait: CIF price = 1,805.08 USD*

• Oman: CIF price = 1,479.79 USD*

• UAE: CIF price = 1,407.98 USD*

Note: *Prices calculated using regulated margins. Exchange rate as on the 17th of April in 2014

The Price Harmonization Process would create a re-alignment of prices in Bahrain, Kuwait, Oman and UAE to the price in Saudi Arabia, the lowest of the basket. The projected reductions are shown below in Figure 1

Figure 1: Example of the potential price reduction of Glivec® due to the Price Harmonization Process

*Qatar is a freely priced market and excluded from the example above

Because Saudi Arabia already has the lowest price approved for Glivec®100 mg 60 tablets, there is no impact on Jordan and Morocco in this example. However, the potential of a subsequent impact on other markets that reference any of the GCC counties can be expected.

The Future Registration Effects

The duration of the registration period varies across GCC counties. In Bahrain, the registration process of new products takes around 18 months while Saudi Arabia takes 24 months. Because of this registration process timeline, a new product, in theory, would launch first in Bahrain not Saudi Arabia. With the impact of the new legislation of the Price Harmonization Process, a product launched in Bahrain at a CIF price of $100 and six months later the same product is launched in Saudi Arabia at $50, the CIF price in Bahrain would be reduced to $50.

Conclusions and Insights

This changing legislation highlights the importance of mapping international reference rules and defining an optimal launch order when marketing a new medication. Significant price reductions for medicines across the GCC counties are expected to be seen going forward and the complex international referencing picture means potential effects for other counties.

Companies should keep the impact of Price Harmonization in mind when considering launch sequence optimization. With different registration timelines, consequently the prices already approved for a medication in GCC counties may be reduced if a lower price is approved in other GCC count. Launching without considering the optimal order could have a drastic impact on the global revenue of the product.