Significant Number Of Drugs Will Launch For The Treatment Of Age-Related Macular Degeneration By 2026, Says GlobalData

The age-related macular degeneration (AMD) market has been dominated by big pharma companies and their pipeline candidates are ensuring a share of this lucrative market, in spite of patent expiries of their highly-priced products, according to GlobalData, a leading data and analytics company.

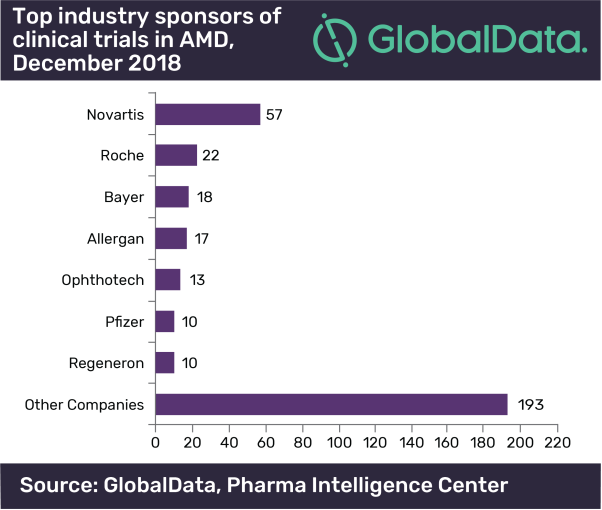

Roche and Novartis’ Lucentis (ranibizumab) was the first anti-VEGF monoclonal antibody designed specifically for the treatment of the wet form of AMD. Currently these companies sponsor the highest number of clinical trials to reclaim their top position in the AMD space.

Dr. Edit Kovalcsik, Managing Pharma Analyst at GlobalData, comments: “In recent years Regeneron and Bayer became top sellers in the AMD space with their anti-VEGF, Eylea. However, Novartis is planning to launch its new anti-VEGF, brolucizumab in 2019, while Roche will compensate for its loss through the launch of faricimab, first-in-class bispecific antibody in 2024 designed for the treatment of wet AMD.”

While both Bayer and Regeneron are among the top seven industry sponsors of clinical trials in AMD, neither of these companies have an AMD drug in late stages of development (Phase IIb/ Phase III) and GlobalData expects that they will not launch a new product by 2026.

The current AMD market is rather sparse, comprising of only five available drugs in the US, 5EU, and Japan and four in China. One of the marketed anti-VEGFs, Roche’s Avastin (bevacizumab), is used off-label for wet AMD, mainly due to its vastly lower price-tag.

Kovalcsik continues: “All three anti-VEGF therapies are highly effective to prevent central vision loss; however, major draw-backs include needing frequent intravitreal (IVT) injections, which results in poor compliance and risk of vision loss. Another problem is the price, which healthcare providers have been trying to minimize through the off-label use of Avastin, which is a cancer treatment.”

According to GlobalData’s report: ‘Age-Related Macular Degeneration: Competitive Landscape to 2026' the AMD pipeline consists of 236 drugs spanning all stages of development. Drugs inhibiting angiogenesis remain the major focus of drug developers for wet AMD as they account for close to 40% of the pipeline.

Kovalcsik explains: “Companies developing new anti-VEGFs are trying to address the burden of frequent IVT injections on the patient and the physician, as well as on the hospital resources. Novartis’ brolucizumab will potentially reduce the dosing frequency for many more patients than currently available anti-VEGF therapies.”

The other form of the late stage of AMD is a dry or athropic form, called geographic atrophy (GA), for which no effective treatments are available, and therefore these patients remain underserved.

Kovalcsik concludes: “The AMD pipeline is strong although the attrition rate is high, particularly in dry AMD, for which all drugs have failed at the clinical stage of development.

“Out of the eleven drugs in late-stage clinical development, only two are being developed for the treatment of GA: Apellis’ APL-2, and Ophthotech’s Zimura. The majority, about 70% of the drugs in clinical stages of development, are designed to treat wet AMD, which leaves plenty of opportunities for developers to come up with effective treatments against GA.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Source: GlobalData