Accelerating Clinical Trial Patient Engagement & Retention Through Mobile Technology

By Mathini Ilancheran, Beroe Inc., and Parth Dalal, AuroSys Solutions

Patient recruitment and retention has always been a major cause of delay and expense in pharmaceutical clinical trials. Almost 80 percent of clinical trials fail to meet their enrollment timelines, and nearly 50 percent of trial sites enroll only one or zero patients.1 Patient recruitment activities represent more than 25 percent of overall trial costs — according to a study by the U.S. Department of Health and Human Services (HHS), an average of $805,785 is spent on recruitment from Phase 1 through Phase 4.2

Almost 80 percent of clinical trials fail to meet their enrollment timelines, and nearly 50 percent of trial sites enroll only one or zero patients.1 Patient recruitment activities represent more than 25 percent of overall trial costs — according to a study by the U.S. Department of Health and Human Services (HHS), an average of $805,785 is spent on recruitment from Phase 1 through Phase 4.2

An effective patient retention and engagement program is critical to controlling dropout rates, and hence reducing costs, lowering duration, and increasing the likelihood of success in clinical trials. Thus, pharmaceutical companies are moving towards a patient-centric approach to retention and engagement, with technology as a key enabler. For technology to be effective, it must deliver the necessary features and fit seamlessly into the patient’s daily routine. However, the right technology not only improves active trial participation, it also improves the quality and accessibility of data collection during clinical research.

In this article, we will assess the mobile health apps market, key features of successful apps, and associated timelines and costs for developing apps that engage patients across categories and conditions.

Technology Enhances Communication & Reduces Costs

The patient-centricity movement in clinical trials recognizes that if patients are supported throughout a study, higher levels of compliance and retention can be achieved. Continuous engagement with patients throughout their clinical trial experience, and simplifying methods of data capture and reporting are now seen as vital to pharmaceutical R&D success.3,4

The rise of electronic clinical outcome assessments (eCOAs), and specifically electronic patient reported outcome (ePRO) tools implemented through everyday mobile technology, has transformed how patients can be engaged throughout a clinical trial.5 Using these tools, pharmaceutical companies can now design studies to include relevant, standardized, and tailored communication plans, delivered through text messaging, email, and/or in-app notifications.6 As such, patients can be prompted to take medication, record health data, and attend site visits. Plus, sites can follow up with patients if data isn’t being entered in the correct manner, rather than waiting for their next site visit.

BYOD (bring your own device) trials, especially in the early development stage, offers true scalability for eCOA and has the potential to greatly reduce the cost and logistical complications of providing and maintaining traditional ePRO devices for trial participants. However, provisioning may be required when, for example, a validated instrument is used to assess primary outcomes, or when Bluetooth integration with next-generation home monitoring devices is involved. Selection of simple BYO smartphone or tablet devices can provide cost-effective solutions, while maintaining the benefits of mobile ePRO.6

An easy and engaging method for data capture can reduce data gaps. This along with an effective ePRO solution can increase quality and reduce the need to pad sample sizes. Padding is done in an effort to minimize the impact of missing data and discontinuations - an extra 10 percent is added to offset anticipated losses. Additionally, in larger event driven outcomes trials, retention of patients increases the number of observe events, bringing the study to an earlier close; reducing overall cost and duration.7

An Overview Of The Mobile Health App & Device Market

Mobile technology is increasingly being implemented in clinical trials due to their real-time data collection feature. Additionally, they provide means of communicating directly with patients across broad demographics and multiple locations.3 Sponsors and CROs are actively searching for opportunities to incorporate mobile solutions into trials to increase the probability success.

