Pharma Procurement Can Make Or Break Startups: Let's Help Mature Our Future Partners To Secure Innovation

By Ivanna Rosendal, VP and global head of digitalization, Ascendis Pharma

How can life science companies benefit from innovative technology and services from startups when our purchasing cycles can be longer than their financial runway? As companies, we need to take responsibility for our own procurement processes, but we also need to help the startups that aim to support GxP processes build capabilities within their companies that support us in the long term. This article details the problem of incongruent timelines and misaligned expectations between startups and pharmaceutical companies, as well as suggests how we can lower startups’ barriers to entry into our industry — ending with a wild wish for more industry-wide agreements on purchasing standards.

Why Pharma’s Window Shopping Is Killing Startups

Last summer, I attended a health technology startup festival in London. I was one of the few attendees from a pharmaceutical company. I spoke to many CEOs and heads of sales who wanted to know how to break into the industry. One man proudly told me that he had managed to demo his product to five pharmaceutical companies. But when I asked him how many times his company had been audited by a pharmaceutical company, he stared at me blankly. I then explained to him that the executives he had demoed for were likely window shopping.

Window shopping is when employees in pharma companies meet with technology or service vendors to understand how the market is developing — without the intent of buying. As such, there is nothing harmful about noncommittal interactions like these, except that the situation is likely understood as a sales lead by the startup. Worst case, they may update their sales projections accordingly and disappoint investors when sales do not materialize. This can lead to failed investment and eventually the closure of the startup company.

However, the obligation is not just on the startups to understand the behavior of the pharmaceutical companies. We, as buyers, can help guide the process with clearer intent, as well as contribute to maturing our future partners’ ability to deliver high-quality and stable operations. Service or technology companies succumbing to the purchasing cycle of Big Pharma is also detrimental to pharma, which misses out on the innovation these companies create. Bridging the purchasing gap should be the pharmaceutical companies’ contribution to the pharmaceutical ecosystem.

Same Pharmaceutical Partnership Ecosystem, Different Timescales

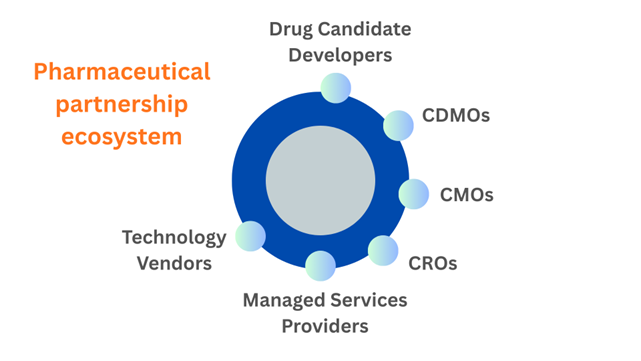

Innovation in the pharmaceutical industry, in my experience, happens more often at the fringes of the pharmaceutical company in collaboration with partners. Drug candidates are developed at universities or in biotech startups. Manufacturing methods and analysis are developed in collaboration with CDMOs and CMOs. Clinical trials are run by CROs, who source sites that are able to enroll patients. These processes are often run by managed services providers, on third-party technology vendors’ software.

Figure 1 Pharmaceutical Partnership Ecosystem

When startups attempt to enter this ecosystem, they may have a solution for a particular problem but don’t understand who the actual customer is for the solution or what it takes for a solution to stand the test of quality and regulatory requirements. Discrepancy between the purchasing cycle of a pharmaceutical company and a startup is both a matter of time and expectations of maturity.

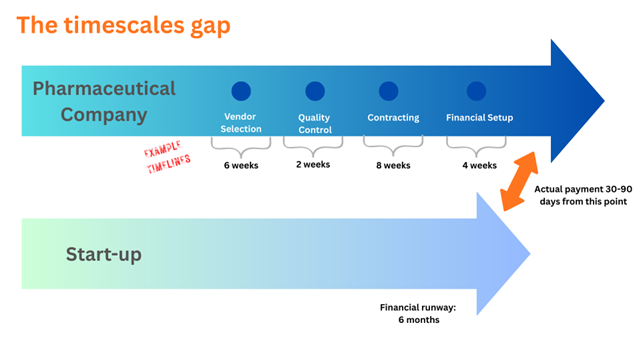

Figure 2 The Timescale Gap: Startups run out of money before the pharma purchasing cycle completes.

To onboard a new GxP vendor to a pharmaceutical company, there are at least four major steps. Each has its own basis in regulation, quality, or compliance:

- Vendor selection

- Quality control

- Contracting

- Financial setup

For each step, documentation exchanges hands, and the expectation is that the vendor is able to pass the gates that the pharmaceutical company sets up. Often, the startup vendor thinks interactions before formal vendor selection are a sign of purchasing intent. Once the actual purchasing process starts, the vendor is ill-prepared and may run out of capital before the pharma company makes its first payment.

How Pharma Can Build Maturity Into Its Vendors

To ensure that the startup vendor actually makes it to the point in time where work can begin, the pharmaceutical company should make the purchasing process clear, rallying internal stakeholders to shorten timelines and educating the vendor on which internal practices are necessary to qualify as a GxP vendor.

Make the procurement stages clear

Pharma companies should communicate to their vendor how the purchasing process proceeds and what steps must be completed before work can begin. I recommend the following steps:

- Clarify which types of regulation, compliance, or quality standards the relationship is covered by.

- Will financial reporting be impacted by the relationship? Then it is covered by financial regulations and stock market exchange rules.

- Will personal data of employees, doctors, patients, or caregivers be handled by the vendor or in the vendor's systems? Then it is covered by U.S., EU, and state regulations.

