Best Practices For Sourcing & Outsourcing In Clinical Operations

By Krishnan Rajagopalan, Ph.D., Life Sciences Transformation Group

The life sciences industry is in the throes of innovation and transformation. Targeted therapeutic approaches for cancer and rare diseases and rapidly evolving genomics and molecular medicine approaches are translating into precision medicines and individualized therapeutic protocols. Gene therapy and gene editing are beginning to transform the industry at a fundamental level. Decentralized clinical trials (DCTs) are aiding the transformation, facilitating a patient-centric approach, and leveraging a variety of digital technologies. Recent application of mRNA-based platforms and expeditious trials and submissions have led to the approval of highly effective vaccines for COVID-19.

Transformation of clinical operations across processes, people, and technology has become a strategic priority, as nearly 70% of R&D spend is on clinical trials. Since a significant portion of clinical trials are outsourced to external partners (e.g., CRO, FSP), it is imperative that life sciences companies have a dependable set of global and regional external partnerships that are flexible and scalable. These partnerships need to fit the diverse needs of small, medium, and large companies and a variety of “future-ready” operating models.

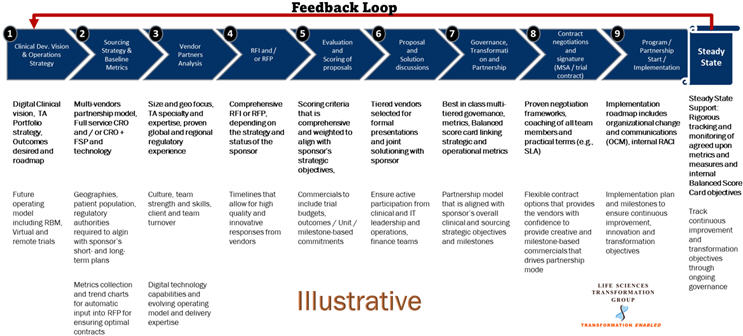

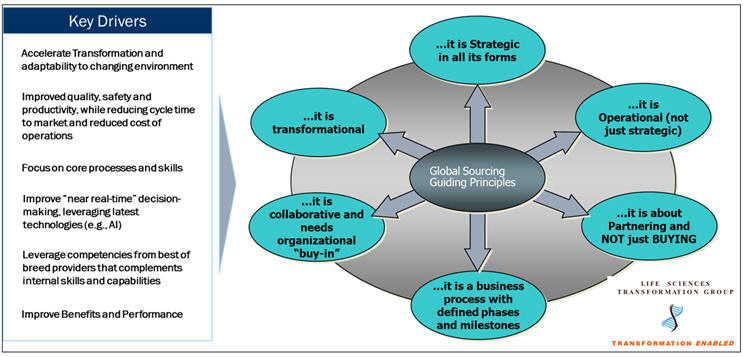

A comprehensive end-to-end sourcing and outsourcing approach that is strategic in all its elements can allow life sciences companies to leverage best practices and realize their clinical transformation objectives. Some of the key activities within the strategic sourcing/outsourcing process that have seen innovation and refinement, along with their key implications, are summarized below:

1. Clinical Development Vision And Operations Strategy

Many of the large and mid-tier pharmaceutical and biotech companies continue to refine their overall business and clinical strategy portfolios to fit the paradigm shift from a disease orientation to a holistic health focus. This shift is having a direct impact on the clinical trial and operations strategies that need to align with the corporate strategy.

Implication: Selecting a couple of CROs and a few functional service providers (FSPs) to provide short- to medium-term operational and resourcing needs will not suffice. A well-defined therapeutic area (TA) portfolio and geography plan, along with the desired outcomes/metrics across strategic, financial, and overall people capabilities, and “future-ready” operating models/technology, are needed. These plans and outcomes, aligned with a road map that has clearly laid out milestones and deliverables, are critical to ensure identification of the most optimal partner(s) and solution/partnership models.

