CRO Selection 101 — How To Get Started

By Joelle Herman, president, NeoTrials, LLC

This three-part article series will look at how best to procure, manage, and implement best practices in this complicated market.

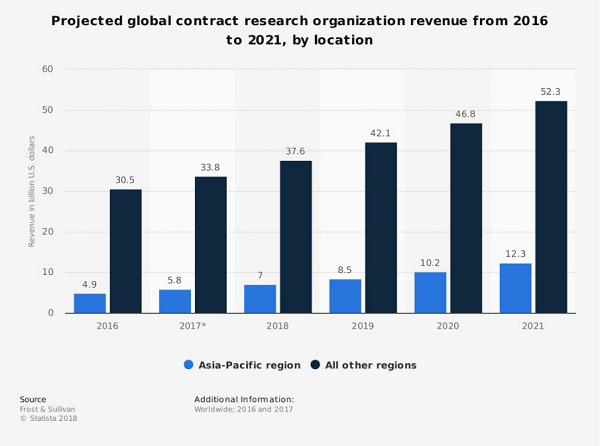

As companies continue to look for smarter ways to develop drugs, biologics, and devices, outsourcing clinical trials to contract research organizations (CROs) and niche providers continues to grow. A recent report from Statistica projects that global CRO revenues will reach $52.3 billion by 2021 just in locations outside of the Asia-Pacific (APAC) region. While that is impressive, APAC, which is one of the fastest growing markets in the world, is projected to grow at a 20 percent compound annual growth rate (CAGR), compared to 11.4 percent “rest of world” revenue.1 This growth is substantial and plays into the critical nature of how product developers procure and utilize CROs. This is a complex process whether you are a large biopharma or a small one poised to initiate clinical trials. The complexity of a successful procurement can be managed with good early planning and a strategic approach.

Champion/Selection Committee

Before you can go out and get bids, the needs of the project/program must be defined by an internal champion or selection committee. A person or team closest to the science or the person responsible for leading the program team or, in a small company, the person managing the clinical trial(s) often are best positioned to lead this effort. A champion will coordinate the entire process across multiple functions (project management, medical, finance, clinical operations, etc.) for the sole purpose of planning the best outsourcing strategy. The champion will ensure a process workflow, define roles/responsibilities, identify challenges (i.e., to eliminate silos or divisions because of competing priorities or lack of vested interest), and ensure goals are defined and agreed to by the selection committee.

A committee that is composed of multidisciplinary leaders often can determine the CRO that is the best fit for the organization. Not all CROs are aligned with your organizational culture, practices, or expertise, so it is a best practice to define these parameters. The selection committee must also have a vested and committed interest in this process. Depending on the size of the organization, the committee may want to define and agree on a communication strategy. This ensures the workflow is moving ahead as per plan and that all members are accountable for their roles and tasks. Additionally, good planning establishes how to maximize core assets and utilize internal resources, supplemented with external resources. A champion and selection committee will define exactly what tasks the CRO will perform and which procedures/processes will govern various tasks. For example, the sponsoring company will establish how the investigator site contracts will be negotiated and who will legally be bound by the agreement(s). CROs bidding on the work need to know exactly what tasks they will perform in order to provide their best approach. With that, the champion/committee will create a specifications document to communicate standard processes, tasks, and tools it is looking to procure. By further defining the scope of the services being procured, whether full service or partial service, companies create a strategic sourcing approach for the clinical trial.

Procurement/Strategic Sourcing

In order to establish and assess the best fit, the committee may want to utilize its vendor network, current CROs, and/or conduct a competition through public announcement of the procurement. A competition is not a new concept, but how you conduct the competition is key, especially if the project is partnered with another commercial entity or federal agency (i.e., federally funded). Also, as the committee considers long-term planning or portfolio management, it seems logical to maximize efficiencies with relationship management. How can teams reduce cost and time in this repetitive process? Commercial procurement models generally take one of three forms. The preferred provider model, which creates a more collaborative relationship with a CRO, ensures repeat business and allows for streamlined buying power. The performance-based model or managed services model drives accountability through incentives/penalties using milestones/target achievements. Another model is used when sponsors want to harness innovation to select the best value-added solution. Some CROs have new technology or innovative approaches aligned with the company’s goals to augment internal resources. Making these requirements clear to CROs that range from generalists to specialists with partial- to full-service clinical research functions allows the CRO procurement filter process to be maximized for best fit. What does this mean for the selection committee? What level of detail and criteria are needed?

