Use Of Wearable And Sensor Applications In Clinical Trials Is Booming

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

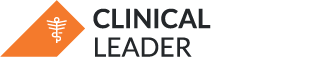

As of 2020, approximately 460 wearables studies are ongoing, per clinicaltrials.gov. Experts predict 50% of clinical trials will incorporate wearables and sensors by 2025, against the 10 to 15% at present.1 Chemical sensors remain the largest segment, playing a role in detection of biomarker chemicals such as glucose for monitoring and maintenance of chronic diseases. The healthcare costs they save are a key market growth factor. Figure 1 shows the estimated market value of wearables and sensors to be $38.6 billion, with a CAGR of 19%, reaching $54.6 billion by 2023.

Figure 1: Wearables & Sensors Market by Revenue (in USD Billion)

Source: Beroe Analysis

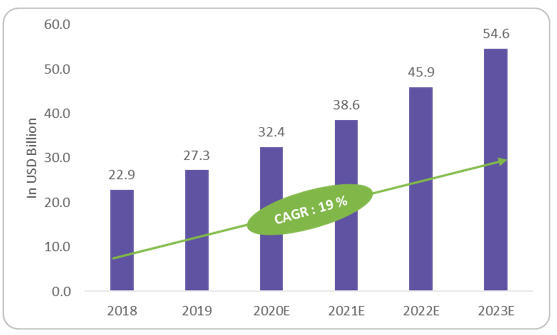

The smartwatch wearable segment holds the largest market share at 60% at present and is expected to increase to 72% by 2022. The shift to patient-centric trials due to COVID-19 is the key growth factor. As a result of personalized healthcare, the demand for Actigraph and Apple watches rose, with rapid penetration by brands such as Xiaomi, Huawei, Garmin, and Samsung. However, fitness trackers are experiencing a slowdown in market adoption, while hearables are experiencing faster growth and a larger presence in the marketplace. Among regulated devices used in trials (Figure 2), the market is dominated by insulin pumps at over 50%, followed by blood pressure monitoring, attributed to hypertensive patients, who make up 20 to 37% of the global population. Continuous glucose monitoring (CGM) saw high growth of $1.3 billion in 2019.2 Similarly, cardiovascular monitoring is also expected to see significant growth, with focus on extended-wear Holter monitors and mobile cardiac telemetry devices.

Figure 2: Regulated Wearable Devices by Product Category

Source: Beroe Analysis

Key Market Trends

Around 1,600 clinical trials were conducted using wearables in 2020, with the numbers likely to rise as a result of increasing virtual trials and remote data collection due to COVID-19.3 Patient engagement can be driven through digital solutions that capture patient data in a remote setting. This helps with patient retention, eliminating the need for additional recruitment.

Trend That Has Seen Success: Remote Monitoring

Wearables are being used by pharma companies to track patients’ health data, such as heart rate, respiratory rate, blood oxygen saturation level, and body posture. For example, Pfizer provided wearable trackers to measure how often eczema patients were scratching in their sleep in their homes, rather than monitoring patients at sleep clinics.

Emerging Trend: Ingestible Sensor-Embedded Pill

Implantable devices and ingestible sensor-embedded pills are newly emerging in the healthcare sector. The first ingestible sensor of Proteus was approved by the FDA in 2015 to improve patient adherence.6 Following this, the first digital pill – Abilify MyCite – was approved for patients with conditions of schizophrenia, manic and mixed episodes associated with bipolar I disorder, and as an add-on for depression.7

Opportunity To Seize: Faster Tech Implementation

Integrating Big Data, IoT, AI, and machine learning into wearable technologies will support greater reach of wearables in the industry. Integration of AI would enable devices to collect more relevant data for improved understanding of patient behavior and vital signs and enable better treatment plans.

Wearable Sensor Technology And Application In Clinical Trials

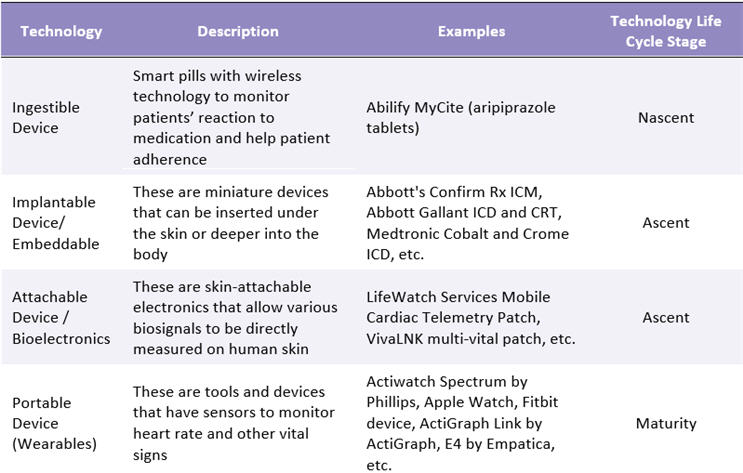

Wearable and sensor technologies have evolved into more reliable products for monitoring of stress levels, blood pressure, glucose levels, emotions, eye movements, and VO2 max and for carrying out electromyography (EMG) and electroencephalography (EEG).4 The FDA approved almost 200 digital health products from 2017 to 2019. Among these, wearable sensor-enabled technologies received the most approvals at 58.5 Table 1 provides an overview of the technologies widely used in clinical trials and their respective life cycle stages.

