How CRO-Sponsor Partnerships Spurred Innovation In 2020

By Denise Calaprice, Ph. D.

For decades, operational progress within the clinical research industry has been profoundly shaped by the relationships between sponsor companies and their CRO partners. Among other advances, these relationships have contributed to sponsors’ abilities to globalize clinical trial operations, expand therapeutically, manage risk effectively, and optimize processes, impacts that have been studied for nearly 20 years in the annual Avoca Industry Survey.

While much of the world observed, the clinical research industry in 2020 speedily adapted its practices to accomplish remarkable feats of rapid and high-quality vaccine and therapeutic development. What close observers had witnessed over the years prior, in contrast, was that the ability to innovate in this manner varied widely across companies, and on balance, had not been a source of industry pride. To study this transition, the Avoca Industry Survey in 2020 focused on practices related to clinical research innovation, and in this article we draw from the data to explore the role played by CRO-sponsor relationships.

WHO PARTICIPATED IN THE SURVEY

The 2020 Avoca Industry Survey was designed to study how the events of 2020 accelerated operational and study design innovations within clinical development, as well as how respondents perceived clinical trial quality and efficiency to have been impacted, how management practices were adapted, and whether respondents anticipated a return to pre-innovation approaches, or an acceleration of innovation, post COVID-19. Invitations to participate were sent to contacts in Avoca’s database late in the year, and an open invitation to participate was also posted on the Avoca website and on LinkedIn.

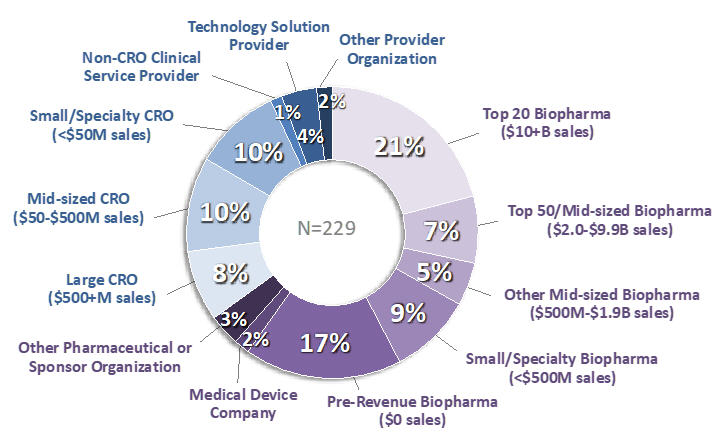

The respondents included 145 representing sponsor companies and 84 representing providers (Figure 1). Approximately half represented Clinical Development/Operations; slightly over 1/4 represented Quality Assurance; and the remainder represented a wide spectrum of management and functional roles. Thirty-one percent of respondents represented companies that sponsored or conducted more than 50 clinical trials during 2020, and 25% represented companies that sponsored/conducted fewer than 5. Most respondents worked for companies headquartered in the US, but approximately one-fifth represented companies headquartered in Western Europe or Japan.

