Understanding How Strategies For Product Adoption Can Inform Clinical Trial Delivery

By Kym Eves and Liam Eves, principals, ReNable Research Ltd.

The drug development industry’s efforts to create successful clinical trial and new drug launches are falling short, with both failing to meet their respective goals (enrollment and sales) from the gate. In part one of this three-part series on leveraging commercial product launch strategies in the clinical phase, we covered the two main reasons for trials’ failure to launch and discussed the role of product launch tactics in preparing for clinical trials.

In part two, we look at product archetypes and adoption drivers as they relate to commercial endeavors and then more closely at how they can be applied to clinical trial execution.

What Does “Product Adoption” Have To Do With Clinical Trials?

Borrowing from our sales and marketing colleagues, we introduce the concept of “product adoption” to the clinical trial psyche to help articulate the underlying objective of a study launch. In its most basic sense, product adoption is the process by which people become aware of, evaluate, and ultimately decide to purchase and use a new product. For recently market-authorized pharmaceuticals, product adoption is multifaceted in that it requires the buy-in of several key stakeholder groups: the prescribers, the payers, and the patients in order to prescribe, reimburse, and use the newly launched drug. Product adoption is sales and marketing's ultimate launch goal, as it signifies the successful acceptance and integration of a product into these stakeholders’ lives, reflecting the effectiveness of marketing strategies and efforts.

Now let’s orient the concept of product adoption so it is meaningful to clinical trials. In this sense, our adoption aim is to secure healthcare providers to conduct our study and to ethically encourage suitably qualified patients in non-pressured ways to volunteer to participate in it. In this clinical trial sense, product adoption is clinical research’s ultimate launch goal, as it translates into fully engaged and active trial sites with study enrollment fulfilled to budget and timeline.

How we currently product adopt in clinical research is frankly stale and, oftentimes, absent entirely. Cries for trials to be more patient-centric have mostly translated into a concentrated focus on patients as it relates to their medical condition, reducing them to single-dimensional beings. And there’s not much thought about the sites themselves, and what sort of engagement we should be doing with them. But when we leverage product adoption themes and tactics, our enrollment game is elevated to a holistic approach that ensures we consider every aspect of a patient’s life and how they interact with the healthcare world around them. This means our enrollment strategies need to also address the psychological, social, and cultural factors that influence behavior and inform how site staff and patients make decisions and interact with one another.

How we best do that depends on the type of product we are studying and its relationship with the healthcare ecosystem in which we will introduce it.

Product Archetypes

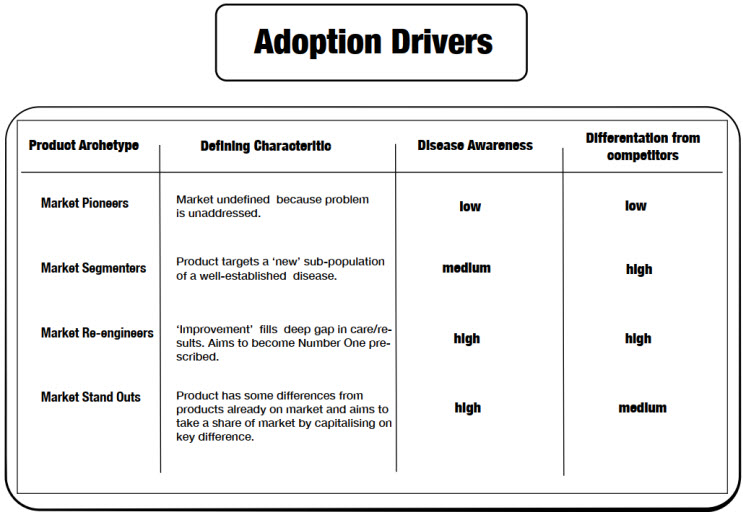

As discussed previously, several more nuanced drug types emerged to replace the old blockbuster/non-blockbuster categorization. The McKinsey team sorted these into four drug archetypes that align with varying levels of clinical differentiation and perceived disease burden to understand what makes market launches successful with each type. The authors adapted these to suit both on-market and investigational drugs and call the four ensuing groups product archetypes. These include:

- Market Pioneers – New products that address an unarticulated, unmet need in many people.

- Market Segmenters – New products in well-known indications developed to target subsets of patients with those conditions.

- Market Re-engineers – New products in well-known indications with significant improvements over existing products such that the new product can become the new market leader.

- Market Stand Outs – New products in well-known conditions that have some benefit improvements over competitors and whose goal is to participate at some level in the market share, rather than dominate it.

