What Can Clinical Researchers Learn From Commercial Product Launches?

By Kym Eves and Liam Eves, principals, ReNable Research Ltd.

The term “launch” holds significant weight in the pharmaceutical industry, symbolizing the moment when1 a new drug emerges onto the market and debuts its benefits to healthcare practitioners and the general public alike. It’s also a term embraced by R&D to signify the commencement of a clinical study –– the metaphorical gunshot moment when the study gates fling wide and the race for patient participation is on. Yet regardless of whether the goal is to achieve sales or patient enrollment targets, successful launches go beyond a mere introductory moment; they are meticulously planned strategic endeavors that foster awareness, generate excitement, and encourage active engagement from the target audience on an ongoing basis.

But despite our industry’s efforts to create successful new drug and clinical trial launches, we are falling short. Only one in five clinical trials reaches completion within its stipulated time frame, with the median delay extending to an alarming 66.7% longer than initially planned.2 Two-thirds of new drugs fail to meet their prelaunch sales expectations in their inaugural year, with those missing their targets continuing to underperform for at least another two years.3

So, what is going on? It cannot be a coincidence that most launches at both ends of the drug development spectrum are failing to deliver. Certainly, within pharma sales and marketing, staff have the skills to produce highly successful launches (and from whom clinical trial management could learn a thing or two). So, something inherent must have changed within the fabric of our industry that needs addressing if we hope to avoid further skyrocketing of development costs and the shortening of our on-market patent protection horizon. Simply put, we haven’t adjusted many of our seminal, engrained behaviors to account for the very brave new world we face in bringing modern therapeutics to market.

This three-part series explores the dynamic nature of modern drug development and its impact on study and new drug launches, with a keen focus on how to “research-enable” launch activities to overcome today’s clinical trial challenges in patient enrollment.

For those weary of the financial drain caused by recruitment setbacks and unmet site management needs, delving into this topic will uncover the frequently missed root causes hindering both types of launches that can be overcome if raised from obscurity to the attention they deserve.

The Top Two Reasons Clinical Trials Fail To Launch

The commonality of trial launch failure is a complex cocktail of causes, each of which needs addressing if our industry’s performance track record is to improve. We have isolated two root causes for discussion in this series:

- the absence of tried and tested product launch tactics in trial preparation activities and

- failure to recognize, prioritize, and fund site operational activities based on the enrollment nuances of the IMP under study.

The Role Of Product Launch Tactics In Trial Preparation Activities

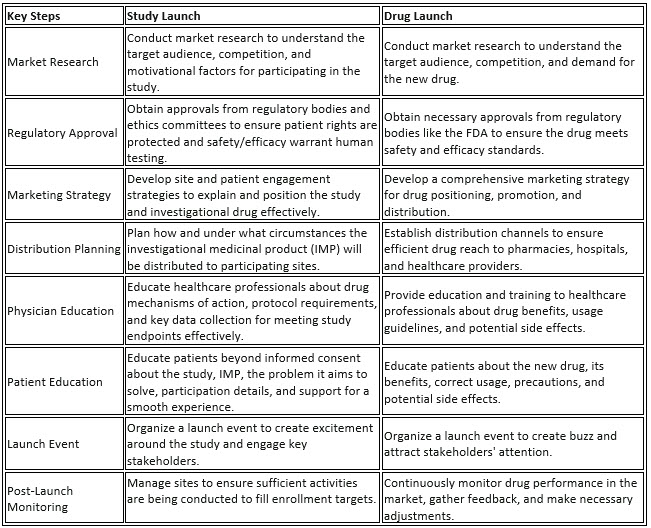

Introducing a clinical study to researchers and a novel drug to market have more in common than we tend to think. Both should involve an overarching strategic process that covers market entry, promotion, and distribution to lay the foundation for successful adoption (interest) and utilization (participation). Table 1 below illuminates the shared key steps between both types of launches while underscoring the inherent differences in their respective goals.