Table 1: Wearable Sensor Technology Overview

Source: Beroe Analysis, Secondary Research, Company Literature

Currently, wearable sensors focus on physical activity and vital sign tracking and do not capture molecular level information. As an alternative to this, biofluids (sweat) can be accessed noninvasively and analyzed to provide physiologically meaningful measures of biomarkers.6

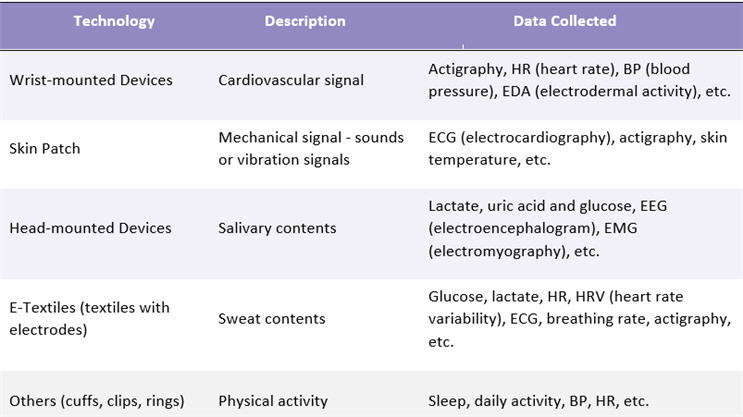

General medicine trials are where the majority of wearables are used to measure multiple numbers of variables such as body temperature, ECG, breathing rate, etc. Wearables are largely targeted at chronic diseases such as neurology, phycology, endocrinology, and cardiology. These wearables have a large impact on patients with diabetes, heart condition, stress management, and neurodegenerative diseases. Table 2 provides an overview of the data collected by wearable type.

Table 2: Wearables Sensor Type and Data Collected

Source: Beroe Analysis, Secondary Research, Company Literature

Conclusion

Successful companies combine robust wearable sensors with AI algorithms that either improve the accuracy of measurements, provide for medically relevant interpretations of measurements, or both. Currently, new product innovations focus on monitoring systems and sensors for body vital signs and for cardiovascular and diabetes management. Examples include sugarBEAT, BEAT platform by Nemaura Medical, Inc., BioSticker by BioIntelliSense Inc., Confirm Rx insertable cardiac monitor (ICM) by Abbott, RD SET sensors by Masimo, multi-vital patch by VivaLNK, Medtronic Cobalt, Crome ICD Portfolio, and Philips Biosensor BX100.

There are multiple companies for pharma companies to partner with based on the therapeutic area and data to be monitored in their clinical trials. The companies providing health, wellness, and technology solutions are a mix of established and niche players. There are also medtech companies that focus on medical solutions to manage health, as well as established consumer electronics and technology companies such as Google, Apple, Fitbit, Garmin, etc. It is recommended that trial sponsors partner with a mix of established and niche/specialist players to get the best of technology and innovation.

References

- Y. Jansen and G. Thornton, “Wearables & Big Data In Clinical Trials — Where Do We Stand?,” Clinical Leader, February 2020. [Online]. Available: https://www.clinicalleader.com/doc/wearables-big-data-in-clinical-trials-where-do-we-stand-0001. [Accessed August 2021].

- R. Zipp, “CGM patients seen rising 38% in 2021 fueled by Type 2 diabetes: poll,” www.medtechdive.com, March 2021. [Online]. Available: https://www.medtechdive.com/news/cgm-patients-seen-rising-38-in-2021-fueled-by-type-2-diabetes-poll/596914/. [Accessed 2021].

- Valencell. Inc , “Wearables in Clinical Trials: Opportunities and Challenges,” Valencell. Inc , 2019. [Online]. Available: https://valencell.com/blog/wearables-in-clinical-trials-opportunities-and-challenges/. [Accessed 2021].

- T. Weerasinghe, “Wearable Devices: Is Growth Wearing-off?,” SPEEDA, February 2019. [Online]. Available: https://asia.ub-speeda.com/en/wearable-devices-growth-wearing-off/. [Accessed 2021].

- MERCOM Capital Group, “Wearable sensors companies received the most approvals,” MERCOM Capital Group, February 2020. [Online]. Available: https://mercomcapital.com/digital-health-products-received-fda-ce-approvals/. [Accessed 2021]

- O. Parlak, A. Turner and A. Salleo, “Wearable Bioelectronics - A volume in Materials Today,” ScienceDirect, 2020. [Online]. Available: https://www.sciencedirect.com/book/9780081024072/wearable-bioelectronics. [Accessed 2021].

- J. Enriquez, “FDA Clears First Ingestible Device For Medication Adherence,” July 2015. [Online]. Available: https://www.meddeviceonline.com/doc/fda-clears-first-ingestible-device-for-medication-adherence-0001. [Accessed September 2021].

- D. Andalo, “FDA approves first digital pill,” The Pharmaceutical Journal, November 2017. [Online]. Available: https://pharmaceutical-journal.com/article/news/fda-approves-first-digital-pill. [Accessed September 2021].

About The Author:

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios across the globe in the outsourcing arena. Her analysis has enabled global fortune 500+ companies in their strategic decisions on supply base optimization, risk reduction, innovation and efficient sourcing. She has written for several publications related to R&D procurement opportunities. With her category knowledge, she has published 35+ articles in leading journals, co-authored with industry experts. She has a master's in management from University College London (UCL) and has worked as a consultant in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com and connect with her on LinkedIn.

Mathini Ilancheran is the principal analyst of R&D for Beroe Inc. She specializes in understanding market scenarios across the globe in the outsourcing arena. Her analysis has enabled global fortune 500+ companies in their strategic decisions on supply base optimization, risk reduction, innovation and efficient sourcing. She has written for several publications related to R&D procurement opportunities. With her category knowledge, she has published 35+ articles in leading journals, co-authored with industry experts. She has a master's in management from University College London (UCL) and has worked as a consultant in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com and connect with her on LinkedIn.