Should You Conduct Your Medical Device Clinical Trial In Latin America?

By Julio G. Martinez-Clark, CEO, bioaccess

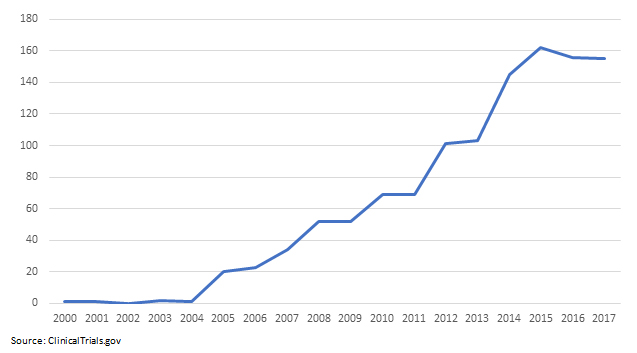

According to ClinicalTrials.gov, device trials have increased 94 percent from 2012 to 2017. The medical device contract research organization (CRO) market is expected to continue growing at 11.5 percent per year; at this rate, the market could reach nearly $13 billion by 2023.1

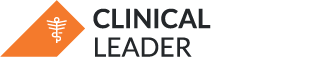

Latin America has seen an explosive growth in medical clinical trials. According to ClinicalTrials.gov, out of the 35,780 global medical device trials conducted since 2000, 1,219 of them (or 3.4 percent) were registered in Latin America.2

The same ClinicalTrials.gov data reveals that from 2000 to 2010, there were 255 medical device clinical trials in Latin America; there were 891 from 2011 to 2017 — an impressive 249 percent growth.

Table 1: Medical Device Clinical Trial Growth In Latin America

This column examines strategies to consider when planning and operationalizing a foreign medical device clinical trial and explores the growth of these trials in Latin America. I’ll address some key success factors and provide recommendations to ensure a cost-effective trial in the region.

Trials Are Being Outsourced To Emerging Countries

In a research paper sponsored by the Harvard Global Health Institute and other prestigious supporters, we can observe how moving clinical trials, estimated to be 40 percent of drug development costs, to an emerging country may reduce trial expenses by 60 percent. The same paper states that clinical researchers, including CROs, are increasingly using global networks to reduce costs and accelerate recruitment.3

Trials have increased in all geographic regions and development categories.4 The Harvard Global Health Institute paper shows that growth has been greatest in Asia and Latin America and among low and lower-middle income countries with emerging economies. The paper concludes that U.S. companies are increasingly outsourcing clinical research to emerging countries.3

Medical Device Companies Are Catching On To The Trial Outsourcing Trend

Medical device companies are not as far along the outsourcing curve as pharma and biotech companies. Just as pharmaceutical outsourcing came in a wave nearly 20 years ago, the trend now is catching on among medical device companies, according to Neal McCarthy, managing director of investment banking firm Fairmount Partners.5 As device clinical research outsourcing matures, the market could more than double before reaching current penetration levels; this makes a 2023 market estimate of about $13 billion realistic.1

The rapid advancement of software, mobile, and sensor technology has opened the door for a new type of smarter medical devices and has enabled nontraditional manufacturers to enter the device market (i.e., Google, Microsoft, Apple). Increased competition, augmenting evolution in technology, and a blurring line between traditional technology and medical devices will increase the need for trials.1 Also, new biotech companies involving gene therapy technologies are proliferating and in need of clinical trials.

“In the cardiovascular area, we are seeing combination products that contain a device with a pharmaceutical drug, or a biologic and a device, as better ways to treat the disease,” said Vicki Anastasi, Icon’s vice president of medical technology in an interview after the 2015 announcement of Icon’s new medical device and diagnostics research group designed to provide global clinical trial services.5 “We also see tremendous increase in wearables and new communicating devices emerging to become a standard of care along with software.”

Table 2: Medical Device Study Trends

The Clinical Trial Struggle For Development-Stage Medical Device Companies

Development-stage life sciences companies usually struggle to find highly talented medical staff who will give them the focus and energy to complete — in a timely manner — quality and ethical clinical research at a very competitive cost.

