Prioritizing The BioPharma Portfolio – Get The Right Assets On The Bus (and The Wrong Ones Off)

By Leslie Sandberg Orne, Trinity Partners

Everyone is looking for the silver bullet: the product that will change the face of biopharmaceuticals and draw blockbuster revenues. If you have one of these, you can stop reading. But if you are like most companies, your portfolio is a mix of some winners, some underachievers, and a lot of “in-betweeners.” The process of getting the right assets on the bus (and funded) in a cash-strapped environment is as much an art as a science. As consultants to the industry for many years, we’ve seen myriad processes – both good and bad.

Prioritizing assets or indications for new products is not a purely technical exercise, and the “right” answer can vary from company to company. The journey of coming to the decision, and what you learn about the market and risks along the way, are what make these exercises worthwhile.

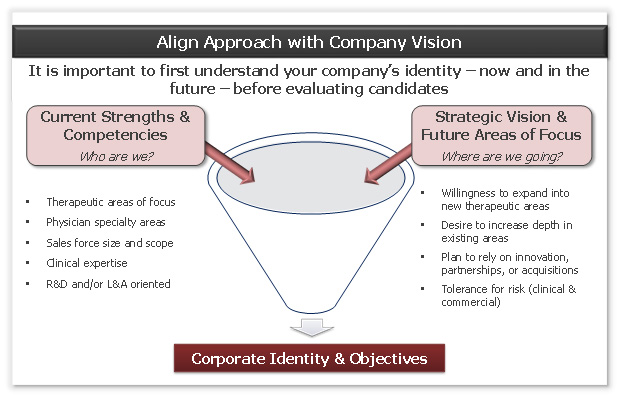

Companies must first be honest with themselves about who they are. Consider the following questions:

- What are our core competencies, especially scientifically?

- Where do we have expertise that no one else has, enabling us to “bend the curve” on probability of success?

- What other products/assets do we have that characterize us?

- What is our vision for the company and our tolerance for risk?

In addition to articulating your company’s strengths, it is critically important to also understand what is out of bounds from a development perspective, either due to lack of expertise or because the time/funding required is unrealistic. Far too many companies waste valuable time and resources on products that do not align with management’s vision for the company and, as a result, are not funded.

Figure 1: the vision discussion

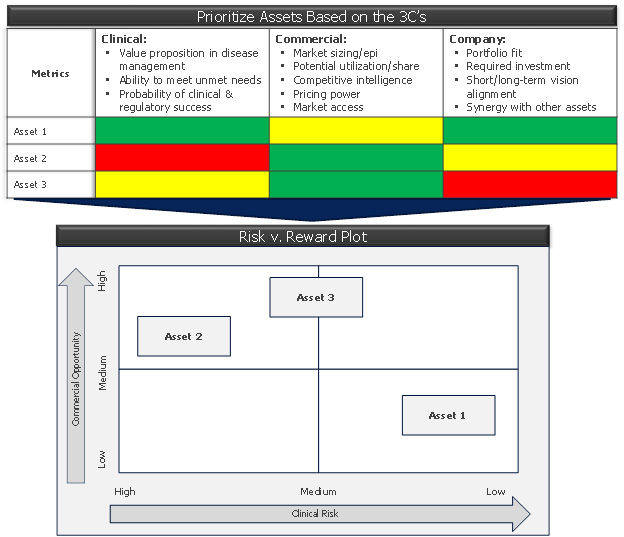

Next, create an objective framework to compare your assets or evaluate development opportunities – which may be indications for the same asset – across the 3Cs:

- Commercial: Assess the markets in consideration – their size, growth prospects, unmet needs and competitive sets. Do your market research with physicians, patients, and payers to understand their needs and what gets them excited. Determine the size of the “white space” available for your product, if any, including accounting for emerging products in other companies’ pipelines.

- Clinical: Evaluate the likely value proposition that your asset will have in the clinical armamentarium. Determine the efficacy or tolerability thresholds it will need to meet to deliver that value. Assign each opportunity a probability of success, not just from a technical perspective but also from the perspective of achieving the requisite value proposition.

- Company: Ask yourself, “How will we compete in this market? What will it cost – in terms of both the required clinical program to deliver the value proposition, as well as the sales and marketing costs to go to market?” Ensure stakeholders are motivated and passionate about the product opportunity.

This framework can easily be captured in the form of a “prioritization matrix,” which codifies the parameters of the 3Cs into quantifiable thresholds (e.g., 1 to 5 or high/medium/low) and assigns each opportunity a value for each metric. This is a great exercise, but don’t expect it to reveal the final answer. You may end up with a mix of opportunities and risk a “clustering” around the middle, or show groups of assets that coalesce in each quadrant. But there is value in going through this process, conducting the research, and having the stakeholder conversations that lead to alignment on the facts. What begins next is evaluating trade-offs, risk management, and the creation of a clean, definable strategy.

Figure 2: the 3C’s prioritization matrix and its outcome (risk v. reward plot)

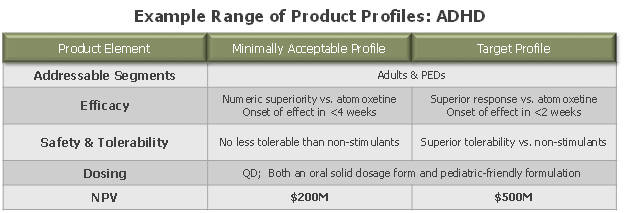

This process can naturally take on many variations. One case study involved the creation of “treatment concepts” across the spectrum of outcomes in each indication of interest, representing a range of possible value propositions in those markets. Market research created simple forecasts for each “concept” – mainly varying on expected market positioning and share – and an associated range of net present values (NPVs). With this measuring stick in hand, the company could set clear thresholds for break-even and target clinical profiles in each indication, and juxtapose all product candidates against these goalposts. The big learning: create a way to be objective on what to shut off and what to keep in order to make decisions as efficiently as possible.

Figure 3: example of “minimally acceptable” (marginal NPV) v. “target” (optimal NPV) product profiles

The process of prioritizing assets can be a highly politicized and sometimes irrational debate. The overarching goal for the portfolio manager should be to move the team toward fact-based decision making by establishing clear but flexible processes. By starting with a discussion around management’s vision and moving into an objective exercise of assessing the commercial opportunity, clinical rationale, and company fit, you can create the forum for discussion that will help put the right assets on the bus and keep the wrong ones off.

Leslie Sandberg Orne, Partner

As partner, Leslie Sandberg Orne co-leads the generalist consulting group and is responsible for Trinity's pharmaceutical, biotechnology, and medical device clients. Leslie provides strategic support to decision makers including CEOs, COOs, and other key personnel across the biopharma industry. She graduated summa cum laude and Phi Beta Kappa from Dartmouth College with a BS in Biology.