2. Sourcing Strategy And Baseline Metrics

A sourcing/outsourcing strategy that includes a systematic analysis of which trials, processes, and technology can be outsourced and to what type of partners, and where, must be completed. This analysis, sometimes referred to as the Outsourceability Portfolio Analysis (OPA), incorporates business, people/skills, and technology requirements, along with the budget, cost saving needs, and, more importantly, business risks and mitigations.

Click image to enlarge.

Implication: An optimal mix of full-service CROs, FSPs, and technology providers (both platforms and systems integrators) is a key component of the sourcing strategy. Quickly collecting past years’ trial metrics data, along with developing a best-case estimate of projections for the future with documented assumptions, will be a critical component of the sourcing strategy. Sharing this has a direct impact on the type of vendors selected, partnership models, flexible contracts, and commitment to outcomes by vendors (as partners) and avoids repeated escalations and missed milestones subsequently. Artificial intelligence/machine learning tools can be leveraged for data collection and analysis for input into RFPs and can potentially lead to reduction in the effort of this step by approximately 30%, based on my experience over the past 25 years.

Click image to enlarge.

3. Vendor Partner Analysis

A thorough analysis of global and regional vendors that can deliver to the client’s clinical operations and strategic sourcing plan specifications needs to be completed, both from an RFI and RFP perspective. Examples of key factors that need to be part of the evaluation matrix and scoring for qualifying for an RFI/RFP include:

- Size and geo focus

- TA specialty, regulatory expertise, and extent of site network

- Proven ability to stick to committed deliverables within timelines and cost

- Adherence to established quality and safety guidelines

- Cultural fit

- Experience in evolving digital capabilities and innovative operating models

- Staff turnover

Implication: The list of eligible vendors to receive RFP/RFI needs to be objective to ensure the most eligible vendors are part of the mix. My team has seen clients select the same set of vendors that they are familiar with or have used in the past (even though they may have had challenges in meeting the key metrics), preventing more qualified vendors from being considered. Stakeholder alignment, empowered business/program leader(s), and effective organizational change and communications become critical focus areas for the overall program to be successful.

4. RFP Rollout, Proposal Evaluation And Joint Solution Discussions

Vendor communications need to be rigorously controlled, and any received proposals that include detailed pricing need to be evaluated using structured scoring models that include both qualitative and quantitative factors.

Implication: Scoring criteria need to be weighted using factors and metrics identified in the clinical operations and sourcing strategic plans. To ensure buy-in on the final vendors selected, the client’s team should include business, IT, sourcing, and operational leads (who will work with the vendor(s) downstream). These process steps require significant bandwidth from the client’s team and should be planned, rather than being “business as usual” activities.

Click images to enlarge.

