A Shift Toward Trial Site Management Organizations: Trends And Implications For Sponsors

By Matthew Wheeler, managing director and partner, L.E.K. Consulting

Clinical trial sponsors face a range of evolving dynamics today that are changing how trials are executed. Macro trends across biopharma include an expanding pipeline and trial volume (especially pronounced in certain therapeutic areas and modalities such as oncology and specialty drugs), increasingly complex trial designs, and evolving trial site and pharma service provider landscapes. Sponsors must acknowledge and consider implications arising from these trends and adjust their organizational strategies accordingly to position themselves for success going forward.

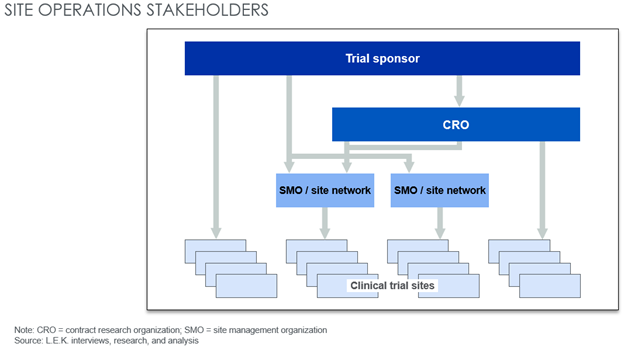

Within the trial site landscape, emerging site management organizations (SMOs) own multiple commercial clinical trial sites and offer dedicated site management services and a single touchpoint for sponsors conducting trials (see Figure 1). SMOs provide a range of value-added clinical services to sponsors, including:

- recruiting patients and facilitating longitudinal management/retention,

- identifying, selecting, and contracting with appropriate trial sites,

- handling regulatory documentation and monitoring ongoing compliance, and

- capturing and reporting trial data.

Although SMOs still account for a relatively small portion of total clinical trial patient volume at dedicated sites (estimated at 10%-20% in 2023), they play an important role in a landscape that has begun to experience consolidation as SMOs, often backed by private equity, look to achieve further scale through acquiring independent sites. In turn, sponsors are increasingly partnering with SMOs for trial execution as they recognize the value that SMOs can provide to trials and organizational success.

Underlying this partnering trend is the reality that sponsors are designing increasingly expensive and complex clinical trials, with more complicated therapies and niche patient populations, which has fundamentally enhanced the SMO value proposition. Through centralized and standardized functions, SMOs can enable faster trial start-up times and effective patient recruitment and retention, ensure timelines and data readout dates are met, and reduce overall costs.

Overall, a sponsor’s decision to partner with and select an SMO for trial execution brings new questions sponsors must consider. However, sponsors can prepare for tomorrow’s new normal through understanding key trends related to SMOs, the implications they have on sponsor trial execution, and incorporating this into organizational strategy going forward.

In this paper, we discuss the key trends shaping the SMO landscape and value proposition, what implications these trends have for trial sponsors, and how sponsors can adapt to these evolving conditions.

Figure 1: Potential stakeholders for clinical trial sponsors

Sponsor Use Of SMOs Is On The Rise

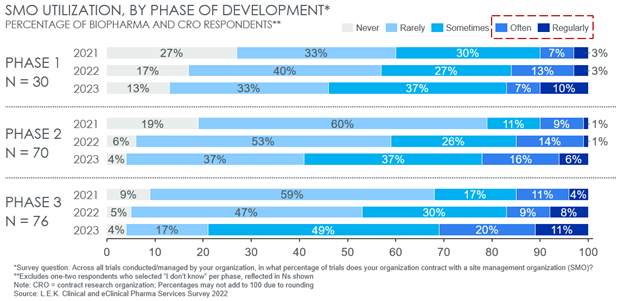

According to 2022 data from global strategy consulting firm L.E.K. Consulting’s inaugural Clinical and eClinical Pharma Services Survey1, biopharma sponsors and CROs have increased their utilization of SMOs since 2021 across phases, but particularly in later-stage trials. Overall, 31% of survey respondents expect to utilize SMOs “often” or “regularly” for Phase 3 trials in 2023, double that of just 15% in 2021. A similar twofold increase was expected in Phase 2 trials, from 10% to 22% (see Figure 2).