The request for proposal (RFP) documentation is a vital piece in communicating the sponsor/client’s needs. The RFP will be addressed in Part 2 of this series, but before you can create an RFP, the committee must define criteria for selection. Matching chemistry like perception or perceived value is important on the surface, but the real measures of potential performance are the following criteria.

Risk management practices are now expected to be incorporated into the selection and oversight of CROs and other vendors. Find out more in SAM Sather's webinar:

CRO Oversight Post ICH GCP E6 (R2) Addendum

Selection Criteria For CRO Selection

- Specific therapeutic area and indication experience

- Team member experience in the indication

- Approach to current challenges (demonstrated understanding of enrollment, feasibility, access to KOLs, and investigative sites with the right population and experience)

- Responsiveness and ability to be limber with internal and external processes/systems (don’t forget to conduct a qualification audit as a contingency to an agreement)

- Quality/consistency of performance/financial stability/inspection history2

- Value (determine the best service for best price)

- Transparency (confirm the scope of service delineates the client will have access to systems)

- Collaboration and communication planning (ask if they have escalation strategies)

- How do they plan (ask for examples of schedules, what plans will be part of the service, i.e., project plans, risk management plan, subcontractor management plan, monitoring plan, statistical analysis plan, data and pharmacovigilance plans)

According to Comprehend,3 a clinical intelligence software provider, the three most common overlooked selection criteria are transparency, collaborative partnership, and real-time responsiveness. These intangible factors should be part of any strategic selection process. Sponsors struggle to quantify these factors, but to win the business, CROs can proactively demonstrate these intangibles with solid evidence. This isn’t one-sided. CROs can only provide their best services when all parties model transparent and collaborative relationships.

Future articles in this series will cover: developing a CRO selection workflow and checklist, addressing documentation and regulation concerns, and applying best practices to overcome the major challenges in outsourcing.

References:

- https://www.statista.com/statistics/817599/revenue-forecast-for-pharma-cros-by-location/

- https://www.pharmoutsourcing.com/Featured-Articles/172751-What-to-Look-for-in-Selecting-a-CRO-CMO-and-How-to-Ensure-the-Right-Choice-A-Quality-Assurance-Perspective/

- https://www.comprehend.com/overlooked-criteria-in-cro-selection/

About the Author:

Joelle Herman is president of NeoTrials, LLC and brings over 20 years of experience in clinical research. Her expertise is in clinical operations program management, focused on outsourcing management. She created NeoTrials after years of consulting to small biopharma and other consulting firms. Prior to consulting, she served as director of clinical operations at DynPort Vaccine Company LLC. Earlier in her career, Herman led global clinical programs for organizations such as Oxxon Therapeutics/Oxford BioMedica, AAI Pharma, Antigenics Inc., and Apheresis Technologies, Inc. She has conducted and managed over 30 global trials in drugs, devices, and vaccines. Herman holds a master of public health in epidemiology and a bachelor of science in microbiology, both from the University of South Florida, and is a certified PMI Project Management Professional. Connect with her on LinkedIn.

Joelle Herman is president of NeoTrials, LLC and brings over 20 years of experience in clinical research. Her expertise is in clinical operations program management, focused on outsourcing management. She created NeoTrials after years of consulting to small biopharma and other consulting firms. Prior to consulting, she served as director of clinical operations at DynPort Vaccine Company LLC. Earlier in her career, Herman led global clinical programs for organizations such as Oxxon Therapeutics/Oxford BioMedica, AAI Pharma, Antigenics Inc., and Apheresis Technologies, Inc. She has conducted and managed over 30 global trials in drugs, devices, and vaccines. Herman holds a master of public health in epidemiology and a bachelor of science in microbiology, both from the University of South Florida, and is a certified PMI Project Management Professional. Connect with her on LinkedIn.