CRO Industry Outlook 2026: The Next Stage Of Clinical Trial Transformation

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

As the CRO market enters 2026, the global drug development landscape is undergoing one of the most significant shifts in two decades. Advances in AI, the rise of APAC as a global trial hub, new regulatory expectations, and increasing scientific complexity are redefining how clinical trials are designed, executed, and scaled. Major CROs, including IQVIA, ICON, Thermo Fisher (PPD), and Medpace, reported strong 2025 performance driven by stabilizing biotech funding and increased outsourcing demand.1

In 2026, CROs are no longer transactional vendors; they are strategic co-developers, integrating technology, therapeutic expertise, regulatory intelligence, and global operations to accelerate drug development.

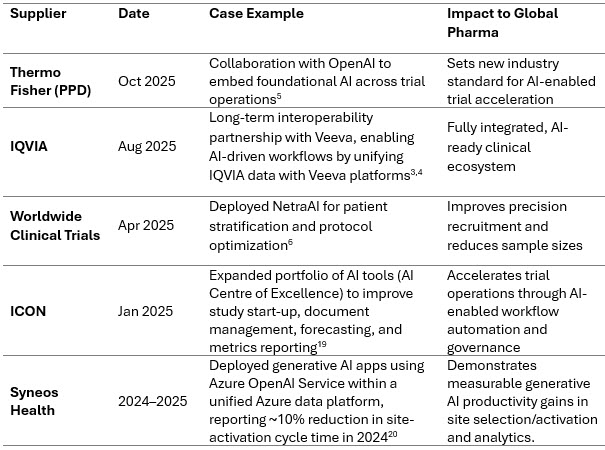

AI-Native Clinical Trials Become The New Norm

AI has moved from pilot-level experiments to foundational infrastructure in clinical development. WHO emphasized the need for higher-quality, predictive, and data-driven trial ecosystems in its 2025 Global Action Plan2, further accelerating CRO adoption of AI-driven tools for protocol design, feasibility modeling, patient targeting, and automated data review.

Recent Case Examples

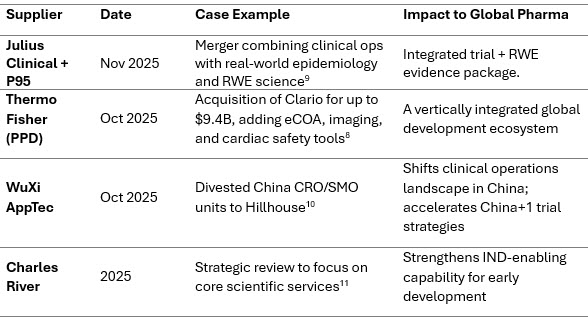

Consolidation Accelerates: A Few Mega-Platforms Emerge

Consolidation continues as CROs strive to build fully integrated platforms spanning labs, clinical operations, endpoint technologies, and AI. Rising digital transformation costs further pressure mid-tier CROs.

Recent Case Examples

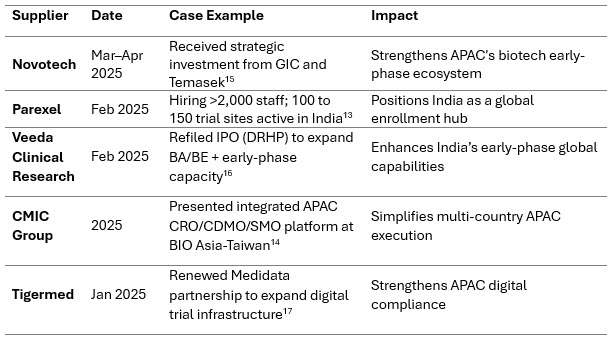

APAC And Emerging Markets Surge As Trial Hubs

APAC’s clinical trials market (valued at ~$11 billion to $12 billion in 2024) is projected to double by the early 2030s.12 Fast enrollment, cost advantages, diverse patient pools, and evolving regulatory maturity make the region central to 2026 strategies.

Recent Case Examples

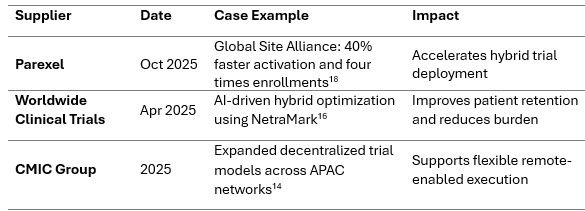

Decentralized And Hybrid Trials Mature

Hybrid clinical trials - combining virtual and site-based activities are becoming standard practice. Regulators increasingly support remote visits and digital methods if data integrity and oversight remain intact.

Recent Case Examples

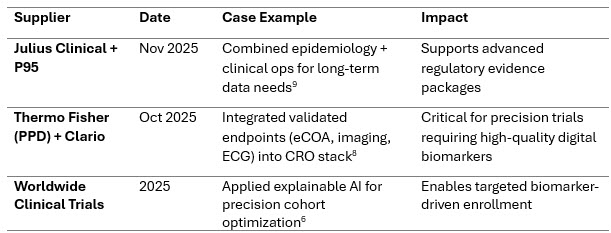

Precision Medicine And Complex Modalities Expand Rapidly

Precision oncology, rare diseases, and gene/cell therapies require stronger biomarker strategies, validated digital endpoints, adaptive designs, and RWE integration.

