Conducting Clinical Trials In India: Opportunities And Challenges

By Sanil Manavalan, M.D., and Catherine Sinfield, Ph.D.

The social, demographic, and economic environments in which the global pharmaceutical industry operates are transitioning. Developed economies with ever-rising healthcare costs are looking to curb healthcare expenditures, and payer demand is moving toward a reimbursement model based on healthcare outcomes. Declining R&D productivity and the looming patent cliff are threatening the sustainability of the current pharma industry business model. Emerging markets — specifically India, given its large domestic market, product development skills, and scientific man power — offer a solution to the global pharma industry to address the challenges of growth and innovation.

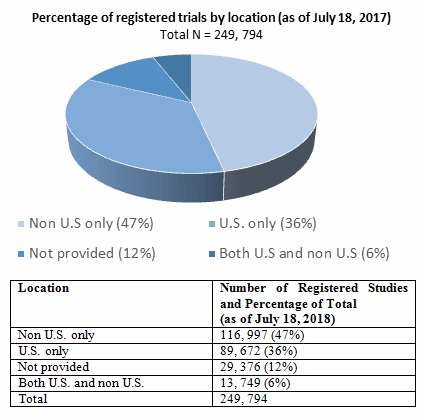

BRIC countries (Brazil, Russia, India and China) can execute trials at costs around half of the costs in the U.S. These countries have had a marked rise in the number of trials in recent years. Data from studies registered at ClinicalTrials.gov as of July 18, 2017, showed that 36 percent of clinical trials were conducted in the U.S. only (n=89,672) and 47 percent in non-U.S. countries only (n=116,997).

The chart below (Figure 1) shows the distribution of locations for all studies registered on ClinicalTrials.gov.

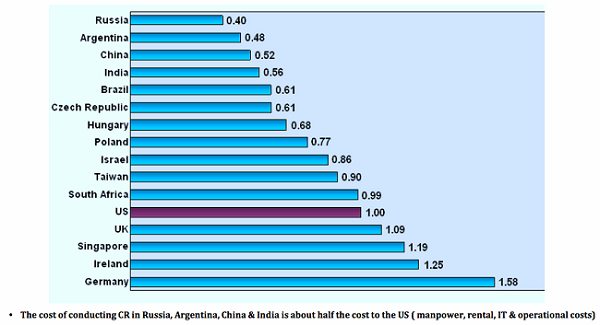

The operational costs of clinical trials are generally lower

Figure 1: Distribution of trials by location (U.S. only and non-U.S) for all studies registered on ClinicalTrials.gov (as of July 2017).

in BRIC countries such as India (Figure 2). Outsourcing of the intense administrative parts of research, as well as the regulatory and ethics filings, to international countries can substantially reduce time and economical expenses. The international locations can often offer access to a larger number of patients, with quicker enrollment, and in general a shorter trial timeline from start to finish.

Figure 2: Cost of conducting Clinical Research (manpower, rental, IT, and operational costs) in Russia, Argentina, China, India, and Brazil relative to U.S (Ayakew, 2013)

Enrollment of patients can be challenging and time consuming in the U.S. Recruitment of patients is often easier in countries with a lower standard of care, as these patients may feel a stronger need to participate than patients in the U.S. A number of CROs and principal investigators (PIs) have gained international experience and can offer assistance in navigating the foreign bureaucracy. In addition, the regulatory workload tends to be lower in countries outside the U.S.

The India Advantage

India is advantageously positioned for the conduct of clinical trials for a several reasons:

- India’s economy shows signs of robust growth, and increased spending on healthcare needs is expected to drive revenue growth for pharma companies. The Indian pharma industry today is the third largest market globally in terms of volume and 14th largest by value. According to reports by McKinsey and PwC, the domestic pharma market is expected to grow at CAGR of 15 to 20 percent annually to be a USD 49 billion to 74 billion market by 2020.

- India offers a large and diverse genetic pool of a treatment-naive population for clinical trials. According to PwC, India, with a population of more than 1.2 billion and projected to increase to 1.6 billion by 2050, is set to become the most populous country in the world, outnumbering even China. Given increasing difficulty in sourcing patients for clinical trials in developed countries, the concept of expanding the pool of available patients in emerging countries, combined with cost savings, makes India well positioned.

- The emergence of chronic diseases like cancer, diabetes, cardio vascular system (CVS) and central nervous system (CNS) disorders may drive demand for newer therapies. With the highest disease burden among all countries, India specifically offers a tremendous opportunity in contributing data for oncology trials as (a) the Indian oncology community is increasingly using genomic testing for their patients; (b) India has an increasing ability to generate quality genomics data and identify patients based on their genomic profiles; and (c) India has a cancer incidence of one million patients and a prevalent population of 2.5 million cancer patients.

- India has the highest number of FDA-approved manufacturing plants outside the U.S. With increasing focus on constraining healthcare costs in the U.S., India’s low-cost manufacturing capabilities combined with high quality standards are advantageous.

