An Analysis Of Clinical Development Benchmarking Practices

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

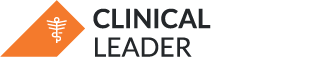

Pharma companies use performance and competitive benchmarking to identify opportunities during their drug development cycle. The benchmarks are aimed at finding ways to make improvements in cost savings, lead time reduction (faster drug to market), and quality of services. With timely recruitment, continuous monitoring, and shorter cycle times being key to the success of a clinical trial, benchmarking has become more important to the industry, and the practice has a large impact on cost, quality, timelines, and a sponsor’s brand name. Common benchmarking practices focus on site performance, protocol amendments, investigator fees, fair market value, outsourced trials, patient enrollment, engagement and retention, portfolio management, resource management, etc. In this analysis we will look at the top benchmarked areas and solutions that expedite this process. Figure 1 describes the various types of benchmarking used by pharma companies.

development cycle. The benchmarks are aimed at finding ways to make improvements in cost savings, lead time reduction (faster drug to market), and quality of services. With timely recruitment, continuous monitoring, and shorter cycle times being key to the success of a clinical trial, benchmarking has become more important to the industry, and the practice has a large impact on cost, quality, timelines, and a sponsor’s brand name. Common benchmarking practices focus on site performance, protocol amendments, investigator fees, fair market value, outsourced trials, patient enrollment, engagement and retention, portfolio management, resource management, etc. In this analysis we will look at the top benchmarked areas and solutions that expedite this process. Figure 1 describes the various types of benchmarking used by pharma companies.

Figure 1: Types of pharma benchmarking

Site Selection, Study Start-Up, and Site Activation Benchmarking

Pharma companies most often use benchmarking for clinical research site selection, study start-up, and site activation. Benchmarking is applied as a standard competitive tool with a focus on a set of compatible and comparable KPIs. This makes the decision process transparent, effective, and more objective, enabling companies to improve the quality of clinical trials by using the results to compare the performance of investigative sites.

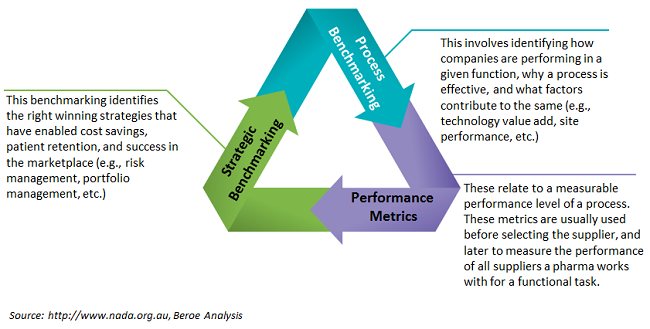

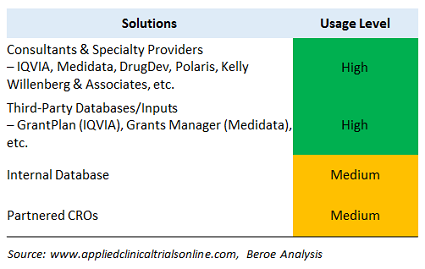

For example, first-patient-in cycle times vary by region, and they are key data points that pharma companies benchmark during site selection and activation. Through feasibility studies, companies are able to identify a site’s ability to execute a proposed study and the complexity of the protocol. Several tools and solutions used in this practice are shown in Table 1.

Table 1: Solutions, Tools to Support Site Benchmarking

Protocol Amendment Benchmarking

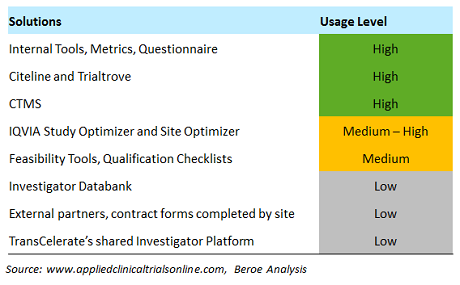

A number of initiatives have been introduced by pharma companies to optimize protocol design. Benchmarking around this area is important, as understanding the protocol amendment experience has a direct impact on clinical trial performance. Protocol amendment benchmarking involves characterizing protocol design practices and conducting a root cause analysis on amendment implementation factors impacting study duration cycle times. The trial performance and cost data for all protocols are measured as part of this practice.

This practice generally involves systematic assessments of the number and causes of protocol amendments in an attempt to create better, less costly protocols. Following this, a budget is established that includes contingency funds if an amendment seems likely. Figure 2 provides some examples of benchmarking practices of global pharma around protocol amendments.

Figure 2: Major protocol amendment benchmarking practices

Fair Market Value (FMV) Benchmarking

With increasing scrutiny and regulations from government agencies (such as the Physician Payments Sunshine Act), the pharma industry is forced to benchmark fair market value (FMV) more precisely than before. The pharma industry is moving toward formalizing the payments to investigators and key opinion leaders (KOLs) to provide consistent payment rate cards, but there is still a lack of harmonization in the process, especially in the U.S. Managing investigator payments is one of the challenging aspects of running a clinical trial. The appropriate investigator payment should be defined based on the therapeutic area, region, and phase of the trial, as well as the protocol demands of the clinical trial. Benchmarking of per-patient costs and compensation caps in order to ensure the accepted rates for investigator payments can help meet these goals. Table 2 provides some of the key tools that provide benchmarking data for this process.

Table 2: Solutions, Tools to Support FMV Benchmarking

Outsourced Trial Benchmarking

CRO benchmarking helps ensure that pharma companies partner with the right suppliers based on companies’ internal parameters. This ensures efficiency in the clinical trial process, with pharma focusing on only core IP work and long-term cost savings, improved cycle time, and quality. Under this, the key parameters benchmarked are:

- CRO Site Performance: Benchmarking is based on the history of successful completion of trials, how much the CRO maintains confidentiality, therapeutic expertise, geographic capability, brand value, and size of operation.

- Patient Access: Capability is benchmarked in terms of patient availability, including access to different types of volunteers for different trials (network, collaborations, hospital units, etc.), associated groups of experts, and patient retention process and initiatives.

- Documentation: Documentation abilities are ascertained through good clinical practice certification, ISO certification, documentation of procedures, and statistical/analytical experts (either in-house or network).

- Internal Expertise: The availability of skilled physicians, nurses, and other specialized personnel, such as Big Data analysts, blood/saliva/skin/assay experts, hospital collaborations, etc., is evaluated.

Conclusion

The above covers only a few of the various benchmarking activities practiced by pharma. In addition to these, benchmarks are carried out on patient engagement, portfolio management, resource management, etc. Patient benchmarks focus on speed of patient recruitment, retention, and cost of engagement campaigns to increase patient awareness, as well as measuring whether patient engagement programs are successful. Portfolio management benchmarking using predictive analysis enables identifying market opportunity (net present value), competition, and timelines for drug development. Increased utilization of full-time equivalent (FTE) resources, mainly for the CRAs and project managers at the site level, with competitive FTE rates, serves as an opportunity to reduce overall staff costs. This has resulted in companies benchmarking resources management to measure the efficient use of spend on contracted and insourced FTE resources. All of these practices are directed toward identifying opportunities and insights in the form of cost savings, process efficiencies, technology impact, talent retention, innovation, best practices, and strategy.

About The Author:

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities. With her category knowledge, she has published 20+ articles in leading journals, co-authored with industry experts. She completed her master’s in management from University College London (UCL) and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities. With her category knowledge, she has published 20+ articles in leading journals, co-authored with industry experts. She completed her master’s in management from University College London (UCL) and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com or connect with her on LinkedIn.