The Role Of The CRO Is Changing. Why?

By Jeremy Weitz, Director of Procurement, Global Clinical Services, Biogen

CROs have provided full-service outsourced (FSO) models to pharmaceutical and biotechnology companies to support clinical trial operations as their primary service offering. However, the shift toward functional service provider (FSP) models has gained momentum. Top 10 pharma companies have all developed and deployed these models in their operations today and nearly half of the Pharma 11-20 by R&D spend have a mixed model of both FSP and FSO operations. This change is driven by various market forces inclusive of bolt-on M&A strategy focus, targeting the need to reduce costs, improve efficiency, reduce cycle times, focus on specialized services, and maintain strategic control. While CROs have successfully scaled FSP operations to capture new revenue streams, these offerings typically come with lower gross margins compared to FSO models. However, despite higher gross margins in FSO services, EBITDA (meaning earnings before interest, taxes, depreciation, and amortization) margins tend to be lower, placing significant pressure on SG&A (selling, general, and administrative) allocation to maintain profitability.

The current trajectory, combined with emerging industry trends such as the formation of site networks and Patient Access Organizations (PAOs), suggests that CROs will continue evolving their role within clinical trials. Part one of this two-part series on the changing role of the CRO explores the shift from an FSO to FSP outsourcing model and what’s driving that change.

The Evolving Preference From Full-Service Outsourcing To Functional Service Provider

For years, FSO services formed the backbone of the CRO business model, stretching across the continuum of large, midsize, and small biotech/pharmaceutical companies. These services allowed sponsors to fully outsource the management and operations of clinical trials, from protocol development to study execution, to delivery of a clinical study report (CSR). However, in the past five to eight years, there has been a noticeable decline in FSO revenue, especially among large and midsize pharma. This shift can be attributed to several factors, including tighter R&D budgets, a growing emphasis on cost efficiency, and the increasing internalization of clinical trial capabilities within pharma companies themselves to improve quality, desire to improve line of sight, and strategic engagement with clinical trial sites.

To recoup lost revenue from the declining FSO demand, CROs have pivoted to scaling FSP models, which focus on providing specific resource-based services such as clinical monitoring, data management, study startup activities, and biostatistics, among other functional services, rather than managing the entire trial operations. The FSP model allows sponsors to retain greater control over the day-to-day trial operations while leveraging the CRO's expertise. Depending on the continuum of FSP models, a sponsor can utilize the CRO's technology, processes, and standard operating procedures (SOPs) or their internal ones.

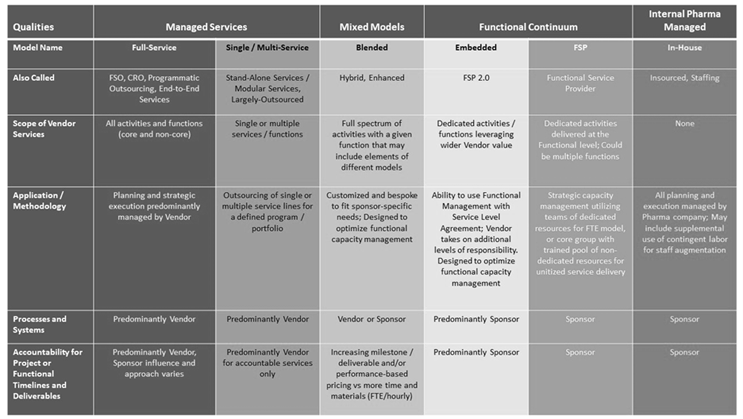

New Taxonomy in Clinical Development Sourcing Models

Image credit: Getz, K.; Shah, S.; Luithle, J.; Travers, M. Redefining CRO sourcing model terminology to optimize outsourcing strategies. Applied Clinical Trials.

All Top 10 or Tier 1 CROs, representing roughly 70% of the market share of outsourced clinical services1, have aggressively scaled their FSP offerings to meet this demand. This shift is also evident in Tier 2 CROs, which are expanding their FSP services to supplement their existing client bases. Additionally, CRO-agnostic companies specializing in FSP operations globally also have grown, sometimes working as CRO subcontractors to support supplemental resourcing needs.

