Phase I Clinical Supply Landscape: Trends, Demarcation And Security

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

The core addressable early phase market is USD 11.9 billion growing with a CAGR of 2 – 3 percent. Early phase trials are outsourced at greater than 60 percent by pharma, as the trials are small in number and a captive unit requires a large amount of capital. The supply market for early phase is comprised by CROs, research centers, and academic institutes. The market size that is comprised by the CROs is estimated to be around USD 8 billion, which is about 67 percent of the early phase market. Academic institution and research institutes comprise the remaining market at USD 3.9 billion (Figure 1). [1]

are outsourced at greater than 60 percent by pharma, as the trials are small in number and a captive unit requires a large amount of capital. The supply market for early phase is comprised by CROs, research centers, and academic institutes. The market size that is comprised by the CROs is estimated to be around USD 8 billion, which is about 67 percent of the early phase market. Academic institution and research institutes comprise the remaining market at USD 3.9 billion (Figure 1). [1]

Unlike late-phase trials, pharma companies conduct early phase trials on both patients and healthy volunteers (HV). This has resulted in distinction of trials as phase I CPU studies and Phase IIb respectively wherein non -oncology trials, HV and Oncology trials are carried out separately. The scenario of conducting trials on specialized patient population in case of phase I trials has created a demand for CROs who have access to specific therapeutic patients. This whitepaper provides visibility on the phase I supply market demarcation, supplier selection KPIs and due diligence that can have an impact on pharma’s sourcing of phase I trials.

Supply Landscape

The phase I supplier market consists of multiple suppliers who are able to cater to several big pharmaceutical companies. Pharma Companies have a greater choice and ability to switch between suppliers, hence increasing the buyer power. The suppliers mind set is to beat competition; hence they focus on leveraging market price through competitive discount structure due to the presence of several service providers. However, the market has dominant firms like PPD, InVentiv Heath, Covance, Parexel, Icon, which account for greater than 40 percent of the market share. The cost of the service varies with the type of therapeutic area and also, their regional presence. For example, niche regional service providers located in Europe might benefit from the subsidiaries offered by the EU, than those present in the US or other regions.

Phase I market saw an increasing number of merger and acquisitions within the 2012 – 2014 periods, wherein global CROs were acquiring specialists to expand their therapeutic expertise; resulting in the supplier market to undergo consolidation, and more market share among global players. Shut downs of CPU units were also seen as a result of less revenue generation from phase I studies of global CROs. The recent news on Quintiles planning to shut down their Guy’s Hospital, South London unit is an example of the same.[2] With greater than 60% of the market being fragmented with specialists, ‘bundling’ of generic functional services into a unique combined service will provide the suppliers with a competitive edge, and help maintain their proprietary position. This includes both therapeutically aligned business unit and functionally aligned business unit, with the former model dominating the market.

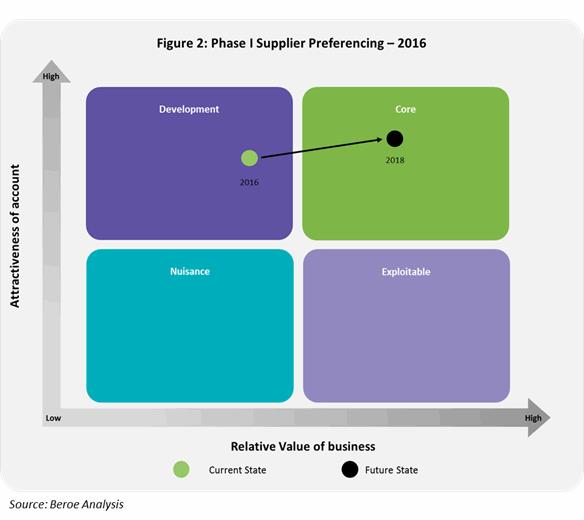

The Figure 2 below shows the attractiveness of the buyer from a supplier’s perspective.

Phase I suppliers view large pharma accounts in the development area of their business. The buyers are considered highly attractive as they bring in high purchase orders, good payment terms, and greater brand visibility. This acts as an enabler to move the accounts into a supplier’s core business area through strategic partnerships in the near future.

