Explosive Investment In Virtual Trial Companies: The Latest Data

By Justin Culbertson, Life Sciences Senior Analyst with RSM US LLP

Virtualization affects the general public as well as investors, whether it applies to clinical trials, life sciences, or healthcare. A Google trends search related to “remote health care,” a topic that significantly benefits virtual clinical trials, shows that interest in the topic has more than doubled since the start of the pandemic and increased nearly five-fold since early 2016. In addition, if you listen in on recent earnings calls for publicly traded clinical research organizations, you will hear the topics of decentralization or virtual capabilities discussed frequently in some regard.

In this article I’ll take a look at this blossoming ecosystem and investment growth in the virtual trial space, specifically virtual trial companies that are foregoing the legacy clinical trial models and leveraging new technologies to, hopefully, change the future of clinical research. Further, I’ll explore the power of the virtual trial platform and the key areas life sciences companies should consider when working with these virtual partners.

What Are Virtual Trial Companies?

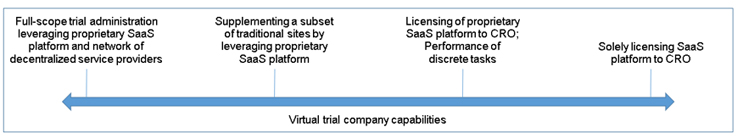

As is the case with legacy clinical research organizations (CROs), virtual trial companies have no “one size fits all” description. As the industry has been educating all of us on the definition of decentralization, there has been a shift from freely using the term “decentralized clinical trials” as a descriptor for trials utilizing significant levels of virtualization to an acknowledgement that virtual clinical trials reside on a sliding scale of virtualization. On one end of that scale is a clinical trial model operating solely through brick-and-mortar sites. On the other end of that scale is a fully decentralized trial, absent brick-and-mortar sites and relying heavily on virtualization. The middle of that scale, with varying levels of virtualization, is where the majority of clinical trials reside today. I prefer a similar approach to our description of virtual trial companies.

A description of the sliding scale for virtual trial companies might look something like this. On one end, a virtual trial company might operate as the sole administrator of a clinical trial reporting directly to the trial sponsor. In this capacity, the virtual trial company is almost indistinguishable from a full-scope CRO. The primary differentiator is often the virtual trial company’s proprietary software as a service (SaaS) platform, which it leverages to align practices between all sites, connect participants to its network of decentralized service providers, and, in some cases, move away from the use of traditional sites. On the other end of that scale, a virtual trial company might not be involved in the administration of the clinical trial. Instead, it may simply license its SaaS platform to a CRO, with which the CRO obtains the aforementioned benefits of the platform. The middle of that scale could be any combination of these scenarios previously provided, including the performance of discrete tasks while supplementing a subset of traditional sites.

Considering A Partnership With A Virtual Trial Company?

As seen in the legacy CRO space, there are exceptions to the rules on defining a virtual trial company. Similar to how some CROs do not perform full-scope administration of clinical trials, instead opting to focus on one specific area of the trial, such as early-stage research and analytics, there are also virtual trial companies that operate in discrete areas of the clinical trial process. While it is the goal of many virtual trial companies to leverage their SaaS platform to provide a unified home for these discrete virtual offerings, such as electronic clinical outcome assessments, telemedicine, and patient recruitment, many virtual trial companies emphasize only one of these components. Sponsors and traditional CROs should consider their needs and the following areas of emphasis when looking for a virtual trial partner.

Unique to virtual trial companies is what I will refer to as “the power of the platform.” The power of the leading virtual trial company platforms is that they consolidate the discrete offerings of a clinical trial into a single home. While the virtual trial company might be inclined to have sponsors and traditional CROs utilize all of these offerings, it isn’t necessary. If the sponsor or CRO is looking for best-in-class patient recruitment utilizing new capabilities in artificial intelligence and machine learning, the virtual trial company has already vetted these providers and integrated these capabilities into its platform. The sponsor or CRO can use that sole offering while preparing itself for a potential full integration into the virtual trial platform in the future.

One question that continues to come up in our conversations with life sciences executives is: How are companies addressing the labor shortage? With there being more job openings than available workers, everyone is feeling the labor crunch. This is where the virtual trial company’s decentralized network of service providers can be beneficial. As clinical trial needs scale, the labor pool can more easily scale through identifying capacity in this network versus traditional recruitment processes. As an aside, this flexibility isn’t necessarily unique to virtual trial companies. Legacy CROs are also utilizing many of the same provider networks.

New Entrants And New Money

Clinical research has thrived during the COVID-19 pandemic. The services sector of life sciences, comprising clinical research and other companies, has outperformed all other sectors. It is understandable as the industry has been at the forefront of vaccine research and the FDA approval process while continuing to maintain its robust legacy contract backlog in areas such as oncology. But one thing that has been made evident through the pandemic is the limitation of the legacy clinical trial model. As noted in my separate article on decentralized clinical trials, Decentralized Clinical Trials: What Are The Opportunities For Data & Cost Savings?, Phase 3 clinical trial durations have increased from approximately two years in 2009 to approximately 3.25 years today. At some point, this trend of increasing trial duration has to reverse; otherwise, the patient will feel the brunt of the impact as it takes longer for life-changing treatments to come to market.

