Overcoming Trial Barriers By Looking Through The Lens Of Product Adoption

By Kym Eves and Liam Eves, principals, ReNable Research Ltd.

In part one of this three-part series on leveraging product launch strategies in the clinical phase, we covered the two main reasons for trials’ failure to launch: the absence of product launch tactics in trial planning and the impact of that absence at site level when it comes to patient enrollment.

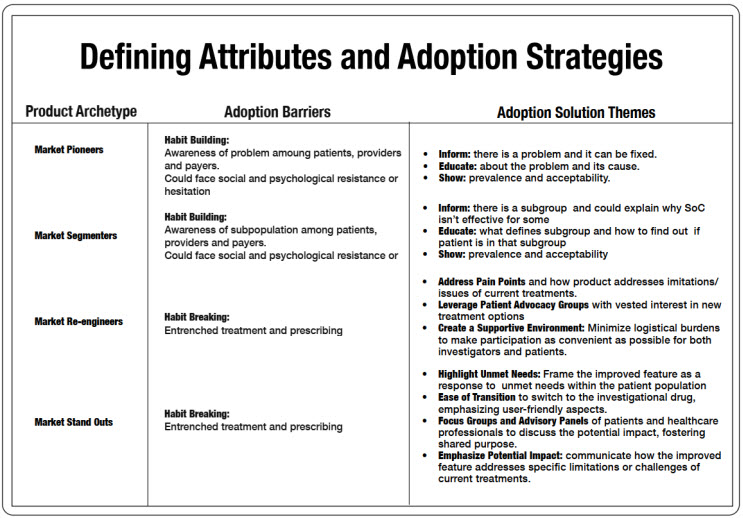

In part two, we looked at product archetypes and adoption drivers based on the new kinds of drugs we are developing today and how understanding each IMP’s defining adoption characteristics can transform clinical trial delivery.

In this final article, we explore how various drug candidates come inherent with barriers to adoption that directly impact how participants and providers engage with clinical research, as well as ways in which to address these hurdles for faster, less costly trials.

How Archetypes And Their Defining Adoption Attributes Become Enrollment Barriers

Because all market-authorized drugs once started as IMPs, their introduction to prescribers and patients at market launch really “ain’t their first rodeo.” The clinicians who served as the product’s trial investigators are the same people who will now write prescriptions for it as a newly launched drug. And the study volunteers are the same patients who will now be prescribed the newly approved drug. In most cases, Phase 2 clinical trials are the product’s actual first encounter with the patients it aims to help and the providers who will offer it. This means that, in many ways, clinical studies serve as early litmus tests on the effectiveness of different adoption strategies and can help to inform a future market launch if the product does indeed go the distance.

But during the clinical trial process, a drug’s defining adoption attribute not only will interface with the general market realities discussed so far, it also will interface with those specific to clinical research. Therefore, both types must be addressed in subsequent IMP adoption strategies for a study launch campaign to succeed. And the market realities unique to clinical research are the enrollment barriers each archetype will face during the conduct of a clinical trial.

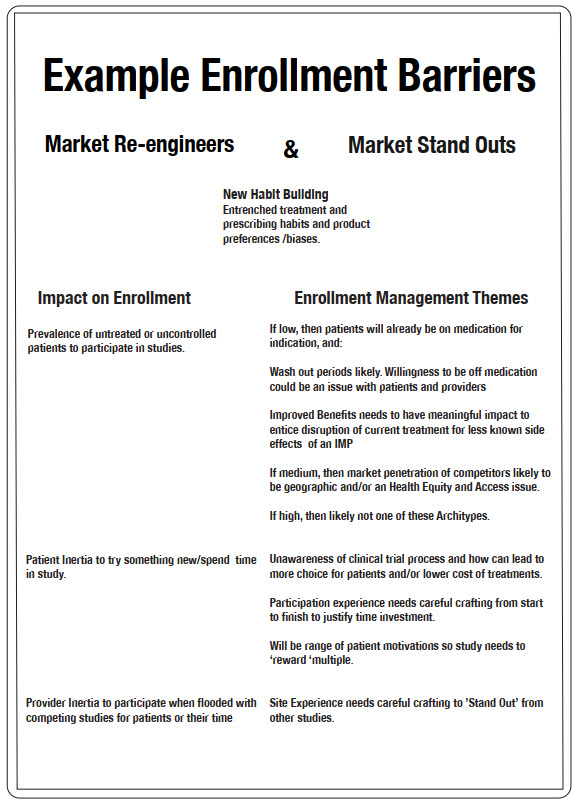

Enrollment Barriers

An enrollment barrier is the inevitable consequence of the status quo of routine healthcare interacting with the newness of scientific innovation. Each product archetype generates a plethora of these barriers, affecting every aspect of clinical trial conduct from site selection and patient identification through to protocol compliance and data collection. Proper analysis of both known and unknown barriers can help remove them, and some examples illustrate the benefits of accurately gauging what the sites will be up against and why we need to think differently about study design and conduct now that our research efforts center on modern-day product archetypes that are infinitely more complex to trial than their blockbuster/non-blockbuster predecessors.