Figure 1. Respondents to the 2020 Avoca Industry Survey: Company Type

PERCEPTIONS OF INNOVATION-RELATED PRACTICES

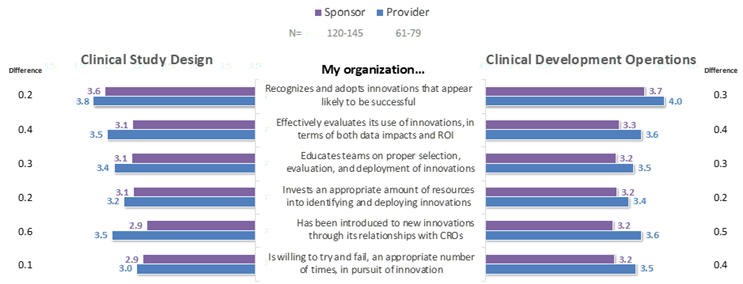

When asked to rate their agreement to positively-phrased statements about their organizations’ innovation-related practices in each of Clinical Development Operations (CDO) and Clinical Study Design (CSD), respondents’ mean ratings on a scale of 1 (strongly disagree) to 5 (strongly agree) ranged from the low to mid 3s, and were uniformly higher for CDO-related than for CSD-related innovations (Figure 2). On average, provider respondents rated every statement higher than did sponsors (Figure 3). Across both classes of companies and both the CDO and CSD areas, the most positive average ratings highlighted organizations’ recognition and adoption of innovations likely to become successful, whereas organizations’ willingness to accept occasional failures and to allocate and educate resources effectively scored more poorly.

Figure 2. Perceptions of Companies’ Innovation-Related Practices

Figure 3. Perceptions of Companies’ Innovation-Related Practices: Sponsors vs. Providers

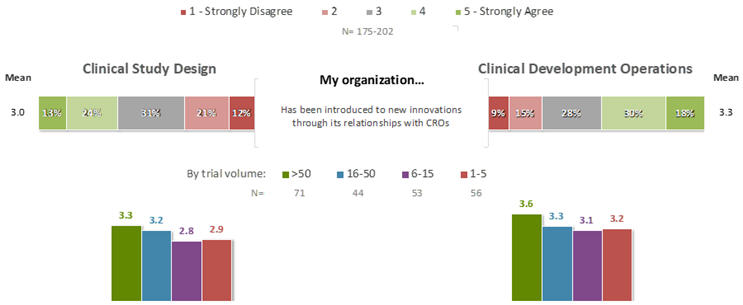

ROLE OF CRO RELATIONSHIPS IN INTRODUCING INNOVATIONS

For the statement “My organization has been introduced to new innovations through its relationships with CROs,” the mean agreement rating was 3.3 for innovations related to CDO, and 3.0 for innovations related to CSD (Figure 4). Interestingly, in each case there were statistically significant relationships between ratings for this statement and corresponding ratings for the statements in Figures 2 and 3: the more that an organization had been introduced to new innovations through its relationships with CROs, the more positively its staff felt about their companies’ recognition and adoption of innovations that appeared likely to be successful (CDO: F=9.6, p=.002; CSD: F=10.1, p=0.002), effective evaluation of the use of innovations in terms of both data impacts and ROI (CDO: F=12.2, p=0.0006; CSD: F=12.4, p=0.0006), education of teams in proper selection, evaluation, and deployment of innovations (CDO: F=2.9, p=0.09; CSD: F=6.8, p=0.01), investment of an appropriate amount of resources into identifying and deploying innovations (CDO: F=7.4, p=0.007; CSD: F=11.9, p=0.0007), and willingness to try and fail an appropriate number of times in pursuit of innovation (CDO: F=5.0, p=0.027; CSD: F=16.1, p<0.0001). Thus, it appears that the relatively positive performance of CROs with respect to these aspects of innovation may be transmissible to the sponsor companies engaging them, when innovations are adopted through these relationships.