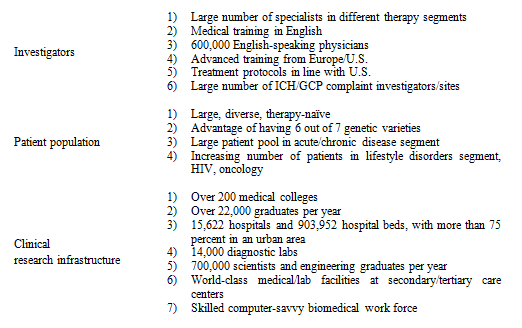

- India also has proven capabilities in medical skills, IT capacity, and a large pool of scientific manpower with 200 years of shared legacy with the United States in medical education and medical practice (Figure 3). With a 12 to 13 percent year-on-year growth, the Indian pharma industry is rapidly achieving a distinctive position in the global pharma space with contract research services and clinical trials.

Figure 3: A breakdown of India’s capabilities to recruit for and conduct clinical trials by medical skills, man power, and capacity and infrastructure

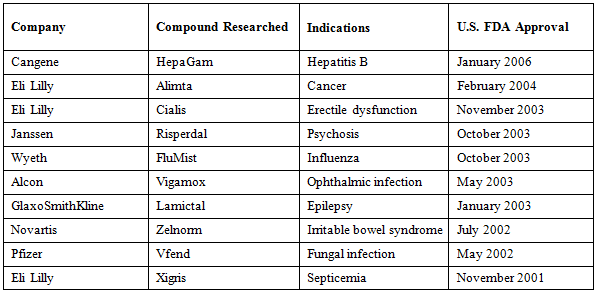

In the past 15 years, India has been critical in contributing trials data for drugs currently in the market today (Table 1).

Table 1: Marketed drugs, with clinical trials conducted in India by company, compound researched, and U.S. FDA approval date

Regulatory Challenges And Outcomes

Emerging countries are subject to the same global standards for conducting clinical trials as developed countries such as the U.S. Local governments have increased efforts to improve their business environment and regulatory adherence. However, this has resulted in some emerging markets enforcing stricter practices than developed regions. The FDA put forth regulations that apply to all foreign studies in 2008, dictating that clinical studies conducted in association with a drug or medical device must follow good clinical practice (GCP) guidelines. One regulatory requirement is review by an independent ethical committee (IEC), which should reduce concerns regarding unethical or poor-quality research. Selecting an international CRO can also offer assurance of compliance with industry standards.

India’s clinical trials industry faced serious legal challenges and disruption of all clinical trials activity due to 2011 litigation challenging the regulatory framework and patient safety guidelines. The result was the implementation of a restrictive three tier clinical trial application process, which considerably delayed approval timelines and India became less competitive in comparison with other emerging markets for the conduct of clinical trials.

In 2014, India re-established new guidelines and protocols for patient consent, patient reimbursement, and adverse events, and issued a directive that clinical trials could only be carried out at accredited centers. More checks and balances have been put in place for certification of sites, ethics committees, and limiting the number of concurrent trials by a principal investigator. Central Drug Standards Control Office (CDSCO) has also issued GCPs inspection checklist recently in August 2016 and is helpful for sponsors and sites. Overall, this translates into better quality trials and cleaner data than what existed prior to the overhaul, the evolving process positively supports clinical research in India while appropriately balancing patient safety.

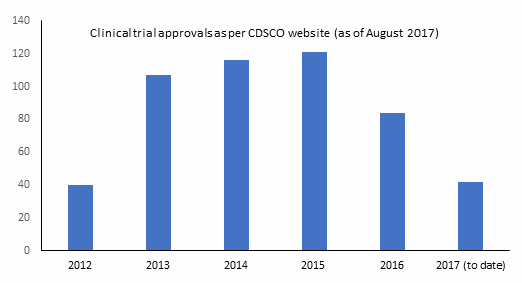

Since the regulatory re-haul, the number of clinical trials approved in India has increased (Figure 4) more than 300 studies have been approved by the Drug Controller General of India (DCGI) — see Table 2.

Table 2: Clinical research study applications approved by the Drug Controller General of India (DCGI) (as of 2014)

Figure 4: Trend of number of clinical trials being approved by regulators in India as per Central Drugs Standard Control

Organization (CDSCO) website (as of August 2017)

While the processes are now clear, the process and time for approval for each step needs to be understood to gain maximum efficiency. Any issue of longer timelines is far outweighed by faster recruitment after approval, and the regulatory workload still tends to be relatively lower in countries outside the U.S.

Summary

With GCP and world-class investigators supported by a large patient base, clinical trials in India could be the solution that the industry is seeking for high quality data, expeditious study enrollments, and low cost. However, the FDA needs to make sure the research resulting from overseas sites are compliant to GCP and that the safety and rights of the participating patients are ensured.

Conducting clinical trials in emerging markets with reduced expenses and a bigger pool of patients benefits sponsor pharmaceutical companies, and it is also beneficial for the local healthcare system and the economy of the developing country.

