Why CRO Site Network Strategies Confuse Me

By Dan Schell, Chief Editor, Clinical Leader

When I saw the news recently about how UK-based Evestia Clinical merged with U.S.-based Atlantic Research Group to form a new global CRO, it got me thinking about how CROs have been changing, which led me to wonder how many have acquired site networks outright or built exclusive partnerships that function like owned infrastructure.

Yeah, I know, this evolution of CROs beyond being just “service providers” has been going on for years and extends beyond direct acquisitions. CROs are forging deep strategic alliances with established site networks, securing operational influence and trial management authority while avoiding the complexities of outright ownership (which also exists in some cases). These partnerships create hybrid models that blur traditional definitions of what is a CRO. (Or, maybe they just expand that definition.)

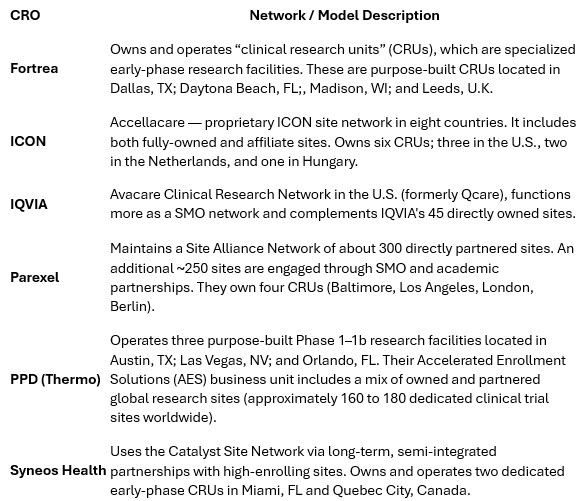

For my own education, I thought I’d try to identify which of the bigger CROs have been dabbling in site ownership and/or partnerships. (Disclaimer: I’m aware this list isn’t comprehensive.)

For CROs, owning or integrating with site networks isn't just about control; it’s about speed and predictability. The goal of any of these networks is to deliver faster site activation, consistent recruitment metrics, and trial diversity, cutting down startup timelines and data variability. With patient enrollment slowing across many trials, sponsors increasingly value built-in infrastructure, especially those with geographic breadth and tight investigator relationships.

But it’s not all black and white. Take Syneos Health, for instance: They don’t technically own the Catalyst sites, but through deep operational integration — shared systems, staff embedded at sites, centralized feasibility — they behave like a proprietary network. There is no doubt that the distinction between “owned” and “partnered” gets fuzzy sometimes, and many CROs are embracing that fuzziness for the reasons I mentioned earlier.

ADDITIONAL INSIGHTS FROM THE “CRO GUY”

Like I said in the disclaimer above, I know this list isn’t comprehensive AND …

- I’m sure there are some other CROs that feel they should be on this list.

- The information on each CRO may not be comprehensive.

For that last bullet, I thought I’d run my list by a guy I consider to be one of the leading experts regarding CROs — Joel White of Marketcap Consulting (check out his “Joel’s Thoughts” newsletter; it’s a good read). He gave me some guidance on my chart, and he shared some additional perspectives on organizations that don’t neatly fit into traditional CRO categories but still play major roles in clinical trial delivery. For example, HCA Healthcare is huge and owns the Sarah Cannon Research Institute (SCRI). “SCRI operates a full-service CRO, and also a network of what I believe are wholly owned (Nashville location) and partially owned (I think) sites across the U.S.,” White says. “McKesson is not a CRO and does not own a CRO, but they are an enormous company that fully owns US Oncology, a huge site network. My guess is US Oncology does more clinical trial revenue than any entity on this list. In February, they also acquired PRISM, which owns several ophthalmology clinical research sites.”

As more CROs stake their reputation on performance metrics instead of traditional service bundles, sponsors may soon judge them by their ecosystem strength, not just protocol delivery. The key question becomes: Which CRO network can deliver clean, fast data with built-in geographic and therapeutic access?