Beyond increasing overall use, a key trend from this data is an increased expectation by sponsors to utilize SMOs for later-stage trials. A total of 20% and 31% of respondents expect to use SMOs “often” or “regularly” for Phase 2 and Phase 3 trials, respectively, compared to only 17% for Phase 1. As assets progress to later-stage trials, protocols generally require higher patient counts, more sites, and more complex data collection and reporting for both safety and efficacy endpoints. Additionally, later-stage trials are more likely to be conducted over a dispersed range of geographies with varied regulatory dynamics. Together, these factors have introduced or emphasize common trial pain points that scaled SMOs look to address and work to amplify the potential SMO value proposition.

Figure 2: Sponsor current and expected SMO utilization across development phases

Implications For Clinical Trial Sponsors

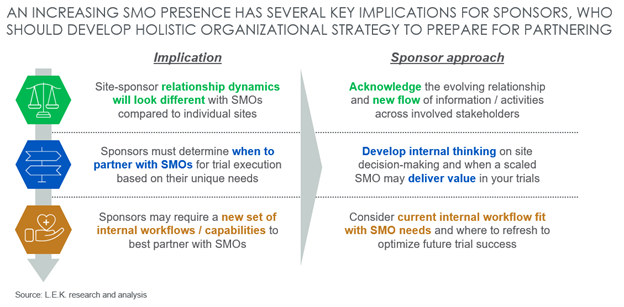

Given that sponsors expect SMO utilization to increase going forward, especially for later-stage trials, it is imperative that sponsors begin to develop organizational awareness and thinking on how this impacts strategy. Broader clinical trial trends (e.g., growing advanced modality pipeline requiring complex trial protocols, rise of personalized medicines targeting niche patient populations and introducing challenges to effective recruitment/retention, etc.) may serve to further drive the SMO value proposition and utilization for unique trial use cases. Biopharma sponsors can best prepare for tomorrow’s new normal by understanding and developing a holistic strategy around three key implications posed by an increasing SMO presence (see Figure 3):

- Sponsors will interface with SMOs differently than with individual sites and may expect that the “center of gravity” in the relationship could gradually shift from the historic norm.

- Sponsors must determine when SMOs are the right choice for them based on their unique trial needs and the degree to which their trials could benefit from the SMO value proposition.

- Sponsors that proactively review and refresh internal workflows/processes will be better prepared to partner with SMOs effectively and drive future trial success.

Figure 3: SMO implications for sponsors

Interfacing With SMOs Will Look Different

Sponsors should first acknowledge that the relationship with a scaled, central SMO can be fundamentally different than that with individual sites in carrying out clinical trials. Call-points may be different, there will be more coordination across sites required, etc. This makes it crucial for sponsors to understand an SMO’s organizational structure, responsibilities, and central policies/processes for trial oversight. Sponsors must ensure that the “right people” are in the room for important updates and discussions across the trial life cycle and that the SMO can effectively communicate key messages down to individual sites and coordinate activities across levels (and also communicate site-level messaging back to the center for distribution to other trial sites).

There is also potential for the center of gravity in site-sponsor relationships to evolve, as SMOs gain more scale and critical mass. Historically, sponsors have dealt with a site universe that is highly fragmented and disparate. As SMOs scale and drive consolidation, this dynamic evolves and implications for site-sponsor interactions have the potential to evolve, too.

Sponsors Must Identify Unique Trial Needs, Potential SMO Value

While SMOs are expected to play a larger role in the clinical trial landscape going forward, sponsors will still have flexibility of working with scaled partners vs. individual sites. Understanding the benefits that an SMO brings — and when those are most relevant — can help sponsors better choose when to proactively seek out the support of an SMO.

As previously shown, sponsors expect to partner with SMOs more often in later-stage clinical trials, where scale may enable SMOs to address common pain points (e.g., more challenging patient recruitment and retention, ensuring operational consistency/management across a wide range of geographies with varied regulatory landscapes, complex data collection and reporting, etc.).

