Leveraging Time-Tested Assets For A Shift In Site Contracting & Patient Enrollment

THE SEARCH FOR PATIENT ENROLLMENT CERTAINTY

The unfailing ability to complete enrollment on time, every time, has been the greatest yet most elusive need among clinical trial managers. Now, a new approach to patient enrollment is emerging – one that could change the world of clinical trials.

Not that long ago, enrolling patients into clinical trials was much easier. Sponsors picked their investigator sites, the site staff checked their charts and databases, and enrollment via in-practice patients could be fully completed on time. These days, however, sites are no longer the exclusive source for enrolled patients. Complex protocols, competition for patients, and fewer investigators make it next to impossible for sponsors to find enough patients to complete enrollment on time.

It is widely accepted that these issues continue to be the leading cause of costly clinical trial delays. Each day a clinical trial extends over schedule, drug developers lose as much as $600,000 in projected sales for small or niche products or as much as $8 million for blockbuster drugs.1 Furthermore, closing an unanticipated enrollment gap often costs millions of additional dollars to add more sites and/or implement site reinvigoration strategies – all relatively unpredictable solutions.

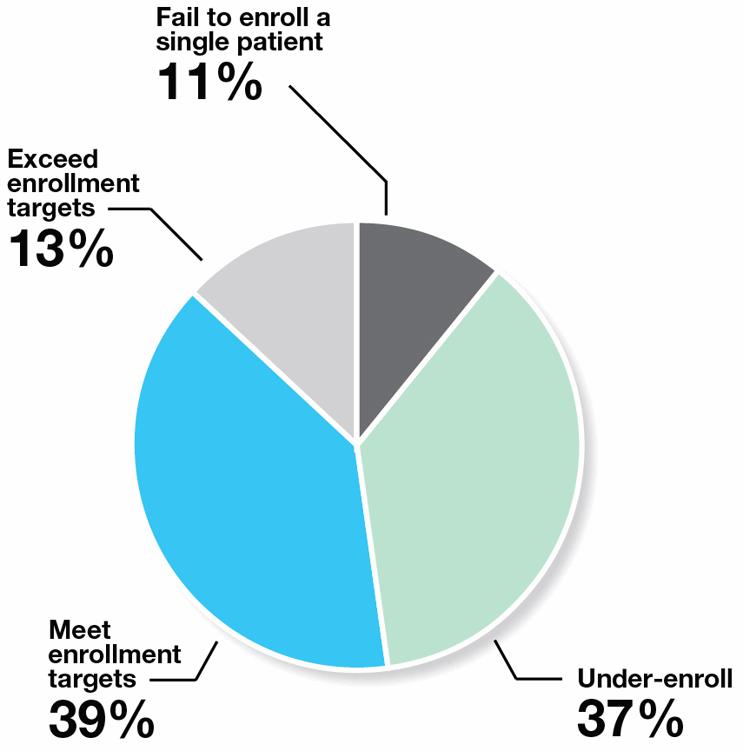

Phase II and III Enrollment Performance on a Multi-Center Study

Source: Tufts Center for the Study of Drug Development

The reality is that where patients come from is changing. Clinical trial managers are finally conceding that it’s next to impossible to complete enrollment on time without patients acquired from outside the realm of investigator sites. Research among sponsors suggests that currently 28% of patients in clinical trials are not active patients at the site, and that in two years’ time, this scenario will increase to 32%.2 While the value of the external patient is becoming more apparent, finding optimum solutions for integrating them into a study’s enrollment strategy is not so obvious. In their struggle to find answers, clinical trial managers experiment with, and try to piece together, services and offerings from a wide and disparate range of sources. The results are as varied as the choices.