- Will data created in the system or as part of the service be relied on for making decisions impacting product quality or patient safety? Then it is covered by drug regulators, such as the FDA and EMA.

- Will the service or software produce any communications about the pharmaceutical company’s products? Then it is covered by the country’s drug marketing regulations.

- Detail the steps needed before the new vendor can be onboarded and receive the first payment.

- What are the steps in the vendor selection process? Help the vendor understand how the steps relate to each other and which documentation is expected.

- What are the steps of vendor quality control? Help the vendor understand which functions need to perform assessments and why. Also, if a vendor audit is needed, help the vendor understand what an audit is.

- What are the steps of contracting? Help the vendor understand the parties involved and what their roles are. It also helps to provide instructions on which legal documents control which parts of the agreement.

- What is needed to set up internal financial systems for payment? Tell the vendor what they need to provide to get issued a vendor number and purchase order and how long payment might take after an invoice is filed.

- Set clear timelines. Tell the vendor how long it will take from being selected until work can actually begin.

Rally internal stakeholders

Sponsor companies should lead the onboarding process. Experienced vendors can navigate the internal landscapes of a pharmaceutical company, but newcomers will have a rough time asking the right questions or having the right stakeholders involved at the right times. The sponsor must be an expert in the internal process, even if the process may be challenging for internals, too.

- Get the right stakeholders involved early. Consider the end-to-end process and be aware of internal processing timelines. Bring together IT security, quality, legal, compliance, finance, procurement, and functionally relevant stakeholders for a kickoff meeting, with suggested timelines for vendor onboarding.

- Tell the vendor what you want them to achieve on behalf of your company, and which trials, manufacturing, or development the onboarding timelines are impacting.

- Understand which documentation is necessary for each stakeholder and when it is due. Provide your startup company with a list and templates, if they exist.

- Manage the timelines proactively. Once you have a full landscape of stakeholders, processes, and the required documentation, conduct processes in parallel as much as possible to keep timelines short.

Once you have your internal ducks in a row, it is time to support your vendor in getting theirs lined up.

Invest in vendor maturity

No matter how efficient you are, you are likely to find gaps in the internal processes and quality management system of a vendor new to the GxP world. Help the vendors build their internal maturity. This will benefit the collaboration in the long term and will also ensure that the vendor can secure other customers and remain in business.

Maturity comprises several things, including robust internal processes and templates. A key area of investment is the quality management system and associated ways of working. The vendor audit can be a catalyst for improving a vendor’s internal processes. An auditor can explain which processes and documentation are required within the pharmaceutical industry and can positively influence a vendor’s internal investment decisions.

Another area of maturity is contracting and service management. During the contracting stage, pharma companies can actually help vendors prepare to support them. They can explain how a service or system should be delivered and explain which capabilities must be built and which service level agreements must be catered to.

A third area of maturity is the governance of the engagement. Pharma companies should help the vendor understand how to interact with different levels of the pharmaceutical company to ensure robust future collaboration.

Teaching a startup how to operate in our industry is time-consuming, and not all vendors are worth the work. So, how do you know which vendors are worth investing in?

How To Decide Which Vendor To Invest In

Many startups promise innovation and faster timelines without knowing what it actually takes to execute these promises. Consider the following parameters:

- Innovation potential. How novel is the service or software to our industry?

- Impact potential. What difference can the service or software actually make?

- Ability to learn and adjust. Is the vendor interested in understanding and adjusting according to the buyer's needs?

- Ability to partner. Is the vendor able to invest the time and bandwidth to create a true partnership?

If you have positive responses to all four questions, your company may want to invest in this startup. If your conclusions are partially positive, consider a smaller project with the vendor before committing too much time and resources. The vendor onboarding process can also showcase their ability to learn, adapt, and partner.

Dreaming Big — What If Someone Did This Work For Everyone?

In this article, I have been advocating for pharmaceutical companies to take a leading role in bridging the gap between startups and Big Pharma. I have advocated that we engage and teach startups how to succeed in our industry, managing their expectations and building necessary maturity.

That is one way to do it. Perhaps not all companies are able or willing to engage so closely with potential vendors. In that case, perhaps we as an industry could accomplish this task together.

The vendor onboarding process has slight variations but is very similar across large pharma companies. What if we united and standardized the pathway for startups to qualify to work with our companies? What if we created an accreditation body that could do this job on behalf of all of us?

For the individual pharma company, this would mean a larger pool of qualified vendors to choose from. For the startup, this would mean they can engage with one body and suddenly qualify to do business with all. It would benefit our ecosystem, bringing more robust innovation into our circles.

But until this exists, next time you deal with a startup, be mindful to communicate whether you are window shopping or ready to buy and guide them through the process of internal procurement while investing in their capabilities for the future.

About The Author:

Ivanna Rosendal is the VP and global head of digitalization at Ascendis Pharma and a behavioral economist. She has worked toward optimizing clinical trials in large and small biopharmaceutical companies for the past 15 years. Now she focuses on leveraging technology to enhance the work of scientists, clinicians, and medical teams, ensuring they can make a significant impact on patient outcomes. Through initiatives like the podcast "Transformations in Trials," she aims to make life sciences more accessible and foster collaboration to drive meaningful change.

Ivanna Rosendal is the VP and global head of digitalization at Ascendis Pharma and a behavioral economist. She has worked toward optimizing clinical trials in large and small biopharmaceutical companies for the past 15 years. Now she focuses on leveraging technology to enhance the work of scientists, clinicians, and medical teams, ensuring they can make a significant impact on patient outcomes. Through initiatives like the podcast "Transformations in Trials," she aims to make life sciences more accessible and foster collaboration to drive meaningful change.