The mHealth market is made up of connected medical devices and healthcare apps, with the former generating 80 percent of revenues between 2013 and 2016. While medical devices have been around for decades, the advent of smartphones with Bluetooth technologies and internet connectivity has resulted in a rapidly growing number of apps designed for a multitude of healthcare-related purposes, from monitoring body temperature to measuring heart rate.8

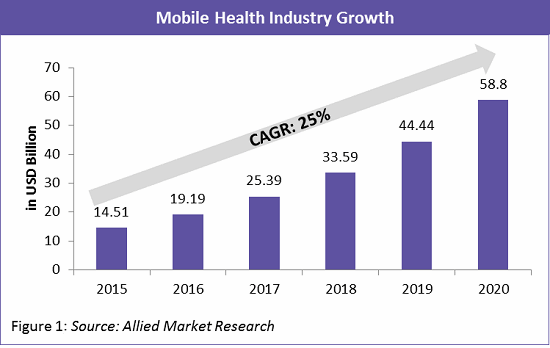

According to Allied Market Research, the mobile health industry is growing at a staggering rate of 25 percent per year and is expected to reach an estimated $58.8 billion by 2020 (Figure 1).The key drivers of this trend are apps and devices for cardiac monitoring, diabetes management, multi-parameter tracking, etc.

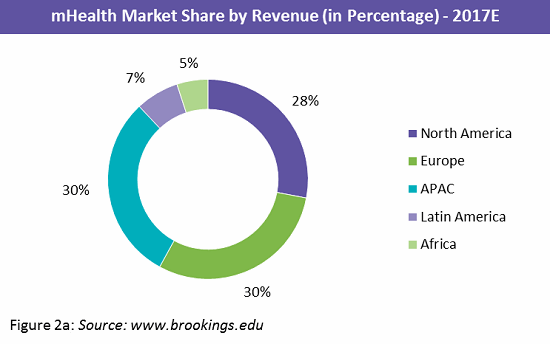

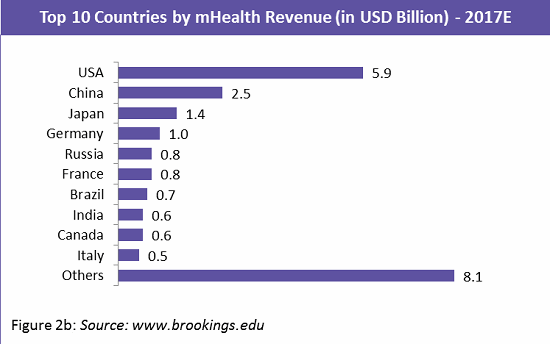

The mobile app market is highly fragmented, with a large number of developers spread across the globe. Europe and the Asia Pacific (APAC) region hold the greatest market share, each at 30 percent, followed closely by North America at 28 percent (Figure 2a). Within the APAC region, China and Japan leading in market share with 37 percent and 21 percent respectively. Figure 2b shows the top 10 countries by mHealth revenue.9

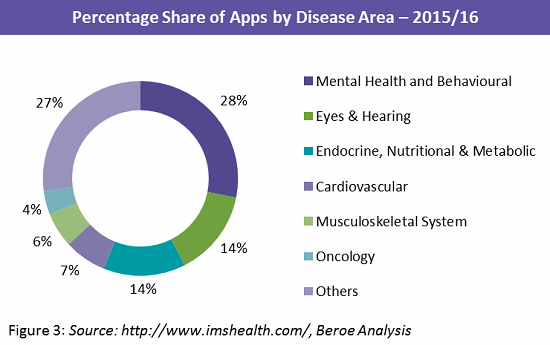

Among the subset of disease-specific apps, those geared toward self-management of chronic conditions such as diabetes, blood pressure, and mental health conditions are most common, with approximately 558 number of mental health apps. The other disease areas of interest are presented in the Figure 3 below.

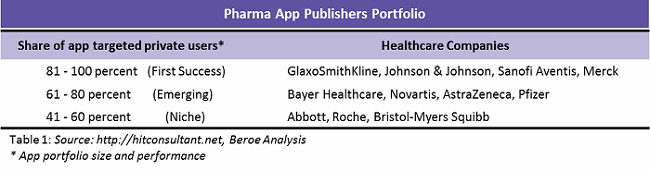

Medical apps have become an increasingly popular way to improve patient engagement and retention in drug trials. Branded patient engagement apps with customization and behavior modification tools can deliver value to all stakeholders and raise the profile of the sponsoring company.10, 11 Table 1 lists some pharmaceutical companies that are colloborataing to incorporate mobile apps in their trials.