The main difference between the two is, of course, that one is trying to promote a market-authorized product whereas the other is trying to get volunteers to participate in one of the data-gathering exercises (a clinical trial) that will eventually inform the marketed product’s package insert. Historically, that has meant keeping anything associated with pharma marketing (like launch methodology) as far away from R&D as possible to:

- Avoid conflicts of interest: There's a potential conflict of interest if the same individuals or teams involved in selling the pharmaceutical products are also involved in conducting clinical trials. This could compromise the integrity of the trial process and raise concerns about biased reporting of results.

- Be regulatory compliant: Regulatory bodies require strict separation between the entities responsible for conducting clinical trials and those responsible for marketing and sales. This helps ensure that trials are conducted impartially and that marketing claims are based on valid evidence.

- Maintain ethical rigor: Maintaining a clear separation between sales and clinical trials helps uphold ethical standards within the pharmaceutical industry. It ensures that patient welfare and scientific rigor remain the primary focus during the trial process, rather than commercial interests.

Yet this well-meant desire to “stay in our R&D swim lane” means we have thrown a lot of the baby out with the pool water, so to speak. There are many useful approaches R&D can adopt from product launch management when it comes to new IMPs hitting the research market that won’t cross lines and would significantly help staff execute trial responsibilities better and with less stress. If we solely focus on aspects of preparing the market for a new entrant (i.e., “priming”), healthcare practitioner (i.e., site), and study subject awareness, education, and engagement, the core principles and their corresponding activities that market launch and study launch share become clear.

Both involve targeting specific audiences relevant to the respective goals. While patient identification targets individuals who meet specific criteria for participation, product launch marketing and promotion target healthcare professionals and patients who are potential users of the new medication.

Both activities require strategic communication to convey key messages effectively. Patient identification activities aim to communicate the benefits and risks of participation in clinical trials as well as what it means to participate in a trial. Similarly, product launch marketing and promotion involve communicating the benefits and features of the new medication to healthcare providers and patients, highlighting its efficacy, safety, and unique selling points.

Both activities involve education and information dissemination to engage the target audience and facilitate informed decision-making. Patient identification activities provide information about the clinical trial process, eligibility criteria, and potential benefits and risks to help individuals make decisions about participation. Similarly, product launch marketing and promotion provide educational materials and information about the new medication, its indications, dosing, administration, and potential side effects to support healthcare providers and patients in making treatment decisions.

Both activities involve building relationships with key stakeholders. Patient identification activities require collaboration with healthcare providers, patient advocacy groups, and community organizations to identify and reach potential participants. Similarly, product launch marketing and promotion involve building relationships with healthcare professionals, patient advocacy organizations, and opinion leaders to raise awareness and build trust in the new medication.

As the above demonstrates, both study and product launches require skilled staff, meaningful planning, and, ultimately, the right amount of investment to do justice to these activities. And yet even though there are many similarities between introducing a new drug into the healthcare market and introducing a new IMP into research, the amount we spend on these launch activities is drastically different.

Priming the healthcare ecosystem for a new IMP requires explicit investment.

Much of readying a clinical trial for launch is consumed by the regulatory, SOP, and contractual administrative tasks associated with getting sites legally and ethically positioned to commence patient enrollment. It is time fully justified and well spent, but if our goal is to improve the delivery of patient enrollment, we should be treating that process as only one of two critical workstreams, rather than the main or only workstream. That second workstream should, of course, be the study launch activities best suited to each IMP, and it should contain tasks such as enrollment strategy development, patient and site engagement planning and execution, awareness campaigns, advertising, education, and investigator/site staff relationship management. An effective study launch workstream goes much further than mere patient recruitment advertising; it is about priming the wider research market for the maximum education, engagement, uptake, and participation of sites and qualified patients. Yet an analysis of how much is typically spent on these activities finds that such tasks are only a fraction of the funding we allocate to duties such as clinical monitoring or site contract negotiation. Often, they don’t even make it to budget line-item status. In our experiences across a variety of indications and product types, it isn’t unusual for only 5%–8% of total Phase 1-3 clinical trial spending to be allocated to these types of study launch activities.