Recent Case Examples

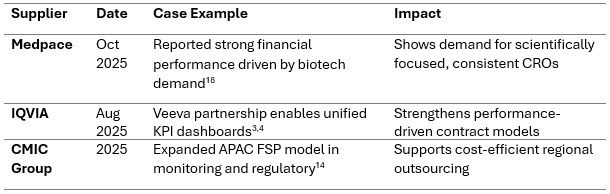

Performance, Speed, And FSP/Hybrid Models Drive CRO Selection

Performance-based contracting and FSP (functional service provider) models dominate procurement. Sponsors increasingly prioritize CROs that provide measurable KPIs and predictable delivery.

Recent Case Examples

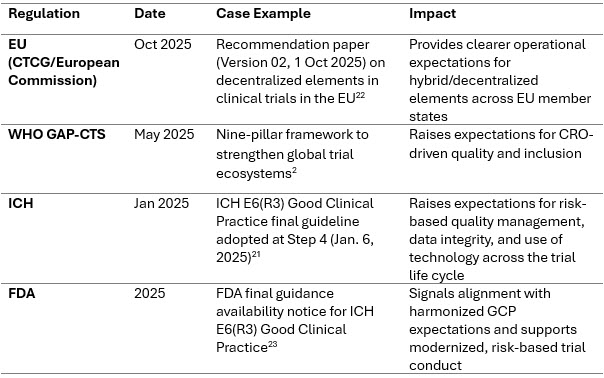

Regulatory Tightening And Global Harmonization

WHO’s Global Action Plan (2025) calls for inclusive evidence generation, stronger ethics, and improved trial infrastructure globally.2 Regulators now expect stronger oversight of digital trials, RWE integration, and diversity planning.

Recent Case Examples

Talent And Operational Capacity Become Differentiators

CROs face ongoing shortages in CRAs, regulatory specialists, and data scientists. APAC has become a major talent hub.

Recent Case Examples (2025–Present)

Cybersecurity And Data Integrity Become Core Requirements

The rise of digital and decentralized trials increases exposure to cyber risk. CROs are consolidating digital environments to improve data governance.

Recent Case Examples

Conclusion

By 2026, CROs have evolved into fully integrated, intelligence-driven development partners. AI-enabled protocol design, predictive site selection, digital endpoints, and hybrid patient-centric models are now foundational to global clinical trial execution. Combined with deeper therapeutic expertise, APAC expansion, unified data ecosystems, and stronger regulatory alignment, leading CROs function as co-architects of modern drug development.

Looking forward, clinical development becomes more digital, global, precise, and performance-driven. CROs that demonstrate measurable speed, scientific depth, transparency, cybersecurity strength, and AI-enabled efficiency will define the next generation of drug development. Those unable to scale, integrate, and innovate will struggle to compete in a market increasingly shaped by complexity and technological maturity.

References:

- Reuters, “Thermo Fisher Q3 2025 earnings highlight CRO performance rebound,” 2025.

- World Health Organization, “Global Action Plan for Clinical Trial Ecosystem Strengthening (GAP-CTS),” May 2025.

- IQVIA, “IQVIA and Veeva Announce Long-Term Clinical and Commercial Partnerships,” August 2025.

- Veeva Systems, “IQVIA–Veeva Interoperability Announcement,” 2025.

- Thermo Fisher Scientific, “Thermo Fisher Collaborates with OpenAI to Accelerate Clinical Development,” October 2025.

- Worldwide Clinical Trials, “Worldwide Partners with NetraMark to Deploy NetraAI,” April 2025.

- Medidata, “Fortrea Implements Medidata Intelligent Trials to Enhance Enrollment and Diversity,” 2023.

- Reuters, “Thermo Fisher to Acquire Clario for Up to $9.4 Billion,” October 2025.

- Julius Clinical, “Julius Clinical and P95 Announce Merger,” November 2025.

- WuXi AppTec, “WuXi AppTec Divests Clinical Services to Hillhouse,” October 2025.

- Charles River Laboratories, “Charles River Announces Strategic Portfolio Review,” 2025.

- Grand View Research, “Asia-Pacific Clinical Trials Market Report,” 2024.

- Reuters, “Parexel India Plans to Hire 2,000 Staff Amid Growing Global Trial Demand,” February 2025.

- CMIC Group, “CMIC Showcases Integrated APAC Clinical Solutions at BIO Asia-Taiwan,” 2025.

- Novotech, “GIC and Temasek Invest in Novotech to Accelerate Global Expansion,” 2025.

- Economic Times, “Veeda Clinical Research Refiles DRHP with SEBI for IPO,” February 2025.

- Medidata Solutions, “Tigermed Renews Technology Partnership with Medidata,” January 2025.

- Parexel, “Global Site Alliance Achieves Faster Activation and Higher Enrollment,” Oct. 2025.

- ICON plc, “ICON portfolio of AI tools drives clinical trial efficiencies,” Jan. 30, 2025.

- Microsoft, “Syneos Health reduces time for clinical trial site activation by about 10% with Azure OpenAI Service,” Microsoft Customer Stories, accessed Dec. 15, 2025.

- International Council for Harmonisation (ICH), “Guideline for Good Clinical Practice E6(R3),” Final version adopted Jan. 6, 2025.

- European Commission / Clinical Trials Coordination Group (CTCG), “Recommendation paper on decentralised elements in clinical trials,” Version 02, Oct. 1, 2025.

- U.S. Food and Drug Administration (FDA), “E6 (R3) Good Clinical Practice (GCP),” FDA Guidance Documents, 2025.

About The Author

Mathini Ilancheran is a research manager, R&D, at Beroe Inc. She is an expert in procurement intelligence and industry analysis, specializing in strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 37+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.

Mathini Ilancheran is a research manager, R&D, at Beroe Inc. She is an expert in procurement intelligence and industry analysis, specializing in strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 37+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.