Of course, sites are the first go-to source for clinical trial patients, notwithstanding consistently unpredictable performance rates. For any given clinical trial, 37% under-enroll, and 11% fail to enroll a single patient. Even when sites can’t meet their enrollment commitments, old habits die hard. Ninety percent (90%) of sponsors indicate that they typically add more (poor performing) sites to get more patients.3

Not surprisingly, the use of patient recruitment providers is accelerating. In fact, the top providers with proven and accountable enrollment services have been used by roughly 30% to 40% of sponsor respondents surveyed, according to the most recent data of this ilk.2 The problem is that this relatively young market is highly fragmented and brimming with enrollment providers of all sizes and constructs, including those that appear innovative and inexpensive. Clinical trial managers eventually discover that each by itself is not sufficiently innovative to fundamentally change the patient enrollment landscape.

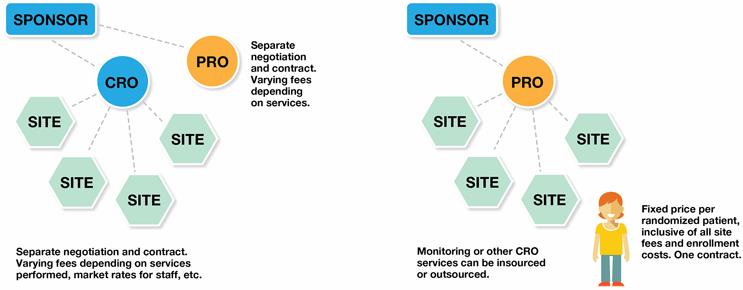

The bottom line is that hiring sites is already a well-accepted practice that produces a certain level of randomized patients from in-practice. The purchasing of external patients to supplement sites’ efforts via the right supplier is also a proven methodology. However, the ad hoc, patchwork use of these and other clinical trial services not only fails to deliver the enrollment certainty that the industry needs, but can create more complications for clinical trial teams. They must vet, juggle and manage sites and multiple vendors, each with its own contract and pricing. There is no accountability for results across sites and providers.

If enrollment certainty is defined as the unfailing ability to complete enrollment on time, every time – with full provider accountability and a flexible commercial model – is there a solution today for achieving it?

Introducing the concept of a dynamic site network model. CROs, recruitment companies and site networks are beginning to coalesce around this approach, and it could change the world of clinical trials. Importantly, for an industry looking for “proven innovation” – an oxymoron at face value – a dynamic site network model has the ability to provide innovation by leveraging proven assets at the site and recruitment provider level.

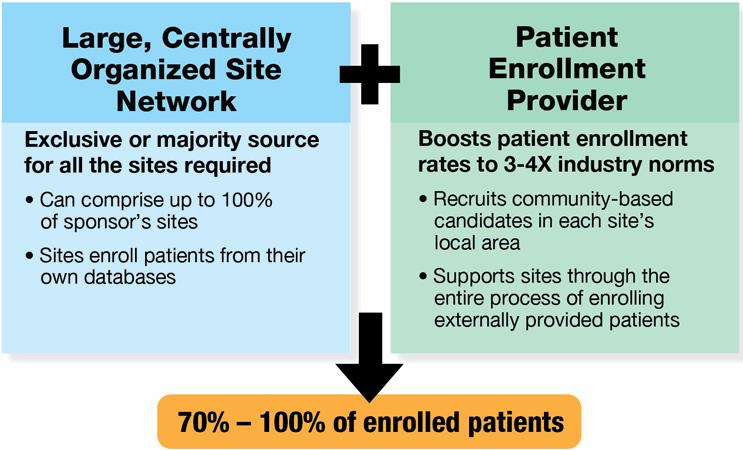

For its construct, the dynamic network model innovatively joins these proven entities under the same commercial terms: 1) a centrally controlled network of clinical trials sites, and 2) a best-in-class patient enrollment provider. When a sponsor hires the dynamic network to conduct a clinical trial, the network sites provide as many patients as possible from within their own databases and other efforts, while the enrollment provider recruits and delivers the remaining randomizations with external patients. Both are contractually bound and structurally organized to work together. The expected result? Enrollment is completed on time, and the commercial terms govern this expectation.