Financial Analysts Are Wise To The Outsourcing Change

Additionally, analysts and large consulting groups have noted the increasing trend toward FSP and its benefits:

“FSP has a much better cost proposition than insourcing. We can get 20%-30% savings in the first year with FSP. …FSP relationships tend to be long duration, predictable revenue streams.”

Deutsche Bank/Investment Bank, April 2022

“Large Pharma will increase share of FSP sourcing model, which will allow them to gain more control of strategic direction. Enabled by investments into building strong internal data capabilities.”

Boston Consulting Group Report, Oct. 2022

“Large Pharma [is] making a push towards FSP. Nearly 70% of Large Pharma respondents indicated that their companies were increasing FSP work. This is consistent with results from prior surveys and what we’ve heard from the channel. FSP is seen as a form of cost savings, but the more important driver is control of project mgt, of quality, of site interactions.”

Dave Windley, Jefferies Industry Report, Feb. 2023

What’s more, recent financial and industry reports highlight a growing trend in FSO revenue reduction across major CROs, driven by the shift toward more flexible FSP models. Over 2 years of surveying large and small/midsize biopharma, The Pulse 20242 reported that 35% indicated increased use of FSPs compared to 29% in the FSO market, highlighting that FSP outsourcing is growing faster than FSO. This is underscored with FSP growth projected to continue at a compound annual growth rate of more than 8.68% from 2024 to 20323.

The impact on the CROs extends beyond the reduction or loss in direct services fees tied to FSO contracts. An estimated half of the CRO market revenue comes from the pass-through of site expenses4, and the shift in study budget allocations directly between sponsors and sites poses a significant threat to CROs' top-line growth. CROs are also attempting to take over ancillary services via their subsidiaries by offering discounted rates, but these discounts often serve to fuel their pass-through costs. Additionally, if CROs do not offer the necessary technology solutions for managing site payments, these expenses could move away from them, opening opportunities for niche service and technology providers to capture a greater share of clinical trial revenue.

What’s Driving This Shift From An FSO To FSP Outsourcing Model?

This transition is largely fueled by biopharma clients’ desire to cut costs and improve efficiency, especially in light of post-pandemic pressures on R&D budgets. Large sponsors are moving away from broad, bundled service contracts toward more modular outsourcing models that offer them greater control over specific elements of trial management. IQVIA's investment in its FSP Advance platform is a direct response to this trend, as it aims to capture the increasing demand for specialized and flexible service offerings. This shift has been mirrored by other CROs, further contributing to the decline in FSO revenue and forcing the industry to innovate and diversify its business models to stay competitive.

The shift from FSO to FSP has not only impacted revenue but also has driven consolidation within the CRO industry. As FSO revenue opportunities decline, many CROs face financial pressure, leading to mergers and acquisitions that reshaped the industry. Major players like ICON, Syneos Health, and PPD have merged or like Parexel have been acquired by private equity firms, reducing the number of independent CROs. This consolidation is heavily influenced by the decline in FSO services, as CROs adapt to a market that demands more specialized FSP models with lower gross margins. “Applied Clinical Trials” has observed this consolidation as a reshaping of the competitive landscape, where fewer but larger CROs dominate the market, leaving limited space for smaller players5.