Images 3 and 4 outline some examples of enrollment barriers for each archetype, and sample enrollment delivery themes that correspond to overcoming them.

Market Segmenter Example

To illustrate how an archetype and its defining adoption attribute produce enrollment barriers, let's delve into the case of a new market segmenter positioned under the new habit-building category. Sites enter this study with enthusiasm, anticipating the positive implications it could have downstream for their patients. The sponsor initially conveys an estimated subtype incidence of one in eight patients, based on existing academic publications. This projection sets the stage for expected screening numbers, shaping the recruitment timeline and resource allocation for the study.

However, once patient recruitment begins, the actual subtype incidence turns out to be closer to one in 20 during the screening period. No one knows for sure why: Is this a geographic or sample pool fluke, and how do we fix it? The incidence discrepancy results in lengthened timelines and inadequate resources allocated for study completion, despite additional investment attempts. Consequently, sponsors are compelled to seek out more sites, amplifying the potential for significant delays and additional costs, including the loss of crucial patent protection time, all without knowing if more sites will solve the problem.

To address this specific enrollment barrier for the market segmenter, a shift in approach is essential. This involves recognizing that traditional drug trial practices, especially those in study design that have been inherited from the era of the blockbusters, may not align with the demands of the contemporary launch landscape, and a fresh perspective is needed. Below are two example approaches that could navigate this challenge:

- Design the Phase 2 study so that, along with safety and efficacy, a key outcome is to establish incidence in the locations where the sites are. Employ a “part A” to screen patients to identify those with the subtype, and, if possible, roll them over into the main part of the Phase 2 study. During part A, the sponsor could collect information from the patients screened about their symptoms, habits, and satisfaction with whatever treatment they have been on. In this fashion, the earliest patients in the market segmenter’s clinical trial journey could start helping to shape and inform not only the remaining clinical studies but also the considerations that would need to be evaluated at market launch.

- Directly and specifically reimburse sites to take sufficient time to comb through their medical records (not the ICD-10 codes; we’re talking the non-structured data and hardcopy records) to identify patients with a specific complaint that aligns with the hallmark clinical or practical manifestation of the subtype (i.e., a particular symptom exacerbation or lack of relief when using the incumbent gold standard product for the unsegmented condition). Include linking symptom to subtype as a secondary outcome of the Phase 2 study, and not only validate the local incidence but establish targeted screening criteria for future studies as well as future on-market clinician education.

Market Re-engineers And Market Stand Outs Archetypes

For those archetypes in the habit changing bucket (market re-engineers and market stand outs), enrollment barriers are somewhat different. If the on-market space is quite crowded for a given indication, or there are lots of competing studies for the same patient population, then the challenge will be getting otherwise adequately controlled patients and/or busy clinicians to engage with the IMP via a study. That means implementing and correctly financing strategies that will deeply engage sites and potential patients. There isn’t a one-size-fits-all solution for this, but it starts with determining the right patient access approaches and carries on across every touchpoint during the trial, from screening to data collection to query completion. We often see decentralized clinical trial (DCT) arrangements fail with these archetypes because of overgeneralized assumptions about patient preferences and insufficient investment in alternative means of patient and site engagement. And woe betide those DCTs that reduce investigator budgets based on fewer in-person visits when operating in an indication with lots of alternative studies that have on-site visits that pay better.

2 Ways Trial And Product Adoption Are Alike

We advocate that it behooves pharma marketing and sales divisions to back R&D efforts to better fund, strategize, and structure their study launches because doing so not only delivers trials faster and, ultimately, cheaper but also can translate to shortened learning curves at the time of market launch preparation. Given it’s during clinical trials that patients and clinicians are first introduced to a (potential) new product, there are things clinical can do to advance marketing’s repertoire of knowledge, even if such information is collected and squirreled away for the remainder of the trial process.

Here are two of many such ways this can be accomplished once we recognize that what underpins trial adoption by practitioners and patient volunteers is virtually the same as what underpins on-market product adoption:

Culling IMPs that don’t suit the market every bit as much as culling those that aren’t safe and effective. When we think of the R&D mantra “kill fast,” we tend to only think of efficacy and safety. But what about market adoption considerations, particularly for stand out products? Seeking patient feedback on new benefits and how they feel about them could rule out new products that otherwise may have a lukewarm market reception if proven safe and effective. A new wound care product that has a different mode of action resulting in 30% faster healing might result in a patient shoulder shrug, while one that reduces malodor as its stand-out feature may fly off the shelves. But we won’t know unless we ask the patients using our experimental drug, as they ultimately will be the same people taking the drug once it’s on the market. The same approach applies to real-world healthcare providers, who can be asked if the promise of a drug presented during a trial would motivate them to one day pull out the prescription pad and prescribe the very same drug to a patient.

Treat study subjects like the valued patients that they are. Truth be told, quality of life (QOL) type of data tends not to get the respect from us R&D types that perhaps it should as it doesn’t normally tie directly into our safety and efficacy focus. But QOL-related data is very important to both types of launches. Research subjects are the ultimate focus group participants, and we could get so much more from our patient enrollment efforts if only we realized this. Asking the right questions of our enrolled patients could point us in the right direction not only for future phase study engagement strategies but also to illuminate pre-market launch planning activities when the time comes. And if we really thought about it, we would wholeheartedly embrace the mantra “every patient counts” — even those who don’t meet our strict enrollment criteria. We could utilize our screen failures in a subset QOL study to dig into patient experiences and preferences, thereby maximizing the ROI of our enrollment spend.