Virtual trial company executives have spoken to the reduced duration they hope is possible through leveraging their SaaS platforms. In some cases, these executives are aiming for two-year or even one-year trial durations. At face value, these would be remarkable reductions. Aside from the need for virtualization due to the COVID-19 pandemic, these ideas of reducing trial duration are extremely attractive and could provide a significant economic benefit to patients as well as investors.

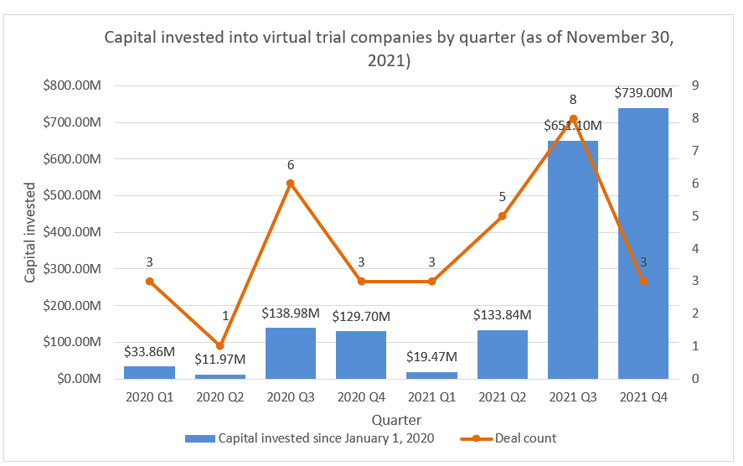

Investors are taking note of the opportunities with virtual trial companies. Aside from the numerous partnerships between these companies and large CROs, investment has been growing exponentially over the past few quarters. Since Jan. 1, 2020, there has been approximately $1.9 billion in disclosed investment in virtual trial companies. Approximately 75% of that investment has been in the past two quarters, which points to a cautiously optimistic and continued investment into this space.

Source: RSM US LLP; Pitchbook Data

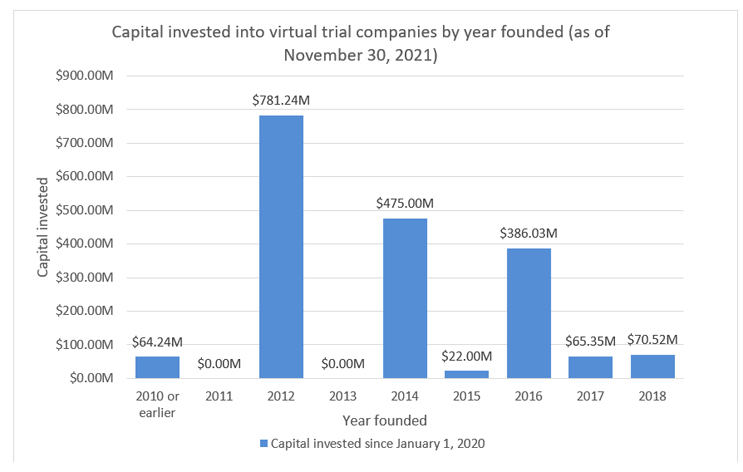

While we talk about these virtual trial companies being “new” to the market, the reality is that over 40% of these companies were founded in 2010 or earlier; however, investments made into these companies have been significantly skewed toward those companies founded post-2010. Of the $1.9 billion of investment, approximately 97% has been with companies founded after 2010. Companies such as Medable and Science 37, which hold two of the largest valuations in this industry, are represented in this post-2010 population.

Source: RSM US LLP; Pitchbook Data

The New Era Of Clinical Research

Sponsors and CROs owe it to themselves and, most importantly, their patients to consider the benefits of virtual clinical trial offerings. Adopting virtual technologies doesn’t have to be an “all or nothing” situation, but lack of adoption could lead to being left behind. While investment into this space should continue, whether that investment continues to be exponential remains to be seen. One thing is certain: This isn’t the first time we’ve seen “the power of the platform” leveraged in an industry. Amazon, Facebook, and Google all utilize platforms as core to their business models. The scalability of platforms gives flexibility that is unavailable in legacy models. Hopefully, clinical research, by way of virtualization, can benefit in the same way that other industries have.

About The Author:

Justin Culbertson is a director and senior life sciences analyst at RSM US LLP. He has more than 10 years of experience serving publicly traded and privately held companies through technical accounting and financial reporting services. He focuses on clinical research organizations (CROs) and similar service organizations in the life sciences industry. Justin has previously advised clients in the areas of new standard implementation, external audit, internal audit, risk management, mergers and acquisitions, process design and improvement, and internal and external financial reporting. He is also a member of RSM’s life sciences national industry leadership team.

Justin Culbertson is a director and senior life sciences analyst at RSM US LLP. He has more than 10 years of experience serving publicly traded and privately held companies through technical accounting and financial reporting services. He focuses on clinical research organizations (CROs) and similar service organizations in the life sciences industry. Justin has previously advised clients in the areas of new standard implementation, external audit, internal audit, risk management, mergers and acquisitions, process design and improvement, and internal and external financial reporting. He is also a member of RSM’s life sciences national industry leadership team.