About The Authors:

Sanil Manavalan, M.D., is founder and chief medical officer of Star Health Network. He has over 20 years experience as an M.D. and a biomedical scientist, including three years of clinical medicine and 12 years of immunology experience. Sanil currently serves as an assistant professor of medicine at Columbia University Medical Center, as an adjunct professor at New York Institute of Technology, and is on the Columbia University’s Institutional Review Board (IRB). He has over 30 publications in peer-reviewed medical journals and has served on the executive editorial board of the Human Immunology Journal, as an associate director of a clinical laboratory, and as a principal investigator. He also serves on the advisory board of Harlem Children’s Society. Sanil earned his medical degree from University of Maiduguri, Nigeria.

Sanil Manavalan, M.D., is founder and chief medical officer of Star Health Network. He has over 20 years experience as an M.D. and a biomedical scientist, including three years of clinical medicine and 12 years of immunology experience. Sanil currently serves as an assistant professor of medicine at Columbia University Medical Center, as an adjunct professor at New York Institute of Technology, and is on the Columbia University’s Institutional Review Board (IRB). He has over 30 publications in peer-reviewed medical journals and has served on the executive editorial board of the Human Immunology Journal, as an associate director of a clinical laboratory, and as a principal investigator. He also serves on the advisory board of Harlem Children’s Society. Sanil earned his medical degree from University of Maiduguri, Nigeria.

Catherine Sinfield earned a Ph.D. in genetics from the University of Leeds (UK) and worked as national clinical research lead for Spire Healthcare, the second largest provider of private healthcare in the UK. Her role focused on clinical innovation through introduction of clinical research, new services, and technology solutions. Catherine managed a strategic alliance with MAC Clinical Research for the recruitment and conduct of clinical trials, and she acted as an independent healthcare advisory member for the Health Education England (HEE) Genomics Advisory Board and HEE Science Advisory Group. In 2016, Catherine completed the Global Health Delivery Intensive Program (GHDI) at Harvard University and is currently enrolled in the MPH Program at Icahn School of Medicine Mount Sinai (ISMMS). As part of the program she is working with Star Health Network to help deliver oncology diagnostics and clinical trials to emerging markets.

Catherine Sinfield earned a Ph.D. in genetics from the University of Leeds (UK) and worked as national clinical research lead for Spire Healthcare, the second largest provider of private healthcare in the UK. Her role focused on clinical innovation through introduction of clinical research, new services, and technology solutions. Catherine managed a strategic alliance with MAC Clinical Research for the recruitment and conduct of clinical trials, and she acted as an independent healthcare advisory member for the Health Education England (HEE) Genomics Advisory Board and HEE Science Advisory Group. In 2016, Catherine completed the Global Health Delivery Intensive Program (GHDI) at Harvard University and is currently enrolled in the MPH Program at Icahn School of Medicine Mount Sinai (ISMMS). As part of the program she is working with Star Health Network to help deliver oncology diagnostics and clinical trials to emerging markets.

About Star Health Network:

Star Health Network is an international full-service provider operating institutional-based clinical trials in India. Star’s focus is on oncology, and through its network of 31 cancer centers more than 250,000 patients can be accessed together with experienced site principal investigators. Star’s India-based SMO navigates regulatory approvals and operations, ensuring a rapid study startup at 60 percent of the U.S. costs. The company moves the majority of the clinical trial overseas to its highly respected GCP-compliant, institution-based research sites, which secure rapid enrolment and deliver consistent quality data at high speed and low cost. You can reach them at clinicaltrials@starhealthnetwork.com.

References:

- Ascher, J., Bogdan, B., Dreszer, J., and Zhou, G. Pharma’s Next Challenge. McKinsey & Company. http://www.mckinsey.com/industries/pharmaceuticals-and-medical-products/our-insights/pharmas-next-challenge.

- Ayalew, K. FDA Perspective On International Clinical Trials. FDA presentation. https://www.fda.gov/downloads/training/clinicalinvestigatortrainingcourse/ucm378499.pdf and https://www.fda.gov/downloads/drugs/newsevents/ucm441250.pdf.

- Bhave A, Menon S. Regulatory environment for clinical research: Recent past and expected future. Perspectives in Clinical Research. 2017;8(1):11-16. doi:10.4103/2229-3485.198551.

- Central Drugs Standard Control (CDSC) Organization http://www.cdsco.nic.in/forms/list.aspx?lid=2055&Id=11

- ClinicalTrials.gov. National Institutes of Health database. https://clinicaltrials.gov/

- India Pharma 2020: Propelling Access and Acceptance, Realising True Potential. McKinsey & Company report. http://www.mckinsey.com/~/media/mckinsey%20offices/india/pdfs/india_pharma_2020_propelling_access_and_acceptance.as

- India Pharma Inc.: Capitalising on India’s Growth Potential. PwC report. http://www.pwc.in/assets/pdfs/pharma/pwc-cii-pharma-summit-2011-v2.pdf