Analyzing The Top Clinical Trial Outsourcing Trends Of 2017

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

In 2017, clinical development services did not witness any significant changes in terms of price index, input cost, and supply-demand gap in comparison to 2016. However, market competition increased, with the supply market seeing continuous mergers and acquisitions, resulting in consolidation and CROs competing for market share in terms of enhanced therapeutic area expertise, geographic reach, full-service capability, technology, and increased functional capability. With pharma companies moving toward CROs and specialists for their clinical development services, clinical outsourcing penetration increased from 43 percent in 2016 to 45 percent in 2017. Greater than 34 percent of these engagements were with large CROs and the remaining 16 percent with specialists. In this analysis we will look into the top outsourced clinical development services — early-phase trials, late-stage trials, clinical staffing, pharmaceutical development services, clinical supplies, regulatory affairs, labs, biometrics, and clinical IT.

supply-demand gap in comparison to 2016. However, market competition increased, with the supply market seeing continuous mergers and acquisitions, resulting in consolidation and CROs competing for market share in terms of enhanced therapeutic area expertise, geographic reach, full-service capability, technology, and increased functional capability. With pharma companies moving toward CROs and specialists for their clinical development services, clinical outsourcing penetration increased from 43 percent in 2016 to 45 percent in 2017. Greater than 34 percent of these engagements were with large CROs and the remaining 16 percent with specialists. In this analysis we will look into the top outsourced clinical development services — early-phase trials, late-stage trials, clinical staffing, pharmaceutical development services, clinical supplies, regulatory affairs, labs, biometrics, and clinical IT.

Category Spending And Growth

Clinical categories related to technology, patient services, and regulatory affairs will see an increase in outsourcing from 2018 forward. High growth will be seen among technology-driven services such as clinical data management, biostatistics, and clinical IT, with an average CAGR of 12 to 14 percent until 2020. An integrated eClinical approach with unification of systems (EDC, ePRO, RTSM, etc.), with all data integrated in a hub arrangement, is the future of better patient-centric trials. Cloud-based delivery modes will increase in the future, due to the ease of integration and maintenance through SaaS compared with web-hosted or licensing models. The regulatory affairs category is seeing the highest growth, at 15 to 16 percent until 2020. As regulatory services consist of largely tedious document-oriented processes with a high cost, expertise is needed to ensure timely approvals, which drives the outsourcing of regulatory affairs. Regulatory writing and publishing hold the largest share among the segments of regulatory affairs. It is estimated to retain that position in the next five years, whereas regulatory consulting and legal representation is expected to grow at a double-digit rate. Figure 1 below provides a comparative view on the total vs. outsourced spending of key clinical categories.

Mature categories such as early-phase and late-stage trials will see slow growth, with sponsors focusing more on patient recruitment, engagement, and retention going forward. This in turn enables growth of the patient recruitment market, which has an estimated market size of $4.8 billion as of 2017, and is expected to grow at a 15 to 16 percent CAGR until 2020. Delays in patient recruitment vary by therapeutic area, with oncology showing 40 percent delay and having 60 percent nonperforming sites. These delays have forced the sponsors to invest more on patient recruitment activities. Moving forward, we will see mobile apps being used to promote study opportunities, prescreen potential patients, remind participants about their study obligations, and collect clinical data from volunteers remotely.

What’s Driving Clinical Outsourcing?

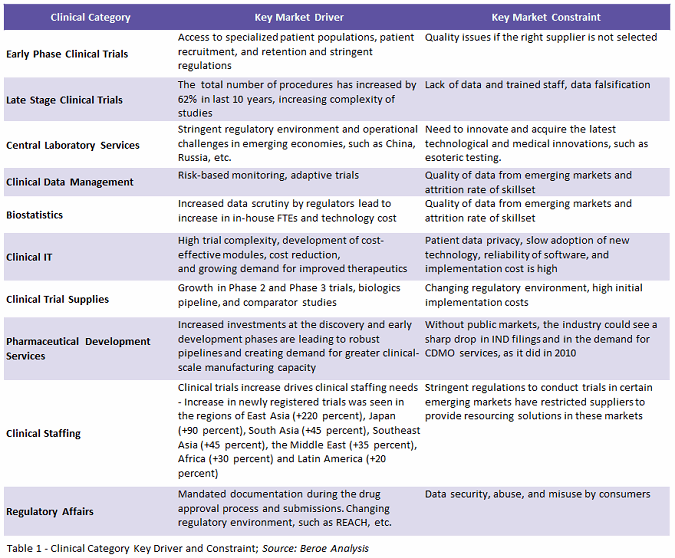

High trial complexity accompanied by robust pipelines and stringent regulations for conducting trials are factors driving clinical development services outsourcing spend. Complexity in terms of increased numbers of trial procedures, access to specialized patient population, along with regulatory challenges in emerging markets and mandated documentation such as REACH legislation, are creating a need for third-party vendors to tackle the problem. These vendors could be a CRO, PRO (patient recruitment organization), SMO (site management organization), ITES/BPO (information technology-enabled services/business process outsourcing), lab, CMO (contract manufacturing organization), CDMO (contract development and manufacturing organization), or niche stand-alone providers. Table 1 below lists the key drivers and constraints for highly outsourced services.

Among all clinical categories, the biggest constraint is the quality and data security issues faced by sponsors in offshoring services to emerging markets.

