South Korea: Sprinting Clinical Trial Development

By Samiya Luthfia Khaleel, Senior Research Analyst – Clinical Research, Beroe Inc

Introduction

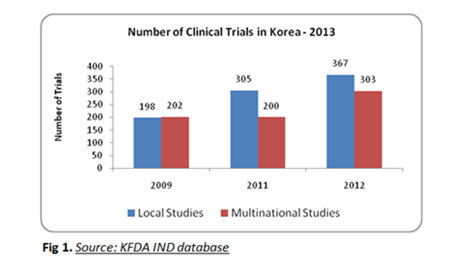

South Korea positions itself to be the major emerging nation in Asia for clinical trials. South Korea has precipitously burgeoned with both global and local clinical trials over the past 10 years. South Korea contributes a share of 5% to overall clinical trial registered globally in 2013. Adding further, there are 142 clinical trial sites certified by KFDA (Korean Food and Drug Administration) thus far. This places Korea second in having the highest number of clinical trial sites globally.

Korean government’s unceasing support in developing clinical and healthcare has attracted many Biopharmaceutical companies to invest in the region and the local clinical trials in Korea are surpassing the multi-national clinical trials recently. The reason for this being that the Korean Government along with the pharmaceutical companies had created new strategies to keep the R&D innovation going. Moreover Korean based pharma and biotech companies invest 65% of their total annual profit into developing innovative therapeutics in their pipeline and also the focus on developing biosimilars bolsters the increase in local clinical studies.

Key areas of influence

Regulatory, Political and Demographic conditions in South Korea are favourable for global, local and regional clinical trials. It is worth noted that Government’s initiatives in the field of healthcare have created an opportunity for industry to participate in uplifting country’s healthcare sector to a greater extent. Technology and medical infrastructure, and cost saving opportunities further complimented the window of opportunities and resulted into a very healthy and sound clinical trial market for the industry.

The factors that boosted the overall clinical trial market in the country are as below.

1. Government’s role: A push to changing clinical trial landscape

Government funding for the development of industry and the infrastructure for thriving R&D innovations stands quintessential to the Pharmaceutical and Biotechnological industries for new drug development. The Korea Drug Development Fund (KDDF) established in 1987 has spent around 2 Billion USD for new drug development until 2010.The government supports overseas clinical trial sponsors for phase 3 studies with funds of KRW 100 Billion with prime rate of 0.5% for 8 year maturity period.

Korea National Enterprise for Clinical Trials (KONECT) established in 2007 concentrated into three divisions:

- Clinical trial Centres - manages the 15 Regional Clinical Trial Centres in South Korea,

- Clinical Trials Training Academy - trains and educates the professionals involved in clinical trials and

- Clinical Trials Technology Development funds are provided by the Korean Ministry of Health and Welfare for facilitating new innovations in clinical trial

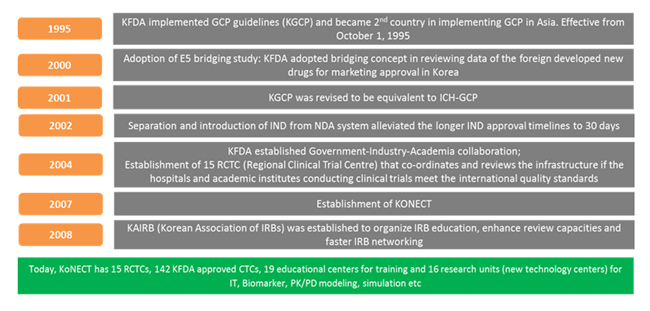

2. Regulatory reforms

Regulatory amendments have entirely re-shaped the clinical trials scenario in South Korea. These regulatory changes have streamlined the whole clinical trial process that paves way for clear approval pathways.

3. Global CRO’s major attraction spot

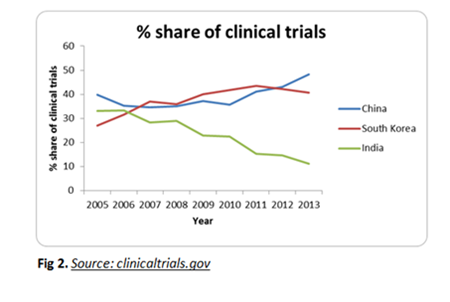

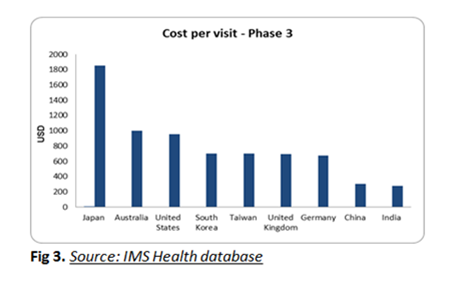

Declining clinical trial opportunities in India caused the shift of focus towards other Asian countries. Though Korea is not competitive in terms of cost when compared to China and India; quality of trials, medical infrastructure and the lucidness in the regulatory pathways attracts most pharma companies to conduct clinical trials in the region which has prompted many global CROs to establish in South Korea creating a healthy competition for the local CROs.

