Getting A Grasp On CRO Selection

By Rebecca McAvoy, Chief Research Officer, Industry Standard Research

The CRO selection process is a complicated one. Many factors come into play during this process, including individual trial needs, contractual arrangements, prior experience with providers, and personal preferences, just to name a few. One critical factor is undoubtedly the presence of preferred provider agreements (PPAs). Companies can spend a great deal of time negotiating these agreements, and their presence, or lack thereof, can make or break which CROs are shortlisted or awarded a Phase II/III study.

ISR delves into service provider selection and performance in our Phase II/III CRO Benchmarking study, now in its 16th year. Because preferred provider agreements can play such a pivotal role in provider selection, we tailor our research questions to ensure they reflect the relevant decision-making scenario(s) for each respondent. First, we must understand which respondents have preferred provider agreements for Phase II/III services.

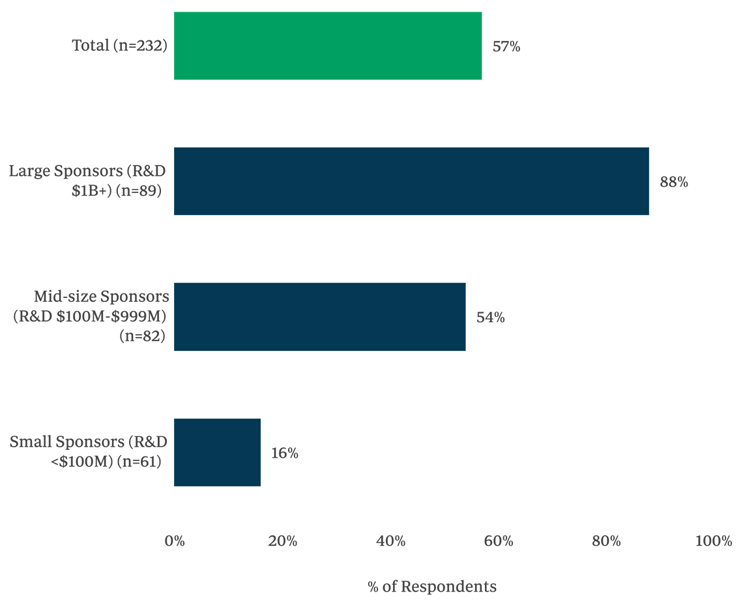

Among the 232 Phase II/III outsourcers surveyed in ISR’s most recent study, over half (57%) have preferred provider agreements in place. Company size has strong ties to the usage of preferred provider agreements, with a significantly higher proportion of respondents from large sponsors (88%) reporting that they use preferred provider agreements as compared to those from mid-size sponsors (54%) and small sponsors (16%).

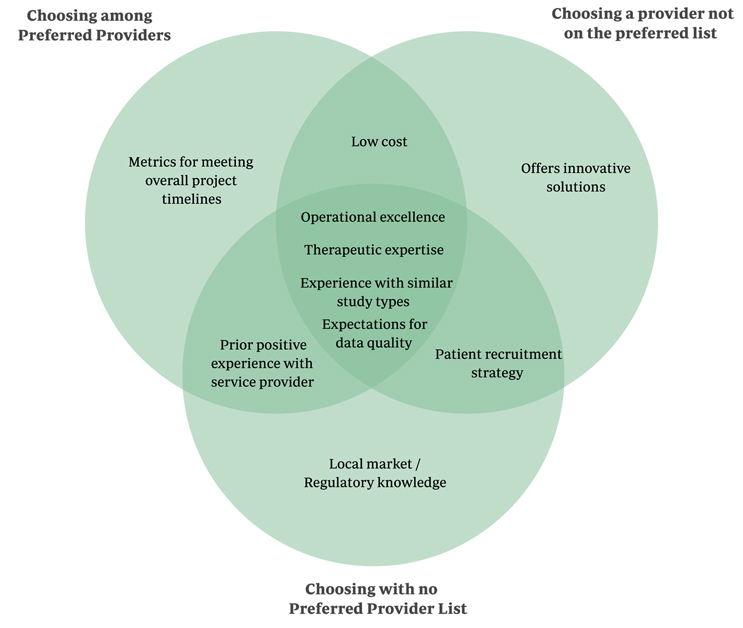

ISR then asks respondents to share their top CRO selection criteria in a manner that reflects the role preferred provider agreements can play in the decision-making process. Respondents whose companies have preferred providers are asked about the importance of selection criteria in two different scenarios: first, choosing among their preferred providers and, second, choosing a provider that is not on their preferred provider list. Respondents whose companies do not use PPAs are asked about their selection criteria in a general fashion. The Venn diagram in Figure 2 is used to portray the similarities and differences in the importance of selection criteria across these three scenarios. The top seven most important attributes in each scenario are shown.

Figure 1: “Does your company have formal preferred provider agreements for Phase II/IIII services?” (n=232)

The attributes in the center of the Venn diagram represent the selection criteria respondents deemed among preferred providers, selecting providers not on a preferred list, or choosing with no preferred provider list. Operational excellence has been a critical and all-encompassing attribute for project delivery over the years. Therapeutic expertise is valued regardless of the decision-making scenario, as a thorough understanding of the therapeutic area is key to effective trial execution. Experience with similar study types is also important across the board, suggesting that CROs should provide examples of success with similar trials. Finally, Expectations for data quality has become more important recently, landing in the center of the Venn for the past three years.

Figure 2

Some interesting findings emerge when examining the differences between the three scenarios. For example, respondents whose companies do not have preferred providers place more importance on Local market/Regulatory knowledge than do respondents whose companies have preferred providers. This may be tied to the fact that respondents without PPAs are more likely to work at small companies that may not have as much in-house expertise with regulatory requirements across multiple geographies.

Another noteworthy nuance is that Offers innovative solutions appears as a uniquely important factor for those who are deviating from their preferred provider list. Some trials may require specialized approaches or knowledge that necessitate searching beyond the capabilities of their preferred providers.

All of this analysis now begs the question of how to put it to use. Understanding CRO selection criteria is essential for both biopharma outsourcers as well as CROs. Decision-makers at sponsor organizations can use the insights of their peers to enhance their own approaches to Phase II/III outsourcing. Leadership and business development staff at CROs can use this information to better tailor their outreach and messages to target sponsors more effectively. To make these data even more powerful, coupling a grasp of sponsor selection priorities with provider performance metrics can lead to even more confident CRO selections for sponsors and marketing for CROs.

REBECCA MCAVOY is Chief Research Officer, Industry Standard Research.

Survey Methodology: Industry Standard Research is a full-service market research provider to the pharma and pharma services industries. ISR’s CRO Quality Benchmarking research is conducted annually via an online survey. For the 2024 CRO Awards data, 42 service providers were evaluated on 20+ different performance metrics. Research participants were recruited from biopharmaceutical companies of all sizes and are screened for decision-making influence and authority when it comes to working with CROs. Respondents only evaluate companies with which they have worked on an outsourced project within the past 18 months. This level of qualification ensures that quality ratings come from actual involvement with a business and that companies identified as leaders are backed by experiential data.

For more information, please visit www.ISRreports.com