In contrast, new drug launch budgets reveal investment in education and engagement of physicians, payers, and target patients to be between 45% and 70% of total launch spending3. While we don’t propose mirroring the level of investment seen in product launches for our trial launch activities, we should allocate more resources, targeted planning, and more effective management to this crucial stage of our trials than we currently do. A study launch serves as the very first point of contact between the product and real-world patients and healthcare providers, making it an often-forgotten cornerstone of market introduction. The consequences of underinvestment and insufficient expertise in product launch strategies within clinical trial management are evident in our recurrent challenges with timely and budget-compliant enrollment. However, these issues merely scratch the surface of a more profound dilemma. At the core of both new drug and study launch setbacks lies a complex interplay between the evolution of drug category segmentation and the pharmaceutical industry's delayed response to the demands of today's rapidly evolving launch landscape. For clinical trials, this results in clinical trial management failing to recognize, prioritize, and fund the site operational activities specific to the enrollment nuances of the type of IMP under study. But to understand what those nuances are, we first need to understand the outdated blockbuster habits that still underpin our approach to developing and launching studies of new drugs.

Beyond The Blockbuster: A Brief History Of Categorization By Sales Potential

Traditionally in pharma, drugs were categorized primarily by sales potential, with companies setting their development sights on those products classified as “blockbusters.” A blockbuster drug can achieve or exceed $1 billion in annual sales, and this model was the gold standard for pharmaceutical success for many years, driving much of the industry's research, development, marketing strategies, and financial planning. If a product didn’t have the potential to reach this level of sales, it was considered a "non-blockbuster.”

The market landscape, however, has evolved significantly since those simpler, more binary days. Advancements in science alongside the advent of patent cliffs and an emerging demand for value through outcomes meant that these two categories became insufficient to describe the ensuing myriad of product sales potential; as a result, a whole host of new drug categories entered our lexicon. “Niche-buster,” for example, refers to a drug that targets smaller, specific patient populations like orphan diseases, whereas a specialty drug treats complex, chronic, or life-threatening conditions such as cancer, rheumatoid arthritis, and multiple sclerosis. Granularization in market potential ran hand-in-hand with the advent of stratified, precision medicine, changing the launch board game at the rules level by demanding pharma adopt a more nuanced, risk-managed, and patient-centric approach to launches across product portfolios.

So how successful have our new drug launch colleagues been in adapting to this brave new world? Not very. According to the McKinsey article we referenced in our introduction, two-thirds of new drugs fail to meet prelaunch sales expectations for their first year on the market, and those that fell short continued to underdeliver for at least the following two years.4 Yet, as mentioned before, those of us in clinical development have fared no better, what with our corresponding track record of only one in five trials completed on time.5

It is evident that we’re facing significant challenges in executing successful launches across the spectrum of drug development and that we need to rethink our approach to make these new types of drugs successful at both the study and market launch points of their product life cycle.

The McKinsey article cited above goes a long way to illuminating what drives a successful market launch today, and it inspired the authors to incorporate its insights into the Product Adoption Matrix component of the authors’ Enrollment Delivery Platform — a highly refined clinical trial delivery model fueled by hard-earned, practical insights into the nature of successful enrollment across thousands of clinical studies involving many different types of products, indications, countries, and cultures.

The matrix itself zeroes in on the critical success factors associated with introducing innovation into established systems, illuminating the common ground between study and new product launches and exposing the complex interaction between market dynamics and research to reveal the key drivers behind behavior change that underscore both product adoption and patient enrollment for the types of products we are producing today. The platform represents a new way of thinking and offers insights that can greatly improve patient enrollment and ultimately, trial delivery.

In the following two articles, we share the mechanics behind these new product adoption principles and offer examples of how an updated approach can focus trial management efforts in the right places to successfully fulfill patient enrollment targets.