Demarcation among Phase I Supply Base

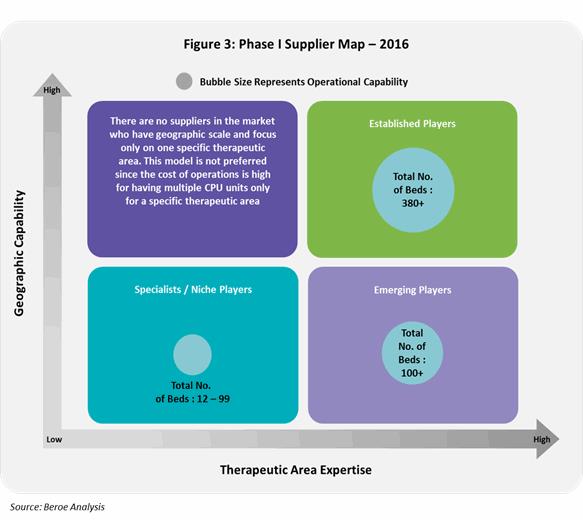

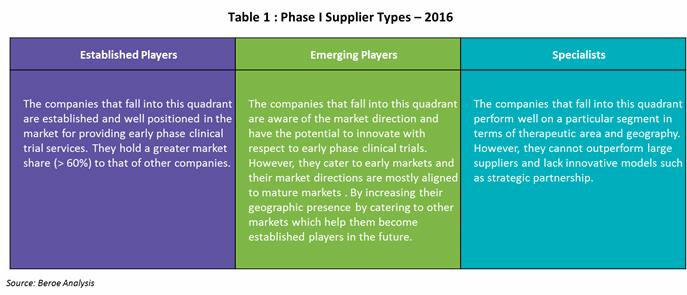

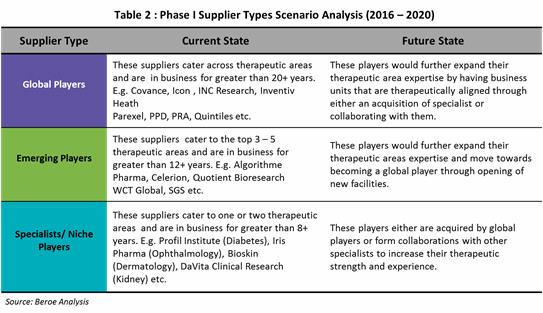

Phase I supply market consists of three types of suppliers: 1) Global established players 2) Emerging players and 3) Specialists/ Niche players. This distinction is based on the operational capability which includes - years of experience, trials experience and total number of CPU beds; and therapeutic expertise.

Figure 3 below shows this distinction among suppliers along with their CPU bed capability.

The below Table 1 gives a description on each players types based on the above mapping.

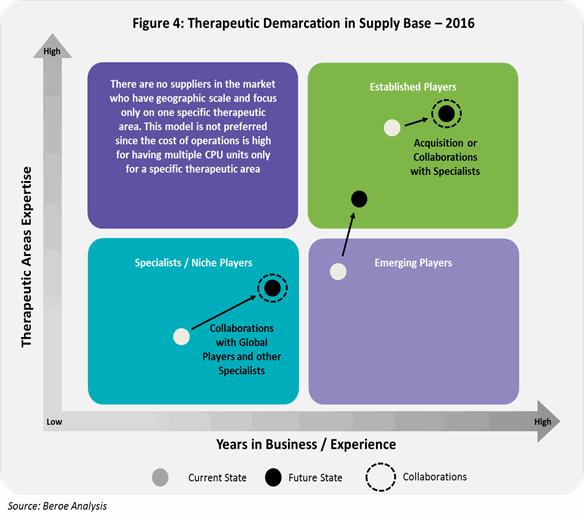

Currently, Global CROs have the capability to cater across therapeutic areas having a greater years of experience compared to specialists or niche players. They are most likely to acquire specialists in the future or collaborate with specialists who have a greater access to specialist patient populations. Emerging players on the other hand, move forwards capability expansion in terms of therapeutic area and geographic presence.

The below Figure 4 shows the therapeutic demarcation in phase I supply base.

The below Table 2 shows the current and future state of the phase I supply base.