Over the past two decades, medical device companies have transferred a significant part of their initial clinical research activities and early feasibility studies (EFSs) overseas in response to a more stringent legal, regulatory, and financial environment in the U.S. These EFSs usually include a limited number of subjects treated with a device, which may be in its early development stage before the design has been finalized.6

It takes about six and a half years and $37 million for a company to bring a device from bench testing to completion of an EFS in the U.S.6 The majority of the U.S. medical device companies are small, with fewer than 20 employees and limited resources. Therefore, many of the medical device innovations would never make it to market, and these companies will not survive the time and financial burden if the device development times are extensive.

The unpredictable, inefficient, and expensive regulatory process to conduct an EFS forces them to conduct research outside of the U.S. (OUS), where trial regulations are more favorable than in the U.S.6 According to a recent survey, the majority of responders said that they have conducted or plan to conduct their EFS overseas to avoid the stringent trial ecosystem in the U.S.6

GlySure, a U.S. company that conducted a trial in India, reported that the outcomes of its OUS trial far exceeded its expectations, with direct trial costs savings of 50 to 70 percent, compared to U.S. or EU costs and, more importantly, savings of nine to 12 months in development time due to faster regulatory approval processes.7

Choose The Right CRO, Site, And PI

Trials require extensive planning. OUS medical device trials, particularly those in emerging markets, add a new layer of complexity because of the unique challenges of distance, logistics, regulatory approval, and cultural differences. The success of an OUS medical device trial hinges on choosing the right CRO, site, and principal investigator (PI) to meet its goals.

The ultimate success of the trial depends on the PI and his or her ability to drive patient enrollment and conduct the trial in accordance with the study protocol, says Christopher Jones, GlySure’s CEO.7 It is critical that a medical device trial sponsor works with its CRO to find a PI who has a genuine interest in the trial, provides feedback on the design of the device, and has the right background and experience. It’s key for a trial sponsor to have people on the ground who live and breathe the local customs and are able to communicate effectively across geographical and cultural boundaries to resolve issues.

Five Countries In Latin America Are Top Medical Device Clinical Trial Destinations

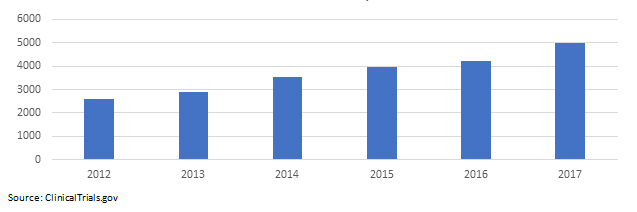

Trial data from ClinicalTrials.gov reveals that there are five countries in Latin America that receive the bulk of medical device clinical trial activity in the region: Brazil, Mexico, Chile, Colombia, and Argentina.

Table 3: Medical Device Studies Per Country

It’s no coincidence that U.S. companies like Hancock Jaffe Laboratories — a 25-year-old California publicly traded company — have chosen Latin America for their EFS clinical trials. On June 20, 2018, Hancock Jaffe Laboratories announced that it selected Fundación Santa Fe de Bogotá University Hospital (FSFB), in Bogota, Colombia, as the site for the first-in-human trial of its VenoValve bioprosthetic medical device.8 FSFB, a 205-bed university hospital, was the first hospital in Colombia to receive the distinguished Joint Commission International accreditation, and it has a research collaboration agreement with Johns Hopkins Medicine International in Baltimore, MD.

Earlier this year, Libella Gene Therapeutics, a Kansas company, announced that it will conduct a breakthrough gene therapy trial at a leading health institution in Colombia.9 Although not technically a medical device, gene therapy is a controversial innovation and one of the most influential trends in medicine. In 2015, MIT Technology Review reported that the CEO of BioViva, a Seattle-based biotech company, claimed to be the first to undergo gene therapy to reverse aging — in Colombia.10

A U.S. medical device company should select a CRO that has local presence in Latin America and experience with development-stage medical technologies, and not just pharmaceuticals, since the trial process and requirements are vastly different. There’s a big difference between planning and conducting a trial where the investigational product has been finalized, compared with a trial where there are fewer patients and the PI and the site must have the flexibility to work with a prototype device.

