Advancing Sponsor / CRO Collaborations To Improve Preclinical Throughput

By Kate Hammeke, research manager, Nice Insight

With an overarching goal of optimizing collaborations in the drug development industry, Nice Insight developed a quarterly survey in which prospective, current, and past customers evaluate the communications and performance of 100+ CROs. By conducting primary research on both outsourcing practices and contractor performance, the information generated can help save time and money spent on the partner selection process by enabling the sharing of knowledge among peers on the sponsor side of the industry. Additionally, CROs can review quantified feedback from sponsors to gain an understanding of how well their businesses are known and perceived across the pharmaceutical and biotechnology industry.

Developing the research tool started with identifying the drivers that influence partner selection, as well as understanding the nuances of the different types of outsourcing relationships — including tactical service providers, preferred vendors, and strategic partnerships — and the value each type of relationship can bring to a sponsor. The Nice Insight team conducted in-depth interviews with industry executives in order to design a survey that would offer insight on key performance measures across the industry. We’ve learned in this short time since publishing the first report in March 2011 that the right relationship between sponsor and CRO will open the doors to further innovation.

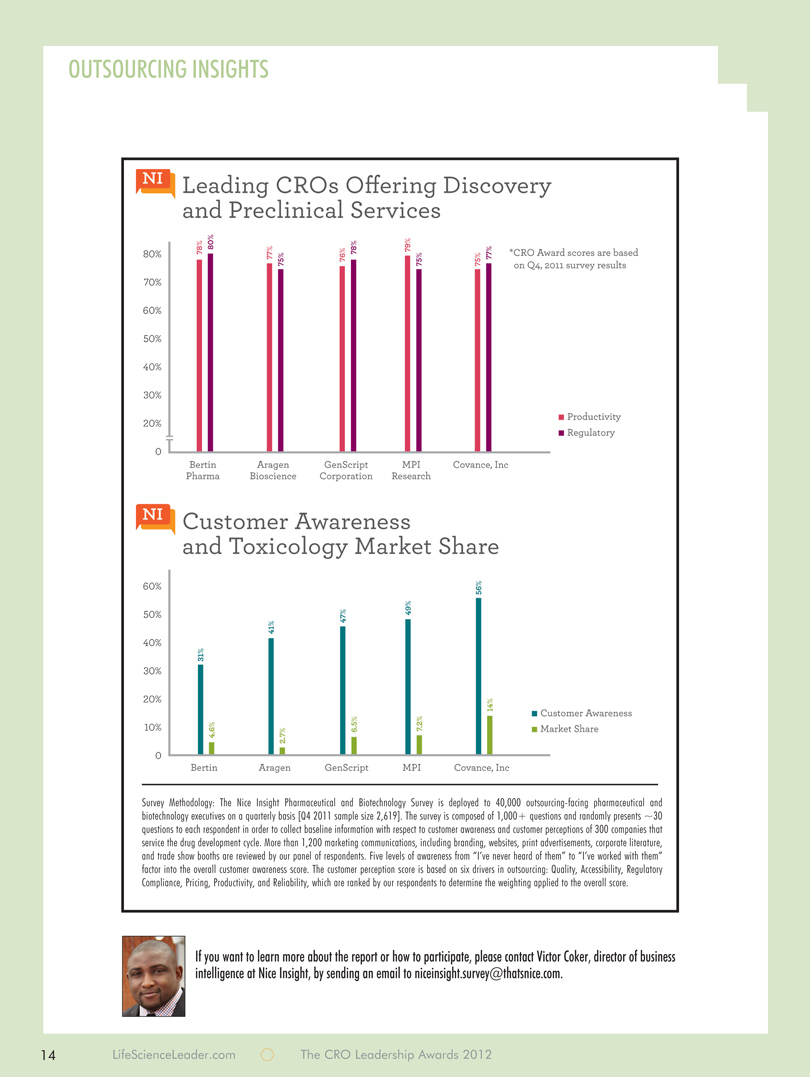

Nice Insight’s survey randomly presents approximately 30 questions to each respondent in order to collect baseline information with respect to customer awareness and customer perception. Five levels of awareness, from “I’ve never heard of them” to “I’ve worked with them” factor into the overall customer awareness score. The customer perception score is based on six key drivers in outsourcing: quality, innovation (which replaced accessibility for 2012), regulatory compliance, pricing, productivity, and reliability. Respondents rank the drivers to determine the weighting applied to the overall score.

The value of the information available through Nice Insight lies in helping users to quickly identify potential partners, while establishing industry benchmarks that show where each CRO is positioned relative to industry averages and its direct competitors.

In the first year, the survey evolved rapidly as direct feedback from Nice Insight clients helped identify further areas of curiosity — such as when (during which phase of development) sponsors are most likely to engage outsourcing services. Survey respondents revealed a dramatic change in early-stage practices, with 50% indicating the company they work for engages CROs during the discovery phase — a practice almost unheard of a decade ago. As intellectual property rights and regulatory standards strengthened, the complexity of projects offered to subcontractors increased.

A Shift To Early-Stage Testing

A key benefit of finding the right CRO to engage for discovery work is the increased potential for more molecules to pass into preclinical trials. After all, according to the book Approaches to Assessing Drug Safety in the Discovery Phase, “it has been estimated that a 10% improvement in predicting future failure before the initiation of expensive and time-consuming clinical trials could save upwards of $100 million on the costs associated with drug development.” As such, the drug development industry has shifted attention toward developing, authenticating, and executing more proactive testing standards in earlier stages.

It is essential for contract service providers to continually communicate their presence and offering to the industry at large, as well as develop targeted messaging for specific audiences. This combined approach increases the likelihood of being on the radar of outsourcing sponsors in general and the possibility of being considered for specific project. As entry into the market becomes more challenging, CROs can benefit from keeping up on outsourcing trends, especially how practices and desired services vary among the different sponsor groups, and arming themselves with information. Both sponsors and CROs can benefit from understanding how customer perception serves as a short-term measure for maintaining clients, and customer awareness serves as long-term measure of sustainability.

*CRO Leadership Awards were based on Q4, 2011 survey results. Q1, 2012 results are currently available on niceinsight.com

Get unlimited access to:

Enter your credentials below to log in. Not yet a member of Clinical Leader? Subscribe today.