Phase I Market: Supply – Demand Analysis

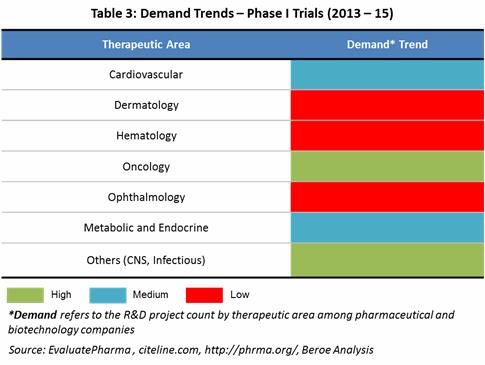

Demand Trends: Oncology, Infectious Diseases, CNS and Cardiovascular are the therapeutic areas having the highest number of phase I projects and products with respect to pharma and biopharma pipeline. The below Table 3 maps the demand trends by therapeutic area based on the phase I projects in pipeline of both pharma and biotechnology companies. [3]

There is a greater amount of outsourcing seen from pharma's side within Cardiovascular, Oncology and Infectious diseases therapeutic areas with 37 percent, 34 percent and 33 percent respectively. As per the IMS institute for Healthcare Informatics, in 2016 USD 83 – 88 Billion of the drug spending would go to Oncologics followed by Antidiabetics and Asthma/COPD between USD 44 – 53 Billion. [4] [5]

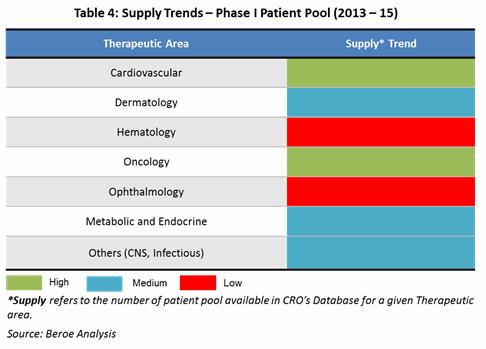

Supply Trends: Among phase I suppliers, greater than 90 percent of the CROs can cater to oncology therapeutic area, followed by Cardiovascular, CNS, and Hematology etc., aligned directly to the demand. Global players such as Quintiles, Parexel who make greater than 50 percent of the market share cater across therapeutic areas mainly due to their large operational capability in terms of beds and experience. Emerging players such as WCT, SGS cater to the top 10 therapeutic areas while specialists who have local presence cater to a specific therapeutic area. Ophthalmology, Dermatology, Women’s Healthcare, Renal/ Hepatic, Metabolic diseases are the top phase I therapeutic areas where specialists are present due to need for specific patient population in these areas.

The Table 4 below maps the supply trends by therapeutic area based on the patient pool availability among suppliers by therapeutic area.

Now that we understand how the supply market for phase I trials is structured, the next step for biopharmaceutical companies is to know how to ensure supply security during the sourcing process.

Conclusion: Ensuring Supply Security

As a first step towards supply security, pharma companies engage with a supplier after a thorough understanding of the supply market as above; followed by supplier capability analysis and financial risk assessment of the selected CROs, even before the Rfx process. Additionally, having an alternate supply base, varied engagement strategies ensures security throughout the clinical trial process. Some of the risks and its mitigation strategies that are considered by pharma to ensure supply security are as follows.

Alternate Supply Base: Big pharma normally engage with 2 or more major players to support their Phase II – IV trials. However, they also have relationships with additional suppliers that can support them in case the project deliverables increase. E.g. Pfizer has expanded their preferred provider relationship from two suppliers (Icon, Parexel) to three by signing a MSA with PPD in 2015 for the provision of clinical trial services. Recently in June 2016, they have selected a fourth CRO - inVentiv Health, who will be a preferred partner until 2019 with focus on areas such as oncology, pain, neuroscience, data and technology. This is a result of their growing pipeline, with phase I trials alone contributing to 37.7 percent of the trials. [6] [7]

Engagement with Patient Recruitment Organizations: There is a risk of patients or volunteers dropping out during a phase I trial conduct especially for rare disease conditions. In order to ensure non-disruption in such cases, pharma engage with Patient Recruitment Organizations (PRO) such as BBK Worldwide, Exco InTouch, Sanguine Biosciences etc., to avoid any lag time. E.g. Pfizer engaged with Sanguine Biosciences to identify patients with a very rare genetic condition congenital analgesia. [8]