Patient Engagement Apps — Feature & Cost Considerations

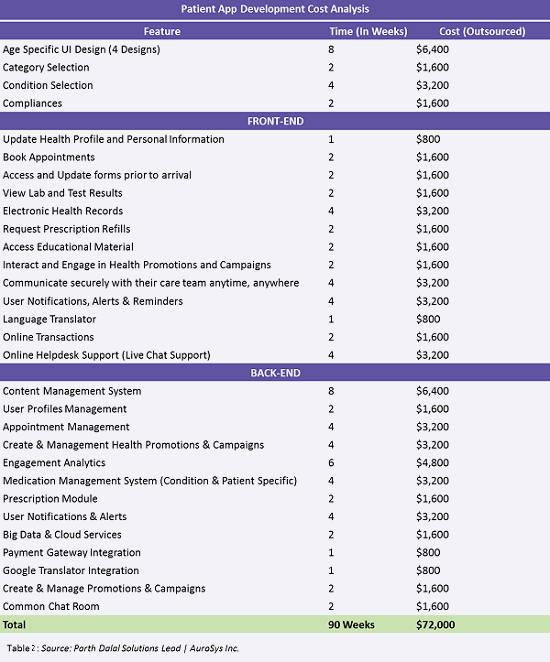

Mobile app development is trending within the pharma space, with most companies co-developing apps with the help of external developer. It is important to understand the attributes, cost components that go into the development for better negotiation with the co-developer.

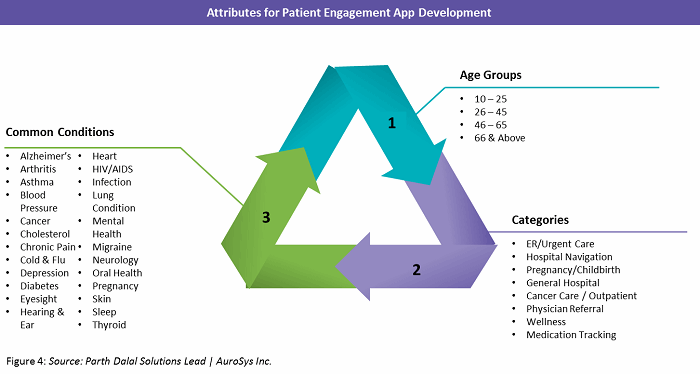

While there are many health apps available in the market today, few possess a feature set that can fulfil the needs of patients with different/multiple conditions. While patient engagement apps are most commonly used by individuals over the age of 45, this group is less likely to use smartphones than younger patients and prefers tablet apps with larger fonts and clean user-friendly interfaces. Patients under the age of 25, on the other hand, prefer fun and interactive smartphone apps that involve gamification.

What if a patient engagement app could be developed to learn and adapt its features based on a patient’s age, condition(s), ethnic background, and language preference? What would it take to build such an app that also runs on every smartphone and tablet on the market, regardless of the manufacturer, screen size, or operating system? The Ionic open-source software development kit (SDK) framework can enable the development of full-featured mobile apps that work seamlessly across all platforms and delivers a robust user experience.

For example, an SDK-based clinical trial app developed by a large U.S. healthcare organization was developed to connect research institutions and patients through a web portal and mobile app. Figure 4 below identifies the development attributes for the app, which allows patients to access a personalized clinical trial dashboard. The solution helps patients and their families navigate the complexities of the clinical trial experience and make informed decisions about trials.

Table 2 shows estimated minimum timelines and outsourcing costs for each feature in a given app, taking the attributes from Figure 4 into consideration.

Currently, there are several apps on the market that have gained traction in the patient engagement space. However, each app focuses on either (A) a specific set of patients with specific conditions, or (B) a particular aspect of patient condition. Some popular ones are listed in Figure 5 below.