Furthermore, average life span of South Korean population is 80 years with a literacy rate of 96%. These attractive figures have been monumental for global to expand into Korea, mainly at the capital city Seoul. Alliance between KoNECT and Quintiles in 2011 has created an impetus to conduct high quality clinical trials in South Korea by devising trainings and workshops to the biopharmaceutical companies, principal investigators and also having better interaction with regional Key Opinion Leaders (KOLs). In a similar case, Icon and INC Research has also partnered with KoNECT. A recent collaboration was seen between Celerion and Korean Drug Development Fund Form focussing on strengthening early phase clinical research Other global CROs like PRA, PAREXEL are also concentrating on South Korea as a destination for conducting clinical trials.

Biosimilars: A key to future growth?

South Korea’s biosimilars market growth at a CAGR of 6.5% from the year 2011-2017, is promising for the clinical trial growth of biologics for the upcoming years. The government shifted focus from the IT industry to biopharmaceutical development with its promising R&D expenditures. Currently the South Korean biosimilars market share is about 3.3% and the government targets to capture 22% by 2020. The below are some of the deals made by Biopharmaceutical companies in this area,

- Samsung Biologics in collaboration with Biogen Idec established a joint venture Samsung Bioepsis Co., Ltd., to develop biosimilars and has also planned to invest more than USD 2 Billion until 2020.

- Merck & Co., and Samsung Biologics in 2013 have also announced to collaborate in developing biosimilars after breaking the collaboration with Hanwha, one of the large business conglomerates in South Korea.

What characterizes South Korea as a favourite destination for clinical trials?

Short Study start-up timelines: Early start-up shortens the time for the drug to reach the shelf. The Institutional Review Board (IRB) and the Ministry of Food and Drug Safety (MFDS) submission review is conducted in parallel in Korea in about 30 days which is a shorter duration for study start-up time when compared to other Asian countries.

Patient recruitment: Faster patient recruitment means early release of drug into the market and hence the cost saved will be equal to the revenue generated by the drug per day post approval. The current population of Korea is 50 million among which 97% of the population have Healthcare coverage which drives the participation of Korean society in clinical studies facilitating patient recruitment. The mean drop-out rate for 21 clinical trial studies conducted by LSK Global Pharma Services, a CRO in South Korea is 11%, which is insignificant.

Korea claims with 0.7% of the patient recruitment for clinical trials in 2011 globally with its 50 million populations standing seventh in the world. Furthermore, it is positioned third after China and India for faster patient recruitment in Asia. In most cases, the patient recruitment is done by the investigator themselves from their own patient cohorts rather than by referral or by advertisements.

Investigator grants: The Investigator cost per visit for the phase 3 trials in South Korea is 60% less when compared to Japan. However it is comparatively higher when compared to China and India.

CRA: 19% of the Clinical Research Associates (CRA) fee corresponds to their travel expense and 22% goes to their off-site monitoring. South Korea is a small country with an area of 38,691 square miles, CRA in South Korea have an advantage of travelling the whole country in a day. The clinical trial centres are generally located in the capital cities and are easily commutable thus saving the travel costs. There has been high turn-over rate and dearth in the clinical trial professionals compared to the mounting clinical trial market scenario in South Korea.

Clinical Trial data sharing: Clinical trial data sharing between China, Japan and Korea is probable through the Tripartite Agreement, created in 2007 to steer the direction of drug development prospective. The clinical trials conducted in Korea can be accepted in Japan provided the PK/PD data on Japanese are available. This prevents duplicating clinical trials in different regions hence saving the clinical trial cost and time over drug development process. The genetic homogeneity and similar disease patterns among Korea, Japan, China and Taiwan extends the opportunities of working collaboratively apart from the language impediments existing between these nations.

Conclusion:

Quality of clinical trials is the major advantage about conducting clinical trials in South Korea. Though there has been a view that shortage of cultural and language barrier exists as an obstacle to consider South Korea as a clinical trial destination, other positive fronts like high literacy rate contributes to better compliance and facilitates easy informed consent process, streamlined and clear regulatory pathways for clinical trial approval process, government support to overseas phase 3 clinical trials and the foreign trial data acceptance among the South Asian countries soars up the potential of South Korea in the drug development process which is evident from the 34% increase in multinational clinical studies in South Korea in 2012 compared to 2011.