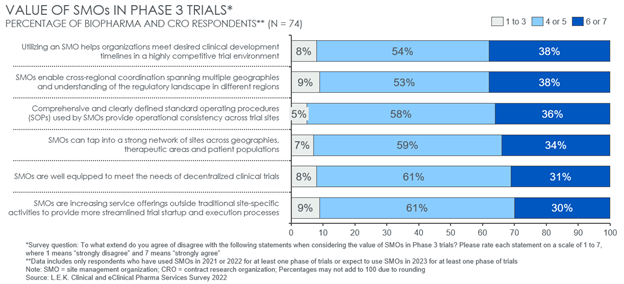

In examining the SMO value proposition further, L.E.K.’s survey found that sponsors value SMO partnerships in addressing several common challenges that often peak in late-stage trials. Specifically, respondents view SMO’s greatest potential value-add in Phase 3 is to (see Figure 4):

- Help meet desired clinical development timelines.

- Enable cross-regional coordination and understand regulatory dynamics across geographies.

- Leverage comprehensive and clearly defined standard operating procedures to ensure cross-site consistency.

For those trials where operations and success hinge on a tight development timeline or strong coordination of activities across a diverse range of geographies, partnering with an SMO may be an attractive option, and sponsors should be proactively considering doing so. These benefits may be more muted in trials requiring fewer total sites across a narrower regional footprint, for example.

Figure 4: SMO value proposition to sponsors in Phase 3 trials

Sponsors Should Review Internal Workflows Before SMO Partnership

Realizing that SMOs will likely play a larger role in the trial landscape going forward, sponsors should review their current internal workflows and site identification processes. Today, most site identification and start-up activity is geared around site-specific workflows. As SMOs allow for more centralized identification, contracting, and start-up, clinical operations workflows will need to adapt to better accommodate this new model. Many of the key pain points associated with clinical operations (i.e., site identification, contracting and budgeting, study start-up and training, patient recruitment coordination, payments and reimbursements) will require modified process flows moving forward. This provides an opportunity to create more seamless and streamlined operations — if dealt with proactively; otherwise, this could add complexity to already challenged operational steps.

The Time Is Now To Consider SMOs

As the complexity of drug development and trial execution continues to increase, the value created by top-performing sites (both operationally and scientifically) is more pronounced than ever before.

Now is the time for sponsors to develop organizational awareness of SMOs and their value proposition and start thinking about how to adapt and win in an evolving clinical trial landscape where scaled SMOs are expected to play an increasing role. Sponsors would first do well to keep a close eye on how the trends discussed in this article unfold in the near-term — whether and how fast SMOs capture a greater percentage of trial volume and that they establish a track record of delivering on the hypothesized value proposition through their scale and centralized operations. Beyond awareness and monitoring, sponsors should begin to think about how they will plan to leverage SMO relationships for their unique needs, and what internal investments/capabilities should be considered in working with them. If these trends materialize as expected, sponsors that have been proactive in preparing to work with and enable SMO success will in turn be well positioned for future trial and organizational success.

Read more coverage from L.E.K. Consulting on the site landscape in our white paper: Exploring the Risks and Opportunities within Clinical Site Management.

About The Author:

Matt Wheeler is a managing director and partner in L.E.K. Consulting’s Boston office and a leader in the pharmaceutical services practice. Matt joined L.E.K. in 2010 and advises clients on a range of topics, including corporate and business-unit growth strategy, platform and portfolio development, new market prioritization and entry, and strategic mergers and acquisitions. Within the pharmaceutical services space, Matt has particular expertise and deep experience across clinical trial services, eClinical tools, and commercial services. Matt holds an MBA with distinction from Tuck School of Business at Dartmouth College, where he was elected an Edward Tuck Scholar. You can connect with Matt on LinkedIn.

Matt Wheeler is a managing director and partner in L.E.K. Consulting’s Boston office and a leader in the pharmaceutical services practice. Matt joined L.E.K. in 2010 and advises clients on a range of topics, including corporate and business-unit growth strategy, platform and portfolio development, new market prioritization and entry, and strategic mergers and acquisitions. Within the pharmaceutical services space, Matt has particular expertise and deep experience across clinical trial services, eClinical tools, and commercial services. Matt holds an MBA with distinction from Tuck School of Business at Dartmouth College, where he was elected an Edward Tuck Scholar. You can connect with Matt on LinkedIn.

Acknowledgements:

The author would like to thank L.E.K. Consulting colleagues Arturo Garza-Gongora, Lee Miller, and Jenny Hammer for their support in developing this article.

References:

1. L.E.K. Consulting 2022 Clinical and eClinical Pharma Services Survey includes respondents employed in U.S., Canada, the U.K., and EU4