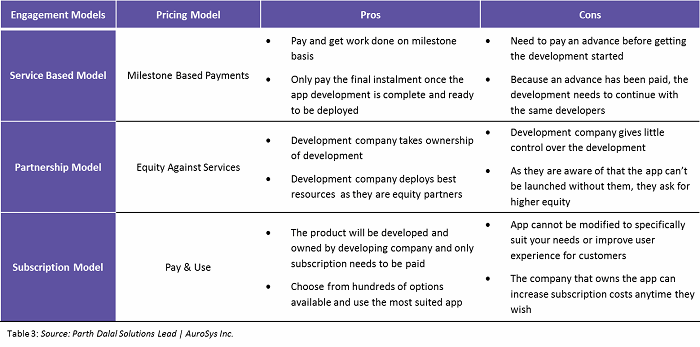

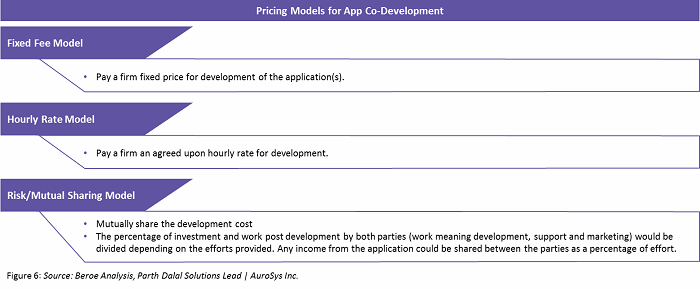

During the process of app development, pharma companies must carefully consider which engagement and pricing model makes the most sense for them, with a focus on intellectual property (IP) rights. Common engagement practices are described in Table 3 below.

Within the partnership model, there are several pricing models, as defined in Figure 6 below.

The app development market is highly fragmented, with technology players who cater to multiple sectors and specialties. Hence, pharmaceutical companies have a broad range of choices and increased buyer power. Developers also consider pharmaceutical companies as attractive accounts that can increase their brand visibility; as a result, this area of app development is trending upwards.

References:

- E. Earls, “Clinical trial delays: America’s patient recruitment dilemma,” drugdevelopment-technology.com, July 2012.

- U.S. Department of Health & Human Services, Examination Of Clinical Trial Costs And Barriers For Drug Development, July 2014.

- T. Davis, "Get Personal," International Clinical Trials, Spring 2015.

- N. S. Sharma, "Patient centric approach for clinical trials: Current trend and new opportunities," Perspectives in Clinical Research, vol. 6, no. 3, Jul.-Sep. 2015.

- "Going All In on eCOA," Journal for Clinical Studies, vol. 8, no. 6, Nov. 2016.

- T. Davis , "Improving the quality and accessibility of clinical data collection through patient engagement," Journal for Clinical Studies, vol. 7, no. 2, May 2015.

- E. Miseta, "The Challenges of Performing Global Trials," Life Science Leader, Supplement, May 2015.

- M. Posada, "The Evolving Landscape of Medical Apps in Healthcare," HIT Consultant, June 2014.

- Y. Xiaohui, H. Han, J. Jiadong, W. Liurong, L. Cheng, Z. Xueli, L. Haihua, H. Ying, S. Ke, L. Na, D. West, and J. Bleiberg, "mHealth in China and the United States," Center for Technology Innovation at Brookings, June 2016.

- S. Baum, "Report: 3 types of developers behind pharma apps and how they can boost downloads," Medcity News, Oct. 2014.

- J. Comstock, "Report: Pharma companies have many apps, relatively few downloads," MobiHealthNews, Oct. 2014.

About the Authors

Mathini Ilancheran is the senior lead analyst of clinical R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities. She completed her master’s in management from University College London (UCL) and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. She is also an engineer with a background in bioinformatics and has experience as a research fellow in Singapore-Delft Water Alliance (SDWA), NUS, with active involvement in scientific tool development and programming. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.

Mathini Ilancheran is the senior lead analyst of clinical R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities. She completed her master’s in management from University College London (UCL) and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. She is also an engineer with a background in bioinformatics and has experience as a research fellow in Singapore-Delft Water Alliance (SDWA), NUS, with active involvement in scientific tool development and programming. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.

Parth Dalal is the solutions lead at AuroSys Solutions. He is an expert in designing industry specific high-tech solutions for web, mobile, and the Internet of Things (IoT). He has extensive understanding of technology platforms and languages to derive accurate timelines and costs of product development.

Parth Dalal is the solutions lead at AuroSys Solutions. He is an expert in designing industry specific high-tech solutions for web, mobile, and the Internet of Things (IoT). He has extensive understanding of technology platforms and languages to derive accurate timelines and costs of product development.