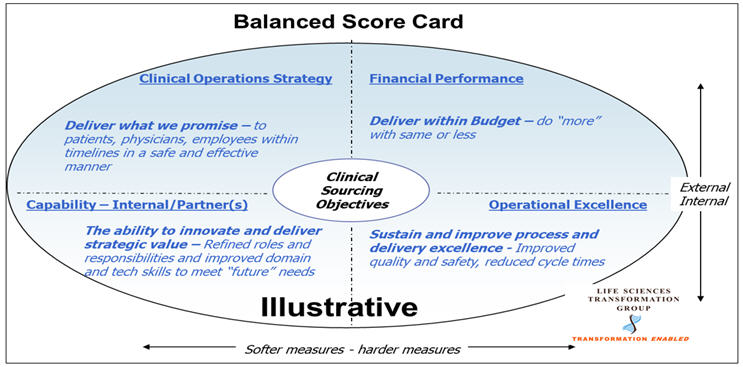

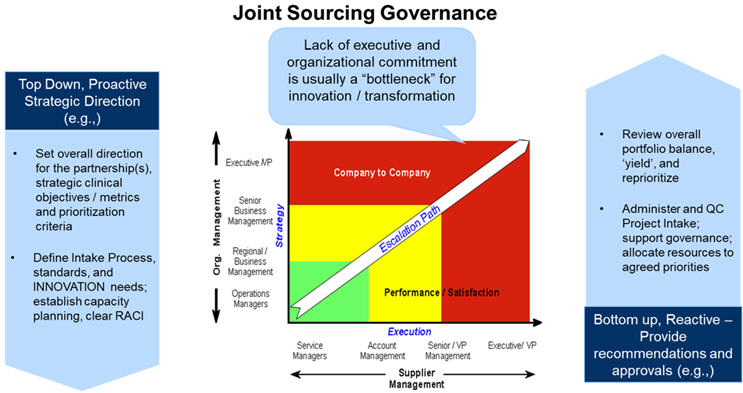

5. Governance, Transformation, And Partnership

Transformed clinical operations require transparent and committed partnerships to achieve the established strategic goals of the engagement. Structured, multi-tiered governance that tracks tangible partnership metrics and strategic and operational objectives, including customers’ and employees’ satisfaction, has been the cornerstone of the most successful partnerships.

Implication: Executive-level commitment is required from all involved organizations (your sponsor company, all vendors and collaborators). Bandwidth and role objectives/performance criteria for operational team members involved in day-to-day management of vendors and governance need to be refined to ensure program success.

6. Contract Negotiations, Steady State Implementation

The negotiation team must ideally include selected operational lead(s) in addition to executive leaders, sourcing, finance, and legal team members.

Implication: Proven negotiation frameworks, coaching of all team members, and documented “must win” tangible terms/metrics and outcomes up front (e.g., improved quality, safety, patients’ and employees’ satisfaction, increased productivity, decreased cost of operations, and reduced cycle times) usually allow for flexible and successful contracts and longer-term partnerships. In most successful cases, we have seen that forming a small, trained service management team (SMT) with cross-functional skills to manage all the vendor relationships in the program (typically not procurement or sourcing teams) has proven to be highly beneficial.

Summary

We are at an exciting stage of transformation and collaboration across the healthcare/life sciences industry, and newer clinical operating models and therapeutic approaches are providing a lot of hope to patients. A strategic approach to sourcing and outsourcing, focusing on the best practices described above, will help sponsors put together the external teams and partnerships they need to ensure clinical outsourcing success. This will allow them to focus on developing and evaluating breakthrough therapies with active participation from patients, physicians, payers, and regulators.

About The Author:

Krishnan Rajagopalan, Ph.D., is the president of the Life Sciences Transformation Group and brings more than 27 years in management consulting, strategic sourcing and outsourcing, and global services delivery to clients. He has advised small, medium, and large life sciences clients on strategy, organizational change and communications, operational model design and implementation, strategic coursing, and outsourcing (CRO, BPO, FSP, and IT services). He also delivered full-service CDM, pharmacovigilance/safety, biostatistics/programming, MW, regulatory affairs, commercial services, and IT/digital to more than 100 life sciences companies for major global services providers from India, China, Argentina, multiple European countries, and the U.S. He can be reached at krishnan.rajagopalan@lstgp.com and on LinkedIn.

Krishnan Rajagopalan, Ph.D., is the president of the Life Sciences Transformation Group and brings more than 27 years in management consulting, strategic sourcing and outsourcing, and global services delivery to clients. He has advised small, medium, and large life sciences clients on strategy, organizational change and communications, operational model design and implementation, strategic coursing, and outsourcing (CRO, BPO, FSP, and IT services). He also delivered full-service CDM, pharmacovigilance/safety, biostatistics/programming, MW, regulatory affairs, commercial services, and IT/digital to more than 100 life sciences companies for major global services providers from India, China, Argentina, multiple European countries, and the U.S. He can be reached at krishnan.rajagopalan@lstgp.com and on LinkedIn.