Figure 4. Role of CRO Relationships in Introduction to Innovations

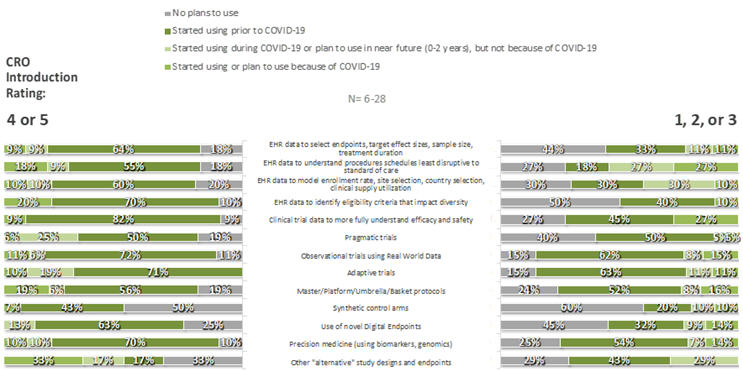

INNOVATION ADOPTION BY TYPE

For each of 35 specific innovations, respondents were asked whether their companies had adopted the innovation prior to the COVID-19 pandemic, because of COVID-19, during COVID-19 but not because of COVID-19, or not at all. Some innovations were commonplace, particularly those in the CDO category: few respondents had not already adopted (or made plans to adopt) remote source data review (3%), remote source data verification (5%), risk-based monitoring tools (7%), electronic patient diaries (7%), e-consent technologies (8%), study visits by telemedicine (6%), and/or home health care providers (8%). In contrast, large fractions had no plan to adopt completely site-less trials (49%), synthetic control arms (53%), or use of AI to detect possible unreported AEs (58%). As can be seen in Figures 5 and 6, respondents that provided ratings of 4 or 5 to the statement “My organization has been introduced to new innovations through its relationships with CROs,” compared to those that provided lower ratings, were more likely to have adopted nearly all listed innovations prior to Covid-19 and were less likely to have no plans for their adoption at the time of the survey.

Figure 5. CDO Innovations by CRO Introduction Rating: Overall Use/Plans to Use

Figure 6. CSD Innovations by CRO Introduction Rating: Overall Use/Plans to Use

CORPORATE INNOVATION-READINESS IN CLINICAL RESEARCH

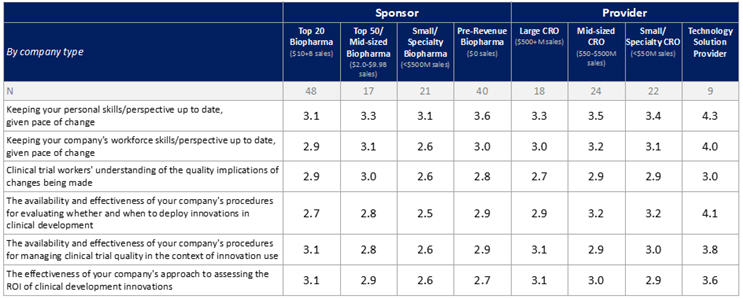

A similar pattern was seen for survey items relating to corporate innovation-readiness. For these items, comfort levels (rated from 1= "extremely concerned” to 5= “extremely comfortable”) varied widely (Table 1). Nearly half of respondents were comfortable about keeping their own skills and perspectives up to date, but only one-third were comfortable about this for their companies’ workforces as a whole. At least one-third were uncomfortable with their companies’ procedures for evaluating whether and when to deploy innovations in clinical development and for managing clinical trial quality in the context of innovation use, more than were comfortable in these respects. Even more were uncomfortable with their companies’ approaches to assessing the ROI of innovations (38%), and with clinical trial workers’ understanding of the quality implications of changes being made (40%), with again, more uncomfortable than comfortable in these respects. In most areas, ratings among respondents from sponsor companies, especially those outside of the “Top 20,” were again slightly lower than ratings among respondents from providers.

Table 1: Corporate Innovation-Readiness by Type of Company

Conclusion

The pharmaceutical industry has relied on Sponsor-CRO relationships to enhance clinical trial performance in a multitude of ways, and the adoption of clinical trial innovations appears to be no exception. In the 2020 Avoca Industry Survey, respondents from provider companies were generally more positive about their companies’ innovation-related attitudes, practices, and workforce readiness than were those from sponsors, and sponsor respondents whose companies were introduced to potential innovations largely by their CRO partners were generally more positive about these things – and had experienced higher actual rates of innovation adoption - than those whose companies were not. Not surprisingly, then, areas in which sponsors have traditionally been more reluctant to fully engage CRO partners, i.e., those related to Clinical Study Design as opposed to Clinical Development Operations, were characterized by lower rates of, and poorer performance in, innovation adoption. Clinical research executives may be well-advised to acknowledge the potential role of providers in the adoption of clinical research innovation and to embrace this dynamic fully through enhanced transparency about potential opportunities.