Conclusion

Conducting OUS clinical trials allows development-stage medical device and other life sciences companies to secure the early feasibility data they need in a relatively short time period — and at much lower cost than in the U.S. or Europe. The key to success is having a strong, capable in-country team, including the PI, site personnel, and CRO representatives, who can drive patient enrollment, follow study protocols, and help resolve issues.

The level of some health institutions and physicians in Latin America is comparable to many institutions in the U.S. or Europe. It’s common to see hospitals in Latin America staffed with fully bilingual U.S. board-certified physicians who have a track record of research and publications. That, and the fact that trial costs are significantly lower in the region, makes Latin America very attractive for U.S. life sciences companies looking to conduct cost-effective and ethical OUS clinical trials.

References:

- Medical device CROs: the next growth opportunity? (2017). Retrieved from https://www.outsourcing-pharma.com/Article/2017/04/17/Medical-device-CROs-the-next-growth-opportunity.

- ClinicalTrials.gov. (2017). Retrieved from https://clinicaltrials.gov/ct2/results?type=Intr&intr=Device&locn=argentina+OR+bolivia+OR+brazil+OR+chile+OR+colombia+OR+ecuador+OR+paraguay+OR+peru+OR+uruguay+OR+venezuela+OR+mexico+OR+bahamas+OR+cuba+OR+dominican+republic+OR+el+salvador+OR+guatemala+OR+haiti+OR+honduras+OR+jamaica+OR+panama+OR+paraguay.

- Global Migration of Clinical Trials in the Era of Trial Registration. . Retrieved from https://www.ncbi.nlm.nih.gov/pubmed/24577390.

- Clinical Trials Market Analysis By Phase (Phase I/II/III/IV), By Study Design (Interventional, Observational, Expanded Access), By Indication (Autoimmune, Pain management, Oncology, CNS condition, Diabetes, Obesity), And Segment Forecasts, 2018 – 2025. (2017). Retrieved from https://www.grandviewresearch.com/industry-analysis/global-clinical-trials-market.

- Icon launches medical device and diagnostics group to highlight Aptiv’s strength, catch next wave of outsourcing. (2015). Retrieved from http://www.centerwatch.com/news-online/2015/03/16/icon-launches-medical-device-and-diagnostics-group-to-highlight-aptivs-strength-catch-next-wave-of-outsourcing/.

- Blueprint for Early Feasibility Study Success: A report of the Early Feasibility Study working group of the Medical Device Innovation Consortium (MDIC). (2016). Retrieved from http://mdic.org/cts/efs/blueprint/.

- Study Abroad: Tips for Successful Clinical Trials Outside of the United States. (2012). Retrieved from https://www.mddionline.com/study-abroad-tips-successful-clinical-trials-outside-united-states.

- Hancock Jaffe Laboratories Selects Site for First-in-Human VenoValve Study. (2018). Retrieved from https://ir.hancockjaffe.com/press-releases/detail/8/hancock-jaffe-laboratories-selects-site-for-first-in-human.

- New Clinical Study May Be the World's First Cure for Alzheimer's Disease. (2018). Retrieved from https://www.prnewswire.com/news-releases/new-clinical-study-may-be-the-worlds-first-cure-for-alzheimers-disease-300580842.html.

- A Tale of Do-It-Yourself Gene Therapy. (2015). Retrieved from https://www.technologyreview.com/s/542371/a-tale-of-do-it-yourself-gene-therapy/.

About The Author:

Julio G. Martinez-Clark is CEO of bioaccess, a U.S.-based contract research, regulatory, and market access consulting company focused on Latin America. Julio holds a bachelor’s degree in electrical engineering (B.S.E.E.), and a master’s degree in business administration (M.B.A.).

Julio G. Martinez-Clark is CEO of bioaccess, a U.S.-based contract research, regulatory, and market access consulting company focused on Latin America. Julio holds a bachelor’s degree in electrical engineering (B.S.E.E.), and a master’s degree in business administration (M.B.A.).