Whether investigational or newly approved, each archetype faces certain uptake challenges because of how they challenge, improve, or alter the current thinking, understanding, and treatment of a given condition, which we collectively refer to as “interrupting the healthcare status quo.” The two status pillars that most broadly inform this interruption are disease awareness and differentiation from competitors.

Disease awareness encapsulates the extent to which healthcare professionals and individuals affected by the disease are informed about its causes, symptoms, risk factors, diagnosis, treatment options, and management strategies. The pillar encompasses both the medical understanding of the disease and the level of public awareness and education surrounding it.

Differentiation from competitors refers to how different the benefits and features of an IMP or new drug are compared to those of products/alterative practices already present in the market. The ease of getting end users to embrace new benefits and features will depend on how meaningful they are versus being different for different’s sake.

See Image 1 (Adoption Drivers) for a high-level summary of each product architype’s defining characteristic and how they rate in terms of disease awareness and competitor differentiation.

How each archetype interacts with the pillars of disease awareness and competitor differentiation underpins what that product will face when it is introduced to the healthcare research market (in the case of IMPs) or to the healthcare prescribing market (in the case of recently market-authorized drugs and devices).

For example, a market pioneer may not face any competition at either end of the development spectrum, but the healthcare ecosystem in which it will be studied or prescribed won’t be fluent in the problem that the market pioneer aims to solve. An effective launch campaign for either an IMP or a new drug will therefore consider these market realities when deciding what is needed to make a campaign a success.

And what informs that need is whether a habit needs to be formed or broken for adoption to take root.

Habits: The Gatekeepers To Adoption

Humans are often described as creatures of habit. Much of our behavior is driven by the routines and patterns that we develop over time because they help simplify life, reduce cognitive load, provide comfort and security, and are often influenced by social and environmental factors. Product adoption and the act of forming habits are closely related as both processes involve integrating a product or behavior into an individual’s routine or lifestyle. And when we align product adoption strategies with habit-forming techniques, we can create successful studies or market launches that encourage deeper and more sustained engagement.

In its most basic sense, therefore, adoption of a product is akin to forming a new habit or breaking an old one. Looking at adoption through this lens, it is helpful to consider the type of newness that a product will be facing. When it comes to adopting something, newness is always about change, but are we changing to make room for something new (market pioneers and market segmenters), or are we switching from something that exists to something new (market re-engineers and market stand outs)? If we aim to adopt the brand spanking new, then the archetype’s defining adoption attribute is habit building. If we are switching from an established product to a new one, then the defining attribute is habit breaking.

These are important barometers that point us in the right direction when it comes to identifying the adoption strategies that will best play to each archetype. For example, in the case of a market pioneer, an effective on-market launch campaign must rectify the lack of disease awareness among providers, patients, and payers before prescriptions are written, taken to the pharmacy to be filled, and reimbursed by healthcare plans. A similar focus on raising disease awareness impacts the market pioneer IMP when it seeks adoption in the research market by sites and patient volunteers. Therefore, inform and educate are the cornerstone adoption strategies for the market pioneer, targeting prescriber-investigators and patient-volunteers on the problem itself, and then (in the case of market launch) showing payers it is, literally, a problem worth solving. Successful examples of market pioneers include Gardisill to protect against HPV and Viagra for erectile dysfunction.

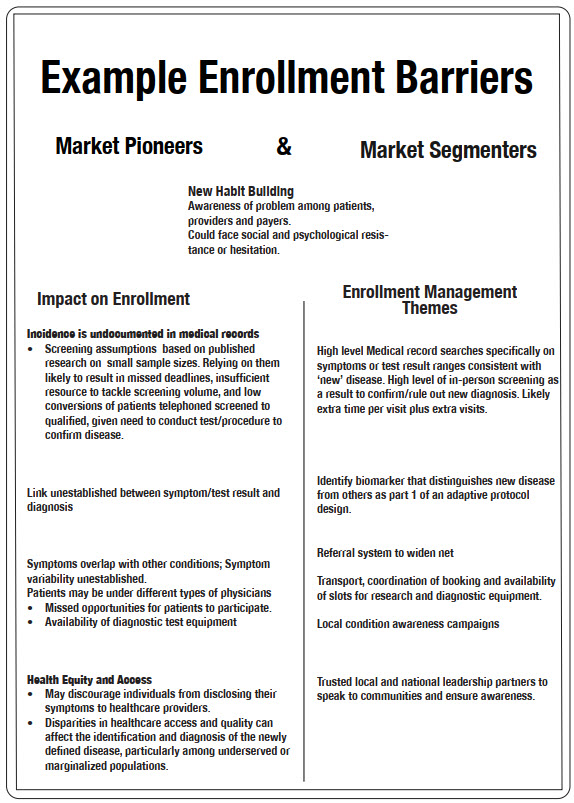

Image 2 explores potential adoption strategies best suited to each product archetype.