Outsourced Vs. In-house Trend

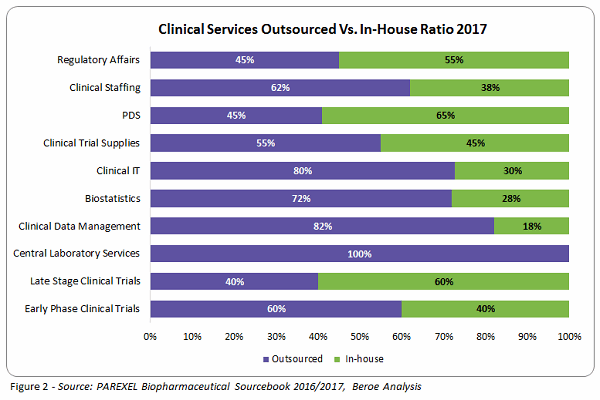

With more drivers than constraints, sponsors have increased the outsourcing of clinical development services to suppliers, tackling challenges along the way. On average, around 64 percent of clinical development services are outsourced, with only 38 to 40 percent carried out in-house (Figure 2).

Over 60 percent of sponsors have increased outsourcing their in-house activities through strategic partnerships and functional outsourcing. Clinical data management, biostatistics, Phase 1 through 4 trials, clinical trial supplies, and central labs are categories in which the strategic partnership model is highly adopted, whereas the functional service provider (FSP) model is preferred for regulatory services, staffing, and clinical IT. Most sponsors used both models, with one having higher adoption rate over the other.

Emerging Destination Trends

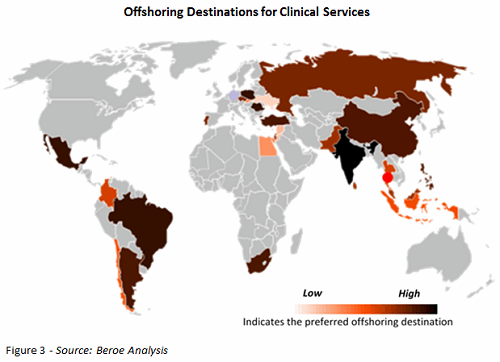

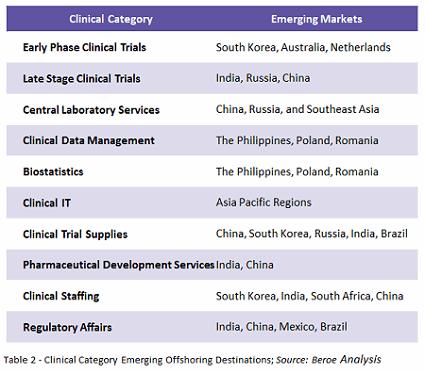

New locations are emerging as offshoring destinations due to the adoption of risk-based monitoring and adaptive trials and an increase in global clinical trials. Offshoring clinical services is seen as a more efficient, cost-effective, and faster way to conduct trials. Figure 3 illustrates the preferred offshoring destinations globally. Currently, China, India, Eastern Europe (Russia), and Latin America are the most cost-effective in terms of clinical trial services.

There is some controversy over offshoring trials to emerging markets. Some sponsors believe that through offshoring, the study teams would encounter less competition for trials, and that investigators would be more willing to find new treatments for their patients, resulting in more resources to focus on patient recruitment and retention. On the other hand, broader interpretations of clinical trial regulations, fewer GCP/ICH trained sites, less experienced staff, low data quality, and a lack of trained clinical monitors act as constraints to offshoring.1 Table 2 shows the various emerging offshoring destinations by category.

What To Look For In 2018

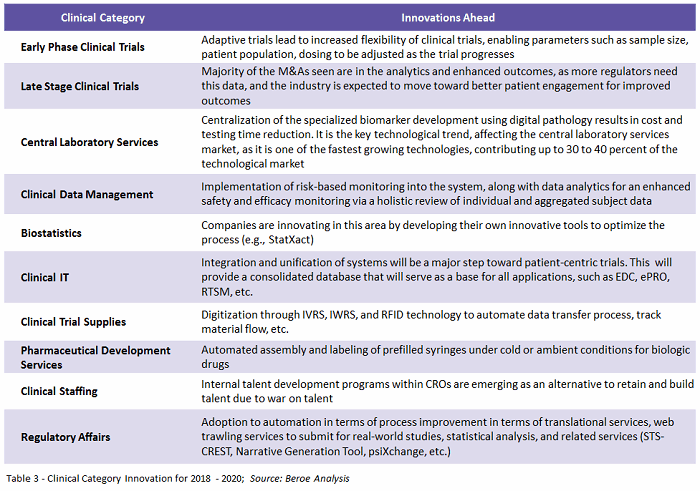

Centralization and unification of data points, using analytics to provide an enhanced outcome, is the key need among sponsors. To support this need, suppliers would have to invest in developing systems that would help in data optimization. Table 3 provides a glance at where each category is heading in terms of innovation.

Patient-centric trials will see an increase in adoption, driving the demand for related services in 2018. Horizontal and vertical diversification among suppliers will continue to be seen, such as, for example, Thermo Fisher’s acquisition of Patheon, to meet industry needs. Regulatory reforms and delays in approval of new guidelines will stand as obstacles to implementation of new technologies and innovations. However, through offshoring and partnering with local suppliers, this challenge can be overcome – driving technology more into clinical trial management.

References:

- “High costs and recruitment issues drive the globalization of clinical trials,” CenterWatch Online, August 2017. Available: https://www.centerwatch.com/news-online/2017/08/21/high-costs-recruitment-issues-drive-globalization-clinical-trials/ [Accessed December 2017].

About The Author:

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities. With her category knowledge, she has published 18+ articles in leading journals, co-authored with industry experts. She completed her master’s in management from University College London (UCL) and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities. With her category knowledge, she has published 18+ articles in leading journals, co-authored with industry experts. She completed her master’s in management from University College London (UCL) and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.