References:

- Shadbolt, C., Naufal, E., Bunzli, S., Price, V., Rele, S., Schilling, C., ... Dowsey, M. (2023). Analysis of Rates of Completion, Delays, and Participant Recruitment in Randomized Clinical Trials in Surgery. JAMA Netw Open, 6(1), e2250996. doi:10.1001/jamanetworkopen.2022.50996

- Hemant Ahlawat, Giulia Chierchia, and Paul van Arkel, "The Secret of Successful Drug Launches," March 2014, McKinsey & Company.

- Chang, S., Young, A., Davitian, M., Gotbetter, W., & Giovanniello, D. (2020, March). LAUNCH COSTS—SPEND WISELY: FIRST-IN-CLASS AND FOLLOW-ON LAUNCH COST ANALYSIS. Health Advances Biopharma Launch Excellence Team.

- Hemant Ahlawat, Giulia Chierchia, and Paul van Arkel, "The Secret of Successful Drug Launches," March 2014, McKinsey & Company.

- C. Shadbolt et al., "Analysis of Rates of Completion, Delays, and Participant Recruitment in Randomized Clinical Trials in Surgery," JAMA Netw Open, vol. 6, no. 1, e2250996, Jan. 2023. doi: 10.1001/jamanetworkopen.2022.50996.

About The Authors:

Kym Eves is a principal at ReNable Research, where she helps companies deliver clinical trial enrollment as well as promising new tools that make drug development so much easier. With a career spanning a variety of senior management and board roles, Kym has a rare combination of SMO/CRO/biotech/clintech leadership experience, giving her a deep understanding of the problems and challenges faced by every trial and drug development stakeholder, and which has been distilled into the Enrollment Delivery Platform. Kym founded one of the first site management organizations in the U.S., is an Ernst & Young U.K. Life Sciences Entrepreneur of the Year, and a recipient of the Gold Stevie Award for Female Executive of the Year in Europe, the Middle East, and Africa. She is a member of the London Mayor’s Business Advisory Board and a former Entrepreneur in Residence for Life Sciences at Cambridge Enterprise.

Kym Eves is a principal at ReNable Research, where she helps companies deliver clinical trial enrollment as well as promising new tools that make drug development so much easier. With a career spanning a variety of senior management and board roles, Kym has a rare combination of SMO/CRO/biotech/clintech leadership experience, giving her a deep understanding of the problems and challenges faced by every trial and drug development stakeholder, and which has been distilled into the Enrollment Delivery Platform. Kym founded one of the first site management organizations in the U.S., is an Ernst & Young U.K. Life Sciences Entrepreneur of the Year, and a recipient of the Gold Stevie Award for Female Executive of the Year in Europe, the Middle East, and Africa. She is a member of the London Mayor’s Business Advisory Board and a former Entrepreneur in Residence for Life Sciences at Cambridge Enterprise.

Liam Eves is a principal at ReNable Research, where he helps accelerate the delivery of clinical trials. After an injury ended his career as a professional footballer, Liam shifted gears by moving into neuroscience research, subsequently leading site management organizations, CROs, and clintech companies. He heralded the birth of a trial delivery methodology that industrialized good enrollment practices, allowing him to scale a single research site to deliver over 85,000 patients annually and to build a £27m/year Phase 2 specialty site, all the while maintaining a 97.3% delivery success rate for almost a decade. His experience spans over 12 therapeutic areas and across many continents. Liam also advises venture capital firms and clinical trial service and technology providers and shares his insights as an author and clinical trial podcast host.

Liam Eves is a principal at ReNable Research, where he helps accelerate the delivery of clinical trials. After an injury ended his career as a professional footballer, Liam shifted gears by moving into neuroscience research, subsequently leading site management organizations, CROs, and clintech companies. He heralded the birth of a trial delivery methodology that industrialized good enrollment practices, allowing him to scale a single research site to deliver over 85,000 patients annually and to build a £27m/year Phase 2 specialty site, all the while maintaining a 97.3% delivery success rate for almost a decade. His experience spans over 12 therapeutic areas and across many continents. Liam also advises venture capital firms and clinical trial service and technology providers and shares his insights as an author and clinical trial podcast host.