Dynamic Network Model

The model is designed to be completely turnkey. There is a single contract to negotiate, one single price per patient for all site and patient enrollment services, and one point of accountability for site enrollment performance, data quality, protocol compliance and patient retention. Its operational model is fully streamlined, and the single pricing model simplifies budgeting.

What does a dynamic model mean for those who outsource clinical trials? First and foremost, this model is expected to deliver patient enrollment rates that are three to four times the industry norm. There are other expected benefits, including:

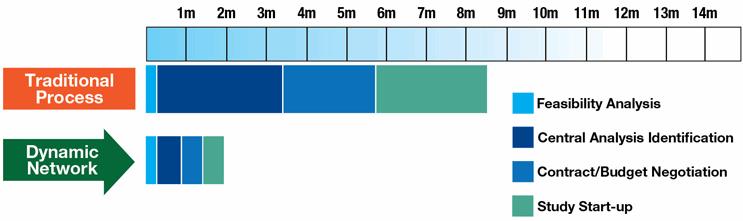

Faster study start-up speeds. All contracts and processes are centralized and managed through one point of contact. Each step leading to start-up is expedited, e.g., contracting, budget negotiations, feasibility analyses, site selection, CDA execution, IRB reviews, and centralized source documents. With the dynamic model, the start-up process can be completed in as little as two months, compared to up to eight months with current practices.

Faster enrollment. Enrollment will occur faster than the industry norm, as well. The commercially joined network sites and enrollment provider work together to ensure that randomization targets will be met via in-practice and community-based candidates. Candidate targeting is more precise; the generation of study candidates is rapid but well paced; and enrollment can be quickly accelerated, if required.

Greater patient volume. The model ensures a sufficient volume of candidates to survive the substantial attrition points between pre-screening and medical eligibility. The enrollment provider generates the respondents needed to deliver the necessary randomizations, then supports all of the sites to efficiently process all externally referred candidates.

Greater control. With a single point of accountability, the clinical trial manager only has to manage one feasibility assessment, one budget, one contract, and one project manager.

Greater confidence in submission. Data consistency is superior in this model. All source and regulatory documents, as well as pre-screening of candidates, are centralized. Training and processes are standardized across all sites. Tracking software is fully integrated between the recruitment provider and the network sites.

Reduced costs. This model all but eliminates the need to over-hire sites, currently driven by the 80/20 rule of site performance. It can also reduce a sponsor’s site footprint, as there is no need to add countries in order to access more patients. Budget variability driven by change orders is eliminated.

Flexible commercial agreements. This model provides for a range of contracting options. For example, all services can be inclusive on a price-per-patient basis, with full patient cost based on study completion. A sponsor can request therapeutic exclusivity and enrollment guarantees of timelines and/or patient volume. Finally, this model can accommodate in-sourced or outsourced constructs to wrap in other trial services, including any number of sponsor-selected sites.

True innovation, defined as enrollment certainty, may finally be a reality with the dynamic network model. By joining two proven enrollment approaches in a completely new and innovative way, this model may offer what sponsors have long been searching for: a simple, proven, highly effective, cost-efficient solution for completing enrollment on time, every time.

Several of the top CROs have made investments in site networks and are expected to combine those assets with patient enrollment services to deliver on the promise of the dynamic network model. Each solution is likely to have variations and nuances for trial sponsors to consider, and early adopters, particularly those running chronic, ambulatory disease trials, may gain a significant competitive advantage from the expected benefits described in this paper.

1. PRNewswire, Clinical Trial Delays Cost Pharmaceutical Companies, Sep 20, 2005, Cutting Edge Information

2. ISRreports.com, 2014, Whitepaper: The Expanding Web of Clinical Trial Patient Recruitment

3. Acurian, Inc. study among clinical trial sponsors.

About Acurian

Acurian, a subsidiary of PPD, is a leading full-service provider of clinical trial patient enrollment and retention solutions for the life sciences industry. The company increases the enrollment performance of investigator sites worldwide by identifying, contacting, prescreening and referring people who live in the local community but are unknown to a research site. As a result, trial sponsors complete enrollment without incurring the unexpected expense of adding sites or time.