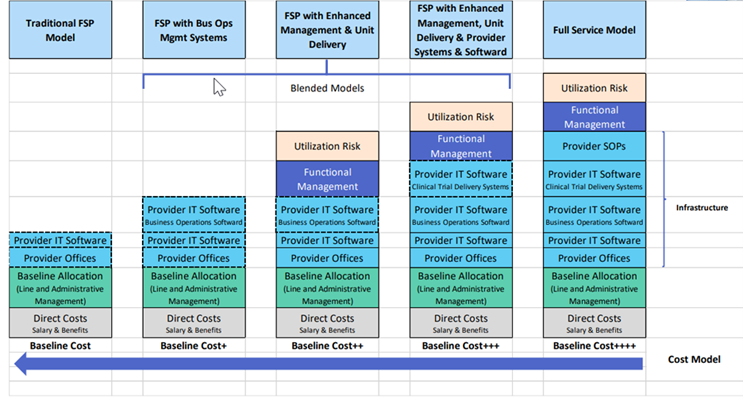

Though FSP services have proven to be an effective way for CROs to maintain revenue streams, they tend to operate with lower gross margins compared to FSO services. Additionally, with the desire of sponsors to take control of their data and increase data quality and real-time analytics by bringing technology in house, this further reduces the scope of FSP offerings. The pricing structure of FSP services is more transparent and often more competitive, putting pressure on CROs to balance profitability with the growing demand for these offerings, further detail found below in the “Transparency in Pricing Methodology in Clinical Development Outsourcing, Across FSP to FSO Continuum” graphic. As such, CROs are grappling with the challenge of capturing new FSP opportunities while facing the reality that the profit potential of FSP is lower than that of traditional FSO. Even though CROs have strategically pivoted to offer more specialized services, the industry remains in search of new revenue streams to offset the declining margins from FSP.

Transparency in Pricing Methodology in Clinical Development Outsourcing, Across the FSP to FSO Continuum

Image credit: Samir Shah, SHAH Pharma Consulting Services, LLC.

The Rise Of Site Networks and Patient Access Organizations — Where Do CROs Belong?

Part one of this series explored the shift from FSO to FSP preferences among sponsoring pharmaceutical companies. In part two, discover the strategic direction of site relationships and PAOs, and explore all the ways in which CROs may evolve to maintain relevancy in this changing ecosystem.

Acknowledgements:

The author would like to Siân Smethurst, Sarah Ward, Tara Aldoory, Emilio Da Silva Neto, Jane Twitchen, Rob Cottrell, and Samir Shah for their insights and engaging discussions that have contributed to the development of this article.

References:

- Tufts Center for Study of Drug Development. Impact Report. 4 (6), November/December 2022. https://9468915.fs1.hubspotusercontent-na1.net/hubfs/9468915/NOV-DEC.jpg

- PPD. The Pulse Report 2024. https://www.ppd.com/pharmaceuticals-research-and-development/

- Market Research Future Global Functional Service Providers Market Overview ID: MRFR/HC/9296-CR | Author: Rahul Gotadki| January 2024. https://www.marketresearchfuture.com/reports/functional-service-providers-fsp-market-10780

- ClinicalResearch.io, From stand-alone sites to large networks: The ongoing evolution of clinical research, January 23, 2023, https://clinicalresearch.io/blog/running-a-site/from-standalone-sites-to-large-networks-the-ongoing-evolution-of-clinical-research/#:~:text=The%20future%20of%20clinical%20research&text=Many%20independent%20

site%20operators%20will,and%20rigor%20to%20clinical%20trials. - Applied Clinical Trials, CRO Update: Where are Contract Research Organizations Headed?, By Mike Straus, March 10, 2022 https://www.appliedclinicaltrialsonline.com/view/cro-update-where-are-contract-research-organizations-headed

Images:

- Getz, K.; Shah, S.; Luithle, J.; Travers, M. Redefining CRO sourcing model terminology to optimize outsourcing strategies. Applied Clinical Trials. Published online September 20, 2022. https://www.appliedclinicaltrialsonline.com/view/redefining-cro-sourcing-model-terminology-to-optimize-outsourcing-strategies Accessed Aug 3, 2023

- Samir Shah, SHAH Pharma Consulting Services, LLC.

Note: The views and opinions expressed in this paper are solely those of the author and do not express the views or opinions of the employer.

About The Author:

Jeremy Weitz is a procurement professional with over a decade of experience in the pharmaceutical drug development industry. His career spans leadership roles from a biotech CRO to major biopharmaceutical companies, including Biogen and AstraZeneca, where he has overseen the development and implementation of strategic global operations.

Jeremy Weitz is a procurement professional with over a decade of experience in the pharmaceutical drug development industry. His career spans leadership roles from a biotech CRO to major biopharmaceutical companies, including Biogen and AstraZeneca, where he has overseen the development and implementation of strategic global operations.