Engagement with Local/ Regional Players: Though pharma engage with global CROs for their clinical trial outsourcing needs, certain pharma companies engage with local or regional players i.e. specialists. This is used as a strategy to harness the regulatory expertise local players possess over a global player mainly for small population studies. This also enables elimination of any cultural and language differences that may exist and cost effective. E.g. Merck engages with TigerMed, Makrocare in Asia Pacific; Intrials, Chiltern in Latin America; Ergomed, TFS in EMEA and Quintiles in North America. [9]

Strategic Long-term Partnerships: Pharma is slowly shifting from outsourcing on a tactical basis to a more strategic approach for a longer time period (greater than 3 years) where risk sharing is an important element. This in turn increases transparency, as pharma see’s lack of transparency in supply chain increases the risk for economically motivated adulteration. The adoption rate for strategic partnerships has increased from 12 – 15 percent in 2013 to approximately 25 percent in 2015 which shows big pharma’s interest to a more collaborative approach. [10]

References

[1] Parexel, Biopharmaceutical R&D Statistical Sourcebook 2015/2016, USA: Barnett International, 2016.

[2] C. Landin, “Closure Threatens Clinical Trial Safety,” Morning Star, March 2016. [Online]. Available: https://www.morningstaronline.co.uk/a-beb9-Closure-threatens-clinical-trial-safety#.V3E6E9J97IU. [Accessed June 2016].

[3] PhRMA, “Innovation in the Biopharmaceutical Pipeline,” January 2013. [Online]. Available: (http://phrma.org/sites/default/files/pdf/2013innovationinthebiopharmaceuticalpipeline-analysisgroupfinal.pdf . [Accessed June 2016].

[4] K. Hammeke, “The Top CROs By Therapeutic Indication Share Strong Regulatory And Productivity Performance,” August 2013. [Online]. Available: http://www.outsourcedpharma.com/doc/the-top-cros-by-therapeutic-indication-share-strong-regulatory-and-productivity-performance-0001. [Accessed June 2016].

[5] Citeline, “Citeline Pharma R&D Annual Review 2015,” 2015. [Online]. Available: https://citeline.com/wp-content/uploads/2015/02/CITIF_RD_AnnualReview_031715.pdf. [Accessed June 2016].

[6] Outsourcing Pharma, “Pfizer reveals PPD as third strategic CRO partner,” April 2015. [Online]. Available: http://www.outsourcing-pharma.com/Clinical-Development/Pfizer-reveals-PPD-as-third-strategic-CRO-partner. [Accessed June 2016].

[7] Outsourcing Pharma, “Pfizer names inVentiv as 4th CRO,” June 2016. [Online]. Available: http://www.outsourcing-pharma.com/Clinical-Development/Pfizer-names-inVentiv-as-4th-CRO. [Accessed June 2016].

[8] D. Tyer, “Pfizer taps mobile app for patient recruitment,” December 2014. [Online]. Available: http://www.pmlive.com/blogs/digital_intelligence/archive/2014/december/pfizer_taps_mobile_app_for_patient_recruitment_623007. [Accessed June 2016].

[9] Outsourcing Pharma, “Always on my mind or return to vendor? CRO models discussed in Vegas,” April 2014. [Online]. Available: http://www.outsourcing-pharma.com/Clinical-Development/Always-on-my-mind-or-return-to-vendor-CRO-models-discussed-in-Vegas. [Accessed June 2016].

[10] P. V. Arnum, “Strengthening Supply-Chain Security,” September 2011. [Online]. Available: http://www.pharmtech.com/strengthening-supply-chain-security?pageID=2. [Accessed June 2016].

About The Author

Mathini is a Senior Lead Analyst in the Pharma R&D vertical. She specializes in understanding the market scenario and industry dynamics across the globe in the outsourcing arena. She has several publications related to R&D procurement opportunities.

She completed her Masters in Management from University College London and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. She is also an engineer with a background in bioinformatics and has experience as a research fellow in Singapore-Delft Water Alliance (SDWA), NUS, with active involvement in scientific tool development and programming.