Translating adoption strategies into launch campaigns requires a talent approaching the level of artform. Need men to be okay with telling a doctor they’re “having trouble in the bedroom”? Get famous sports figures to admit to the same problem in a series of ads on the Golf Channel, and watch prescriptions get filled. Strategies such as this are designed to address a drug’s defining adoption attribute and require a deep understanding of current behaviors, practices, and preferences among patients, prescribers, and payers. This understanding is the foundation on which all else is built, be it patient enrollment or prescription sales. Failing to be fluent in this area is akin to constructing a house without a ground floor: anything subsequently built on faulty foundations likely won’t be strong enough to withstand the winds necessary to change the habits that underpin the healthcare status quo. We seemingly accept this truth when it comes to market launches, but when it comes to study ones, it gets lost among the million or so tasks we need to do to get a trial up and running. Yet aggressively addressing an IMP’s defining adoption attribute in a non-promotional way during study preparation would transform study’s launch, effectively shortening the time lapse between launch and FPFV. In the final article, we explore how various drug candidates come inherent with barriers to adoption, in the market and among participants and providers in clinical research, as well as ways in which to address these hurdles for faster, less costly trials.

About The Authors:

Kym Eves is a principal at ReNable Research, where she helps companies deliver clinical trial enrollment as well as promising new tools that make drug development so much easier. With a career spanning a variety of senior management and board roles, Kym has a rare combination of SMO/CRO/biotech/clintech leadership experience, giving her a deep understanding of the problems and challenges faced by every trial and drug development stakeholder, and which has been distilled into the Enrollment Delivery Platform. Kym founded one of the first site management organizations in the U.S., is an Ernst & Young U.K. Life Sciences Entrepreneur of the Year, and a recipient of the Gold Stevie Award for Female Executive of the Year in Europe, the Middle East, and Africa. She is a member of the London Mayor’s Business Advisory Board and a former Entrepreneur in Residence for Life Sciences at Cambridge Enterprise.

Kym Eves is a principal at ReNable Research, where she helps companies deliver clinical trial enrollment as well as promising new tools that make drug development so much easier. With a career spanning a variety of senior management and board roles, Kym has a rare combination of SMO/CRO/biotech/clintech leadership experience, giving her a deep understanding of the problems and challenges faced by every trial and drug development stakeholder, and which has been distilled into the Enrollment Delivery Platform. Kym founded one of the first site management organizations in the U.S., is an Ernst & Young U.K. Life Sciences Entrepreneur of the Year, and a recipient of the Gold Stevie Award for Female Executive of the Year in Europe, the Middle East, and Africa. She is a member of the London Mayor’s Business Advisory Board and a former Entrepreneur in Residence for Life Sciences at Cambridge Enterprise.

Liam Eves is a principal at ReNable Research, where he helps accelerate the delivery of clinical trials. After an injury ended his career as a professional footballer, Liam shifted gears by moving into neuroscience research, subsequently leading site management organizations, CROs, and clintech companies. He heralded the birth of a trial delivery methodology that industrialized good enrollment practices, allowing him to scale a single research site to deliver over 85,000 patients annually and to build a £27m/year Phase 2 specialty site, all the while maintaining a 97.3% delivery success rate for almost a decade. His experience spans over 12 therapeutic areas and across many continents. Liam also advises venture capital firms and clinical trial service and technology providers and shares his insights as an author and clinical trial podcast host.

Liam Eves is a principal at ReNable Research, where he helps accelerate the delivery of clinical trials. After an injury ended his career as a professional footballer, Liam shifted gears by moving into neuroscience research, subsequently leading site management organizations, CROs, and clintech companies. He heralded the birth of a trial delivery methodology that industrialized good enrollment practices, allowing him to scale a single research site to deliver over 85,000 patients annually and to build a £27m/year Phase 2 specialty site, all the while maintaining a 97.3% delivery success rate for almost a decade. His experience spans over 12 therapeutic areas and across many continents. Liam also advises venture capital firms and clinical trial service and technology providers and shares his insights as an author and clinical trial podcast host.