Approaching Clinical Trials With Commercial Insights

Both study and product launches introduce new therapeutic drugs to patients, with the former doing so at the start of a product’s clinical development journey and the latter at its end. Yet despite significant objective overlap with each type of launch, study launches have historically failed to fully embrace the tactics and methodologies seen as fundamental to new drug launches, which would, if applied in a modified form, greatly improve the engagement of sites and patients, ultimately resulting in more effective study enrollment. The product adoption matrix and the principles behind it that have been shared in this article suggest a way forward that embraces modified product adoption strategic thinking when it comes to developing and managing successful patient enrollment and study launch campaigns.

The need to adopt truly effective enrollment strategies in clinical development has never been greater. Gone are the days of the binary blockbuster/non-blockbuster drug types. Thanks to advances in our understanding of the biological levers underpinning disease, our current drug development landscape is as nuanced and complex as the diseases we now aim to modify. Biotech and pharma companies need to be proactively investing in understanding how such new therapies interface with the healthcare status quo we inevitably interrupt and ultimately wish to change, in both the research market, where the investigational version of the drug presents specific enrollment barriers, and in the post-approval market, where adoption attributes inform the most effective adoption strategies for that drug.

Furthermore, embracing the deepest root-level goals shared by both R&D and marketing and sales divisions unlocks a more unified way to bring products to market as well as universally reducing the time and cost it takes. By treating our study subjects like the valued patients they are, we can plant the seeds of patient, practitioner, and payer insight much earlier for the eventual harvesting by our product launch colleagues while simultaneously paving the way for better designed next phase trials that put patients on par with the traditional data collection and analysis focus of clinical development. Such an integrated approach not only improves trial performance but also smooths the transition of new therapeutics from controlled environments into real-world clinical settings, optimizing launch success and getting new treatments to the patients who need them most. After all, this is ultimately what we all are working for, regardless of the company division we find ourselves in.

About The Authors:

Kym Eves is a principal at ReNable Research, where she helps companies deliver clinical trial enrollment as well as promising new tools that make drug development so much easier. With a career spanning a variety of senior management and board roles, Kym has a rare combination of SMO/CRO/biotech/clintech leadership experience, giving her a deep understanding of the problems and challenges faced by every trial and drug development stakeholder, and which has been distilled into the Enrollment Delivery Platform. Kym founded one of the first site management organizations in the U.S., is an Ernst & Young U.K. Life Sciences Entrepreneur of the Year, and a recipient of the Gold Stevie Award for Female Executive of the Year in Europe, the Middle East, and Africa. She is a member of the London Mayor’s Business Advisory Board and a former Entrepreneur in Residence for Life Sciences at Cambridge Enterprise.

Kym Eves is a principal at ReNable Research, where she helps companies deliver clinical trial enrollment as well as promising new tools that make drug development so much easier. With a career spanning a variety of senior management and board roles, Kym has a rare combination of SMO/CRO/biotech/clintech leadership experience, giving her a deep understanding of the problems and challenges faced by every trial and drug development stakeholder, and which has been distilled into the Enrollment Delivery Platform. Kym founded one of the first site management organizations in the U.S., is an Ernst & Young U.K. Life Sciences Entrepreneur of the Year, and a recipient of the Gold Stevie Award for Female Executive of the Year in Europe, the Middle East, and Africa. She is a member of the London Mayor’s Business Advisory Board and a former Entrepreneur in Residence for Life Sciences at Cambridge Enterprise.

Liam Eves is a principal at ReNable Research, where he helps accelerate the delivery of clinical trials. After an injury ended his career as a professional footballer, Liam shifted gears by moving into neuroscience research, subsequently leading site management organizations, CROs, and clintech companies. He heralded the birth of a trial delivery methodology that industrialized good enrollment practices, allowing him to scale a single research site to deliver over 85,000 patients annually and to build a £27m/year Phase 2 specialty site, all the while maintaining a 97.3% delivery success rate for almost a decade. His experience spans over 12 therapeutic areas and across many continents. Liam also advises venture capital firms and clinical trial service and technology providers and shares his insights as an author and clinical trial podcast host.

Liam Eves is a principal at ReNable Research, where he helps accelerate the delivery of clinical trials. After an injury ended his career as a professional footballer, Liam shifted gears by moving into neuroscience research, subsequently leading site management organizations, CROs, and clintech companies. He heralded the birth of a trial delivery methodology that industrialized good enrollment practices, allowing him to scale a single research site to deliver over 85,000 patients annually and to build a £27m/year Phase 2 specialty site, all the while maintaining a 97.3% delivery success rate for almost a decade. His experience spans over 12 therapeutic areas and across many continents. Liam also advises venture capital firms and clinical trial service and technology providers and shares his insights as an author and clinical trial podcast host.