Understanding Key Early Phase Clinical Trial Cost Drivers

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

Pharmaceutical companies have been implementing intensive cost–saving efforts in the recent years through mergers, reducing overheads, and trimming down of entire business units for efficiency.1 These efforts have increased the need to outsource services to external vendors throughout the R&D value chain. The early phase clinical trial market in 2014 saw an approximate outsourcing rate of 56 percent with most of the patient studies being externalized to both global and specialist CROs. As cost efficiency is the main focus for pharma, it is important to understand the cost behavior of outsourcing services.2

Pharmaceutical companies have been implementing intensive cost–saving efforts in the recent years through mergers, reducing overheads, and trimming down of entire business units for efficiency.1 These efforts have increased the need to outsource services to external vendors throughout the R&D value chain. The early phase clinical trial market in 2014 saw an approximate outsourcing rate of 56 percent with most of the patient studies being externalized to both global and specialist CROs. As cost efficiency is the main focus for pharma, it is important to understand the cost behavior of outsourcing services.2

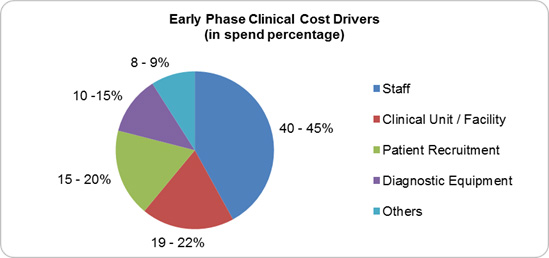

An important step in identifying the cost behavior of any outsourced category is to identify the cost drivers that determine the overall cost of the service. Once this is understood, strategies can be devised to reduce the biggest cost driver and also help in the negotiation process with the service provider. Let us now take a look into the key cost drivers for an outsourced early phase clinical trial service (Figure 1).

Figure 1; Source: Beroe Analysis

1. Staff or Resource Cost

Staff cost is the biggest driver within the early phase clinical trial category ranging between 40 to 45 percent of the overall cost. The early phase market saw Phase 1 staffing costs rise by 157 percent from 2008 to 2013 as the average number of CRAs assigned to a Phase 1 trial increased.3,4 This staff increase is a result of the increased complexity of early phase trials with a mean number of 100 procedures per patient for Phase 1 trials as of 2012 to 2013.5 The largest staff categories deployed for Phase 1 trials are CRAs and Data Managers with an average FTEs of 2.5 to 4.1 per trial.6 Suppliers build their staff cost by factoring unit prices per task along with the number of FTEs involved to carry out that task. Each of these tasks has a dedicated team consisting of nurses, project managers, sub-investigators, pharmacists, regulatory managers, clinical research associates, medical officers, etc. The cost to train these resources is also factored under this cost component.

2. Clinical Unit / Facility

Clinical unit refers to the costs related to running a clinical pharmacology unit (CPU) which is owned by the supplier to carry out early phase trials. The CPU costs are calculated on a per bed per day basis including staff surveillance costs comprising catering, overhead, and administration expenses.7 This cost factor can vary between 15 to 35 percent of an overall budget depending on the study design. Important to note, however, is that some suppliers include the clinic and screening resources cost as a part of this cost component rather than the staff or resource cost.

3. Patient Recruitment

High risk-benefit balance when hiring a healthy volunteer and dropout rates make patient recruitment the third-largest cost driver, ranging between 15 to 20 percent. Oncology clinical trials have the highest dropout rate, wherein a particular study showed 71 percent of the seven clinical sites that ran the trial were unable to enroll patients after initiation.8 Stringent regulations (i.e., the rule that a study subject is not allowed to participate in multiple studies) also add to the complexity, driving costs up as the number of patients needed for a trial increases. The main cost parameter is the recruitment cost, which is low for recruitment of healthy volunteers at 3 percent and high for study specific population at around 15 percent. Apart from the above costs, subject / patient compensation and the activities carried out within the recruitment department i.e. advertising, internal database management, and screening process also fall under this cost parameter.

4. Diagnostic Equipment

This cost driver varies based on the biologic compounds that are in the study, as certain types of compounds require diagnostic equipment only available in specialty labs. The cost includes routine equipment user fees for ECG machines, bed cardiac telemetry monitoring devices, etc. and for lab supplies, including drug testing equipment, breathalyzers, bed cardiac telemetry monitoring, tympanic thermometers, blood pressure cuffs, and general clinical supplies (syringes, swabs, specimen collectors, etc).The overall total cost incurred for diagnostic equipment is calculated per item as a sum of material and staff costs. Depending on the study design and type of tests required, this cost can vary between 12 to 20 percent.

5. Clinical Trial Management System (CTMS), Clinical Data Management, and Biostatistics

Digital software is adopted at a rate of 70 percent for site monitoring and 60 to 65 percent for site assessment, initiation, management, and subject enrolment, making this an additional cost to full-service outsourcing suppliers.9 The CTMS cost includes the license fees payable to EDC, ePRO, eCRF, and other technology solutions providers. The bio-statistical analysis and report writing service cost would fall under this cost factor which encompasses data Quality Check (QC), Case Report Form (CRF) transcription (paper or EDC), data query resolution, and archiving. This cost factor varies between 8 to 10 percent depending on the software being used for data analysis.

Apart from the above costs, other expenses incurred by a supplier to carry out an early phase trial include medical writing services (protocol, subject information/ICF), principal investigator fees, IMP and biological samples storage, and clinical monitoring, etc. There are also pass- through costs to consider, such as IRB fees and advertising costs. By understanding what drives each cost parameter, pharma companies and their suppliers can better plan to reduce each of these cost drivers to enable overall cost benefits.

References

- http://blog.mdsol.com/what-are-the-key-cost-drivers-in-clinical-trials/

- http://www.ey.com/Publication/vwLUAssets/EY_News_release_Big_Pharma_facing_historic_upheavals/$FILE/EY-News-release-Big-Pharma-facing-historic-upheavals.pdf

- http://www.cuttingedgeinfo.com/press-release/as-early-stage-clinical-trial-costs-rise-late-stage-costs-level-off/

- http://www.pharmatimes.com/article/13-11-12/Early-stage_exacerbating_trial-cost_inflation.aspx

- http://www.phrma.org/sites/default/files/pdf/PhRMA%20Profile%202013.pdf

- https://globalhealthtrials.tghn.org/site_media/media/articles/OAJCT-8172-clinical-data-management--current-status--challenges--and-fu_0619101.pdf

- http://www.ehma.org/files/WP-6-HealthBASKETSP21-CT-2004-501588_D18_France.pdf

- http://www.businesswire.com/news/home/20130826005180/en/Dropout-Rates-Oncology-Phase-Trials-Remain-10#.VVCK4Y7vPIU

- http://www.appliedclinicaltrialsonline.com/clinical-technologies

About the author: Mathini is an experienced analyst in the Pharma R&D vertical. She specializes in understanding the market scenario and industry dynamics across the globe in the outsourcing arena. Her analysis on specific clinical research service segments has enabled large pharma companies in their strategic decisions on service outsourcing contracts. She completed her Masters in Management from University College London and is also an engineer with a background in Bioinformatics.